Why rising interest rates are a good sign

It can happen that quickly. In the US, yields on the10-year government bonds have risen to around 1.6 %. In August they were still at 0.6 %, a whole percentage point lower. Investors holding such securities in their portfolios have suffered losses as a consequence. In other currencies, interest rates for long-term bonds have also moved upwards, but the increase was more restrained. Thus, the difference between yields in dollars and those in euros and francs has increased.

The higher yields reflect on the one hand the spreading optimism about growth, which is particularly the case in the US. On the other hand, concerns about inflation have been given new impetus. In our view, however, the rise in inflation will only be temporary, as it is mainly driven by base effects with the oil price playing an important role in this. After the collapse a year ago, it is now higher than it was 12 months ago. However, by summer at the latest, these effects should fade out and inflation rates should fall again.

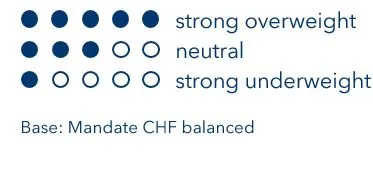

We believe that the inflation and interest rate discussions will not throw the equity markets off track. We therefore confirm our neutral positioning on equities. In the bond part of the portfolio, we are shifting into USD bonds at the expense of government bonds in the respective reference currency. This allows us to benefit from the higher yield in USD. In the case of the Swiss franc, the difference in 10-year bonds stands currently at around 1.8 percentage points.