Banking on the recovery

There is no sign of taking a breather or slowing down. The stock markets made further strong gains in December and the first few days of January. The defining theme is the expected economic recovery. Further impetus has been given by the fact that crucial political issues have been resolved.

Whether it was the Brexit trade agreement or the Democrats in the US winning the run-off elections for the two Senate seats in Georgia, the results were positively received by the markets. As justified as the optimism for 2021 might be, and as much as we pointed out the reasons for it in our December investment magazine Telescope entitled "The Green Recovery“, a healthy degree of caution is advisable in our view.

The Corona virus still has a firm grip on our lives and politics in the here and now. And the Capitol riot in Washington has drastically demonstrated how deeply divided American society is. The wild swings in Bitcoin's price over the past few days are also a stark reminder that financial markets are not a one-way street.

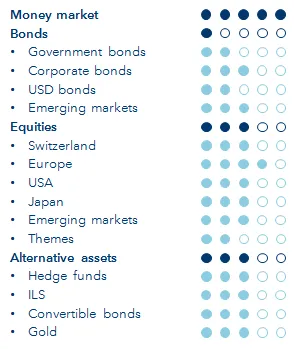

At the turn of the year, we have adjusted the strategic investment quotas in asset management and feel encouraged by the the latest developments. With a strategic increase in the equity quota, we are banking on the economic upswing in the coming years and consider alternative investments to be essential in order to be prepared for setbacks. In particular, we consider insurance-linked securities (ILS) to be a very useful part of the asset allocation in the current year.