Economic risks have not disappeared

The US Federal Reserve is changing its tune to cautiously prepare the markets for a post-Corona world with less monetary stimulus. But instead of going up, yields came down. What seems surprising at first glance can, however, be explained. When the world's most important central bank pulls the lever, investors have to question their assumptions and expectations. What, for example, do the supply bottlenecks in the industry, the higher inflation or the threat of new restrictions due to the delta variant mean?

At the same time, economic indicators such as the ISM-index, which shows the business climate in the USA, weakened. This shows that there are risks to the upswing. Of course, they have always been there. But market psychology is such that risks are often ignored. Or, conversely, the focus is solely on risks.

The biggest pessimists have identified as a risk that the Fed could stall the economic upswing. In our view, this is not a scenario at present. We assume that investors will perhaps lower their expectations somewhat. But they should clearly expect the upswing to continue without ignoring the risks. That would be like a refreshing summer rain for the financial markets.

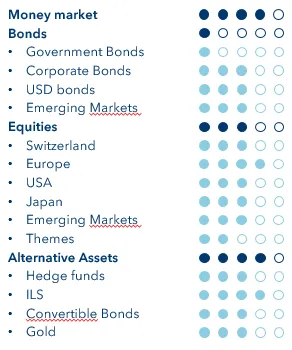

Our tactical investment allocation is geared towards recovery and is weatherproof at the same time. We have a neutral weight in equities, a strong underweight in bonds and an overweight in money market and alternative investments.