Let summer begin

The economic recovery is in full swing. While the industrial sector was the first to come back, service companies are now also reporting a strong revival. This has a lot to do with the vaccination programmes, where Europe has been able to catch up in recent weeks. Restaurants and hotels can open again, sports studios may receive guests. And especially with a view to the summer holidays, the travel industry can look forward to more bookings. The revival of the service sector comes just at the right time, as industry is experiencing supply bottlenecks despite full order books. The economic outlook for the next few months is therefore very good overall. The supply bottlenecks are temporary and will not endanger the recovery in our view.

This challenges the central banks in the US and Europe to think about their emergency bond purchases. If they too conclude that the recovery can stand on its own two feet, they will have to rein in their activities. But wait: we are not talking about interest rate hikes, this is only about lower amounts spent on bond purchases. We expect plans to this effect to be announced in the second half of the year. Even then, monetary policy would remain very generous overall.

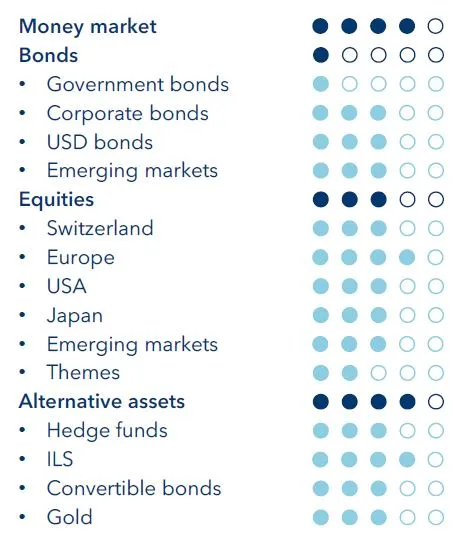

Our mandates are positioned for the recovery. Because these have traditionally been good times for emerging markets, we have decided to take a position in Chinese bonds.