Seizing Opportunities with Alternative Investments

The macroeconomic environment in 2022 was volatile: inflation, interest rates, high volatility and Russia's invasion of Ukraine unbalanced the markets. Nevertheless, valuation changes in alternative investments were much weaker than in traditional investments. In view of these developments, it can be assumed that alternative investments, and there especially more illiquid asset classes, could also come under pressure. The next few years will therefore be more difficult, as the benign macro environment that has prevailed for most of the past decade may no longer be the case. Below, we therefore take a look at the various alternative asset classes to see whether alternative investments have managed to grow, succeed and thus deliver on their promise of being adaptable and resilient in these circumstances.

Alternative investments in 2022

Alternative investments have evolved in 2022 - but this evolution has not been uniform. As the positive stimulus factors have stalled in 2022, private market investments have seen valuations decline, fundraising become more expensive and transaction activity decrease in 2022. In addition, investor caution has increased. This has triggered a shift in investor preference away from riskier asset classes such as private equity (PE) towards commodities and private debt (PD), which are perceived as relatively safe. Continued growth in PD is therefore to be expected. At the same time, high commodity and energy prices are expected to allow commodity and infrastructure fund managers to generate good returns for investors, even though these asset classes are not immune to higher borrowing costs due to rising interest rates. Real estate investment performance was significantly muted, with selected hedge fund (HF) strategies performing well under 2022 pressures.

Private Equity (PE)

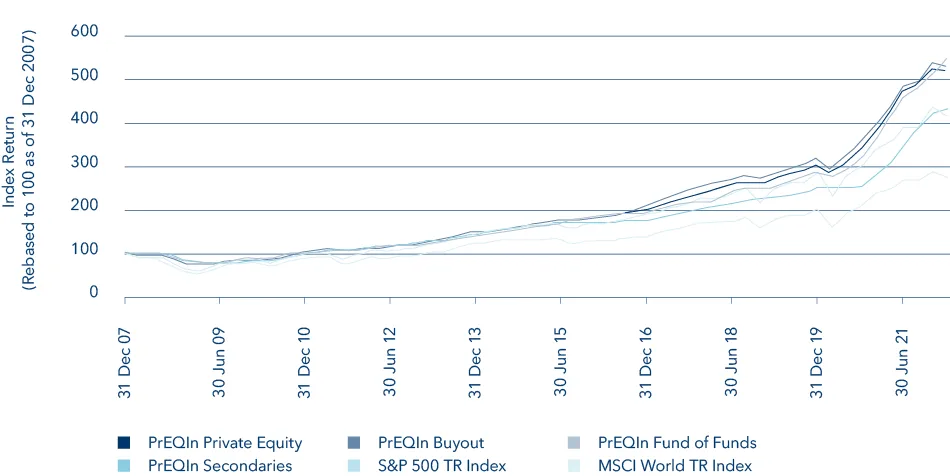

PE has provided investors with high returns over the long term, significantly outperforming public indices such as the S&P 500 TR Index and the MSCI World TR Index. The first signs of a slowdown in the performance of PE investments can be seen in PE buyouts, where a correction of 1.8% was recorded, mainly due to the declining performance of transactions in the information technology and healthcare sectors. However, with a 5.8% decline in IT buyouts versus -28.8% in comparable ETFs, the correction in the private markets is not yet complete.

As such, the PE industry may be on the verge of a shake-up as managers (GPs) around the world face a more challenging fundraising environment. As the global economic outlook continues to deteriorate, it will become more difficult for PE firms to generate returns.

Venture Capital (VC)

VC outperformed PE from 2009 to 2019, generating attractive risk-adjusted returns, but remains the most vulnerable alternative asset class going forward. 2023 could be a turning point as valuations have fallen and competition for deals has eased, creating more opportunities for VC managers to deploy their reserves in search of promising targets with attractive prices.

Based on data from Preqin, within the VC asset class, expansion and late-stage strategies have performed best after the global financial crisis, with an average net internal rate of return (IRR) of 28.3% between 2009 and 2019, while early-stage strategies have also generated high returns (average net IRR of 26.6%) with slightly higher risk (standard deviation of 25.2% compared to 24.0% for expansion and late-stage strategies). Nevertheless, the current economic climate is likely to have a greater impact on expansion and late-stage strategies, where valuations are highest, while early-stage strategies are likely to be more resilient in the short term.

Private Debt (PD)

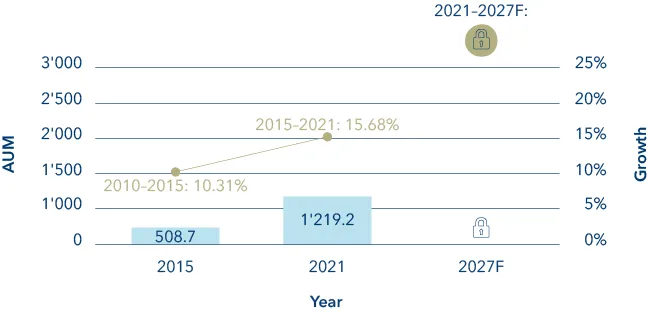

PD has seen a maturation of the asset class. Despite changing macro-economic risks, PD investors are well positioned to protect themselves from potential volatility and to generate solid returns. With further interest rate hikes expected, PD is therefore likely to attract more attention from investors who have not been active in PD to date. The growth of PD in the coming years is expected to be higher than that of alternative investments in general, especially compared to PE and real estate (RE). Thus, PD is expected to gain market share overall.

Real estate (RE)

The outlook for the global real estate market is characterised by strong headwinds. Rising interest rates and valuation concerns are likely to affect both fundraising and deal-making. Against this backdrop, investors are selective in their exposure to the asset class. According to Preqin data, value-add strategies are taking an increasingly large share, accounting for 35% of total fundraising, well above the long-term average of 27%.

While real estate growth is likely to continue, albeit at a slower pace than to date, investors see the asset class as one of the most overvalued. This will impact both fundraising and deal activity. Rising borrowing costs and a possible and more importantly uneven deterioration in occupier demand could occur if several countries fall into recession. In addition, households have less disposable income to spend in shops or online, which could impact retail and industry.

Infrastructure

High energy prices benefited many infrastructure developers in the energy sector in 2022. The telecoms sector also saw continued activity in the transaction market, supported by demand for bandwidth and resilience as hybrid working becomes more common. Nevertheless, interest rates are weighing on asset prices through the discounting effect, which will impact yields over the next 12 months. Infrastructure assets will gain ground overall over real estate and gain more market share. The need for Europe to gain energy independence following Russia's invasion of Ukraine is central to a long-term shift towards more intensive renewable energy investment in the region. In the US, the recent signing of the Inflation Reduction Act, along with the Biden administration's earlier Infrastructure Investment and Jobs Act, provides a strong tailwind for unlisted infrastructure in North America.

Commodities

Despite macroeconomic uncertainty and rising recession fears, the asset class has since held up well. Global investment opportunities in energy are huge as the shift to net zero energy supply becomes more apparent, Russia's incursion into Ukraine has highlighted several oil and gas dependencies, and large supply deficits have emerged in many commodity markets. However, most commodities were already in a super-cycle when Russia invaded Ukraine, often driving global energy prices to record highs. Moreover, commodities are technically linked to inflation, as commodity prices are a component in the calculation of inflation rates. Therefore it is not surprising that commodity prices and inflation have risen in tandem over the past year. Moreover, commodities are widely seen as suitable for diversification - hedging losses incurred when other asset classes lose value due to inflation. However, when assessing the potential outlook for commodities, it is important to bear in mind that some demand is highly dependent on the state of the economy. For example, a significant global slowdown in the world economy due to interest rate hikes could also lead to falling commodity prices. This in turn is usually accompanied by a decline in inflation - except in a stagflationary environment, where inflationary pressures do not abate despite the recession.

Hedge Funds (HF)

It is fair to say that hedge fund investors are momentum investors. Outflows follow periods of large market declines and vice versa. The interest rate hikes in the second quarter of 2022 as well as geopolitical tensions and the war in Ukraine have put significant pressure on markets and forced investors to rethink their allocations.

HFs thus experienced a difficult 2022, but were able to add value to many portfolios. Although losses should never be celebrated, HFs did offer some protection. Within the hedge fund asset class, however, there was considerable variance between different strategies and sub-strategies. Commodity trading advisors (CTAs), macro and relative value strategies helped generate positive returns for investors in the first three quarters amid market volatility. Multi-strategy and credit strategies absorbed some of the shocks, while equity and event-driven strategies disappointed many. However, they still outperformed many other market segments.

Outlook

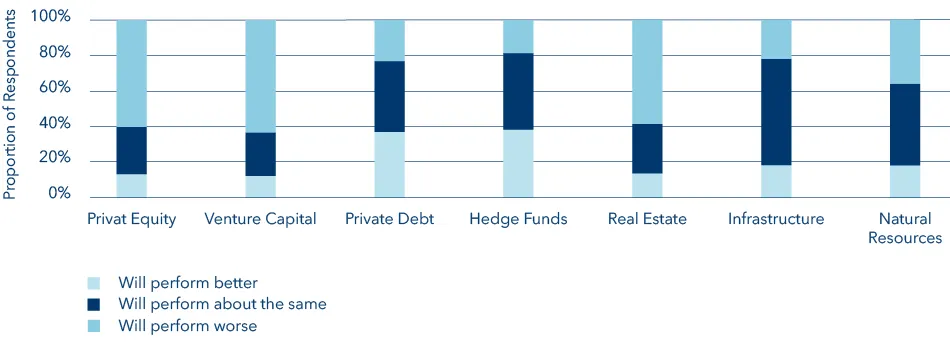

Rising interest rates and high inflation have an impact on investors' strategic asset allocation (SAA). However, these effects vary depending on the alternative asset class. Thus, macroeconomic headwinds will affect PE, VC and RE in the near term. Nevertheless, opportunities remain across all alternative asset classes. Commodities and infrastructure assets are currently seen as the alternative asset class that can benefit the most from the current environment. Even in the current volatile environment with high downside risks, but the ever-present possibility of dynamic market recoveries, alternatives to long-only strategies are seen as good opportunities. Therefore, hedge funds and liquid alternatives can be seen as potential major beneficiaries of the interest rate turnaround and inflation. Thus, an end to the negative trend in the importance of hedge funds and liquid alternatives in investors' SAA may be imminent.

Opportunities remain across all alternative asset classes

Wolfdieter Schnee Head of Fund Client & Investment Services,