Investing in the green and social transition

Recent months have made it clear that sustainability is an issue that extends far beyond environmental and climate aspects. The Corona pandemic is having a fundamental impact on the way we live our lives – our social interactions, how we shop, how we work. The lockdowns resulted in an economic standstill, yes; but they also had some noticeable and quite positive side-effects: empty streets and a sky suddenly void of jet contrails reduced noise pollution and improved the air quality and thus the quality of life. For many, this was a wake-up call. The pandemic not only opened up new investment opportunities in the realm of industrial transformation, but also sharpened investors’ desire to put their money to work in a goal-oriented, sustainable way. Increasingly, investors are asking themselves how they can play a role in achieving sustainability goals by means of their investments.

Note: This is the introduction to our five-part Investment idea series “Investing in the green and social transition”.

Published so far:

Sustainable investments have met with growing interest for quite some time. However, the focus to date has been mainly on the use of ESG (environmental, social and governance) ratings in order to exclude those companies that fail to meet the relevant criteria. In most instances, the environmental issues dominated. According to fund specialist Morningstar, there were more than 4,100 sustainability funds worldwide at the end of 2020, managing total assets of more than USD 1.5 trillion (four-fifths of which are managed in Europe, followed by the USA at 14%). The growth trend is unbroken. It should be noted, though, that many passive and broad-based sustainability funds do not pursue a specific goal, but instead merely aim to be more environmentally friendly in a general sense.

Favoured companies in passively managed sustainability funds (as % of all existing funds of this nature)

Sources: Morgan Stanley, VP Bank

Investment solutions of this kind usually have the high-profile ESG indices as their benchmark, so their rule-based selection processes and focus on market capitalisation can result in cluster risks. 62% of all such funds are positioned in the shares of software giant Microsoft with a weighting of just under 5%. Large-cap companies like Tesla, NVIDIA, Walt Disney and PepsiCo are also included in more than half of the passive investment funds (see chart). Although these companies do have the best ESG scores in their respective industries, the businesses as such are not necessarily based on products and services targeted explicitly at environmental or social issues.

Although for quite some time there has been considerable interest in focused investments in specific aspects of sustainability – renewable energy sources, for example – today’s global health crisis has broadened and intensified this trend. The latest survey conducted by the European Investment Bank (EIB) reveals that almost three out of four Europeans believe that they, too, can personally help to combat climate change, as is reflected in their wide range of sustainability-related investment interests. Their focus still centres on renewable energy, but they are also turning their attention to other sustainability issues such as biodiversity, marine conservation and the environment in general, as well as resource efficiency, health, security and equal opportunity.

Aside from this increasing social awareness, the key drivers of the emerging move towards sustainability will come in the form of regulation and government financial support. The EUR 1.8 trillion budget adopted by the EU Commission for the years 2021 through 2027 foresees general member-state government spending of around EUR 1.1 trillion, but it also earmarks EUR 750 billion for an EU recovery fund aimed at and reserved mainly for projects that help the European Union achieve its longer-term climate targets. In order to ensure that the available funding is used in a goal-oriented manner and does not simply slip through the cracks, a so-called “taxonomy” is being created – in other words, a classification and allocation system under which subsidies or contracts will be granted solely to those companies that are not only capable of implementing sustainable projects, but also act sustainably themselves. The details of this taxonomy have already been largely worked out and the final version should be available towards the end of 2021.

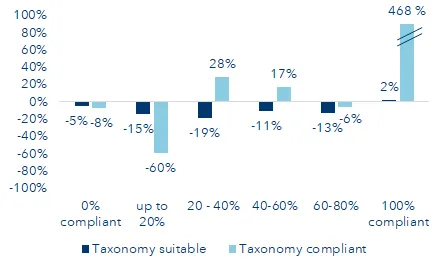

As a result of this social transition, sustainability aspects have become increasingly relevant in many areas of life. This also applies when it comes to investing, and there are various ways to go about doing so. Many investors prefer that their investments are in line with their personal goals and values. This approach is widespread and is usually implemented by excluding certain business activities or corrupt practices. But the reverse of that strategy can also be a viable alternative, namely by including only specific areas that are of particular concern to the investor. Professional money managers have already started to key on this trend, and sustainability funds are investing significantly more in companies that meet the governmental grant criteria (taxonomy guidelines, see chart).

Sustainability funds’ relative weighting of companies in conformity with EU taxonomy guidelines

Sources: Goldman Sachs, VP Bank

Theme based focus on sustainability

The myriad aspects of sustainability give rise to an unusually broad range of opportunities for long-term investors. To narrow the focus in a way that makes it easier to zero-in on suitable companies that are playing a direct role in the green and social transformation, we have condensed the spectrum into five distinct theme buckets and shed light on a number of thematic fund solutions addressing the related issues:

If you want to know more about investable products, please get in touch with your VP Bank contact.

- Environment and climate action

- Health and demographic change

- Renewable energies and a circular economy

- Equal opportunity, education and security

- Sustainable infrastructure

1. Environment and climate action

The urgency for climate action and nature conservation becomes clear when considering that, collectively, our natural environment generates an estimated social and economic benefit of USD 125 to 140 trillion per year, or about 1.5 times the global annual gross domestic product (GDP). When it comes to manufacturing, about half of the industrial world’s value creation is moderately to highly dependent on Mother Nature. The long overdue yet logical consequence, which a number of countries have done already: grant Nature subjective, constitutional rights. The preservation of biodiversity and conservation of wetlands, waterways and oceans as a basic necessity for life will take on enormous economic significance in the years ahead. Please find part 1 of the serie here.

2. Health and demographic change

The global health crisis has kept the world on pins and needles for almost two years now. The shortcomings of the healthcare systems in the industrialised as well as the emerging countries have been unsparingly exposed for all to see. It is a proven fact that investments in health-related infrastructure and services improve general living conditions and social wellbeing. A quality healthcare system leads to higher life expectancy (in 2020 average life expectancy for women in Europe was 82; vs. Africa 65) and has a direct influence on a country’s economic development. Birth rates (Europe: 1.6 children per woman; Africa: 4.1) combined with higher life expectancy bring about demographic change and as such are also key determinants of economic trends, e.g. consumer behaviour in the future. Both issues are therefore of immense importance in terms of global economic development over the coming decades. Read more here.

3. Renewable energies and a circular economy

Going forward, this sustainability theme will be a top priority for many countries. 65% of all man-made CO2-pollution is attributable to the burning of fossil fuels; global agriculture accounts for a further 28%. The pace of increase in these emissions slowed somewhat in 2019, but major adjustments will still be needed in the way energy is produced, transported and used. So, it should come as no surprise that this is also the focus of government subsidies and the direct funding of infrastructure projects. Detailed paper to follow.

4. Equal opportunity, education and security

Equal opportunity, education and security result in greater social stability and lead directly (especially in the form of education) as well as indirectly to higher economic growth. Especially in a world where technological advances are progressively supplanting unskilled labour, education will play an even more significant role. Also, studies have shown that equal opportunity makes a meaningful contribution to a company’s development. And then there is the issue of security in its broadest sense (i.e. including matters such as cybersecurity), which will also play a pivotal role in the stability and development of certain regions. After all, seemingly simple things like reliable access to clean water – which 30% of the global population lacks – need to be viewed as security aspects as well. Detailed paper to follow.

5. Sustainable infrastructure

Global population growth will continue to dramatically heighten the demand for water, food, energy and housing in the coming decades. Not only is the construction, operation and maintenance of public utilities a major challenge; so is the sheer volume of resources required to accomplish that. The envisaged huge amounts earmarked for investments in sustainable infrastructure make it clear that this already foreseeable undertaking can only be mastered through wise, long-term planning. Detailed paper to follow.

Important legal information

This document was produced by VP Bank AG (hereinafter: the Bank) and distributed by the companies of VP Bank Group. This document does not constitute an offer or an invitation to buy or sell financial instruments. The recommendations, assessments and statements it contains represent the personal opinions of the VP Bank AG analyst concerned as at the publication date stated in the document and may be changed at any time without advance notice. This document is based on information derived from sources that are believed to be reliable. Although the utmost care has been taken in producing this document and the assessments it contains, no warranty or guarantee can be given that its contents are entirely accurate and complete. In particular, the information in this document may not include all relevant information regarding the financial instruments referred to herein or their issuers.

Additional important information on the risks associated with the financial instruments described in this document, on the characteristics of VP Bank Group, on the treatment of conflicts of interest in connection with these financial instruments and on the distribution of this document can be found at https://www.vpbank.com/Disclaimer_en.pdf