Is inflation on the verge of flaring up?

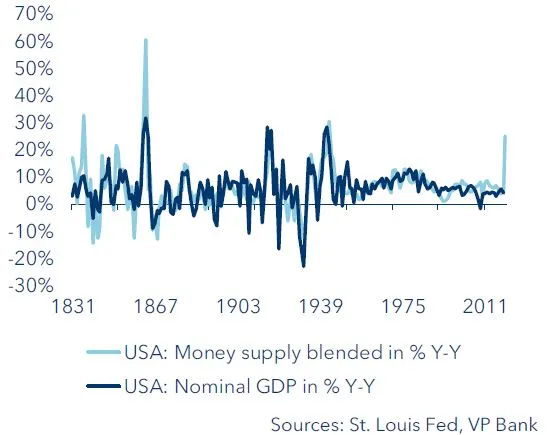

On both sides of the Atlantic, the money supply aggregates have surged. The last time the US experienced anything close to such an increase was during and after the Second World War. According to the quantity theory of money, this will not merely pass without consequences. The theory posits that an increase in money supply ultimately leads to an increase in prices, provided that the velocity of money in circulation and the available supply of goods in an economy remain constant. In fact, this correlation exists not only theoretically, but also in real life – or at least it tends to (see chart).

USA: Change in money supply and inflation rate (annualized)

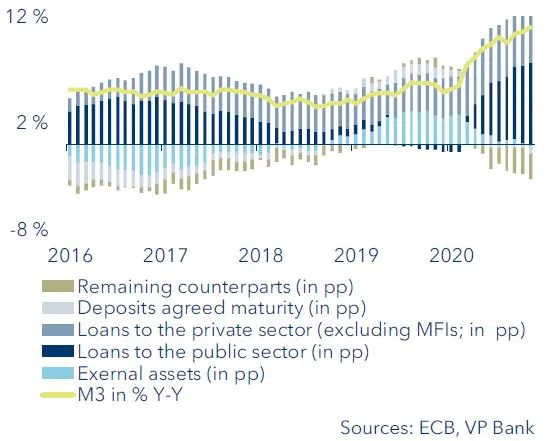

Presently, this constellation suggests that inflation rates could increase noticeably. However, special factors are at work here due to the Covid-19 crisis. Hence, the usual correlation visible in the chart above cannot be simply copy/pasted to the current situation. The recent bulge in the money supply is a reflection of state aid measures aimed at countering the economic fallout from the coronavirus pandemic. The money supply numbers compiled by the European Central Bank (ECB) underscore this point. On one hand, the broadest money supply aggregate (M3) is being driven by emergency lending programmes for companies in distress; on the other hand, the states themselves need fresh cash to fund those measures. So this is a pandemic-specific influence (see chart) and therefore needs to be viewed as an exceptional factor.

Money supply growth in the eurozone (M3)

That said, we do not foresee a significant increase in inflation, at least for the time being. Why? Because high unemployment in the USA and short-time work in Europe will keep wage costs low, and ultimately the money supply will tend to decrease once companies start to pay back their loans from the government.

|

What is inflation? Inflation is understood to mean a persistent increase in the prices for goods and services. In other words, the cost of various products covering many aspects of daily life increases over several calendar quarters. A price index is used as a gauge in this regard; for example, the consumer price index tracks the prices of a “basket” of essential household goods and services and reflects how the total cost changes over time. |

Nevertheless, we face certain base effects which, over the summer months, should boost inflation rates at least to a certain degree. In reaction to the outbreak of the pandemic and the resulting containment measures, the price of oil fell by more than 50% in March 2020. Since its low in April, however, Brent North Sea crude has already recorded almost a threefold increase. So as of March, energy price increases on an annualised basis will have a noticeable impact on the inflation readings. But this will only push them back to pre-crisis levels.

The role of the central banks

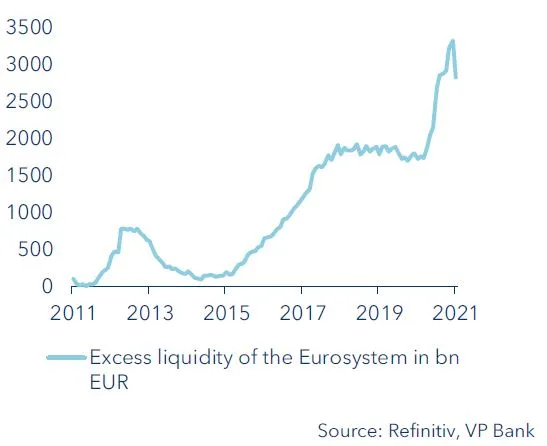

The quantitative expansion of supply plays a major role in the current approach to monetary policymaking, be it in Japan, the USA or the eurozone. The central banks are buying securities in the open market. These purchase programmes should have the effect of increasing the money supply. However, the sellers of the securities (primarily banks and insurance companies) have been depositing a large part of the sale proceeds in their own accounts at the respective central bank instead of channelling the liquidity into the real economy in the form of loans. This means that a high proportion of the newly created liquidity remains with the central bank. There is little danger of inflation so long as that money stays there. The net result: those multibillion-dollar securities purchase programmes by central banks lose their scariness – at least in terms of inflation.

Excess commercial bank reserves held at the ECB

First, wages have to rise

However, inflation should not yet be written off entirely since the real danger comes from another corner. Inflation rates have been in decline for almost four decades (see chart), and not even the persistently loose monetary policy in force since the 2008 financial market crisis has done anything to change this.

.

Global rate of inflation and trendline

Inflation needs oxygen in order to burn, and that usually comes from higher employee wages. If wages increase due to the scarcity of qualified workers in a prospering economy, companies will sooner or later factor those higher costs into the end price of their products. And if the basket of goods becomes more expensive, employees will in turn demand higher take-home pay. This syndrome is known as the wage-price spiral and was most recently observed in full force during the 1970s and 1980s. Since then, the global workforce has been in a state of wage inertia – simply because of the ample supply of labour. Three demographic waves in the past several decades have put workers in a poor bargaining position as “too much labour” chases a limited supply of jobs, due namely to:

- the entry of the so-called “baby boomers” (i.e. those born in the high-birth-rate 1960s) into the job market during the 1980s;

- the fall of the Iron Curtain, which liberated a legion of new, cheap labour in Eastern Europe; and

- the opening up of China, the “workshop of the world”.

Through the integration of Eastern Europe and China into the global economy, more than a billion additional people of working age became available in the global labour market. Consequently, trade unions lost their influence as companies threatened to (or in fact did) move their production to the Eastern hemisphere. Wages therefore had hardly a chance to increase significantly. For example, in the USA today, real hourly wages are just about where they were in the 1990s. Against this backdrop, it should come as no surprise that inflation rates have trended downwards. And as a result, there has been no pressure on companies to pass higher wage costs through to the consumers of their products.

The winds are changing

United Nations calculations indicate that mankind is currently in the midst of an epochal change in demographics. The baby boomer generation will reach retirement age in the coming years, and China will start to feel the massive long-term aftereffects of its erstwhile one-child policy. For the OECD nations, this means that the proportion of their working-age population in relation to total population will fall from around 65% at present to around 58% in 2050. China in particular will see its workforce shrink dramatically from 75% to 55% of the populace in 2050.

In other words, workers will become a rare commodity. And if the supply of labour diminishes in a market economy, the price of labour (i.e. wages) will rise. It can therefore be assumed that the trend in wages will reverse and employee compensation will increase.

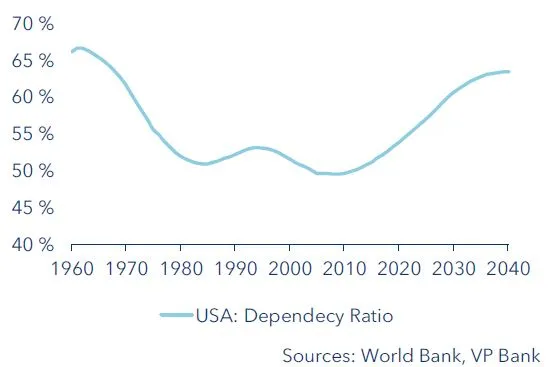

This would not be the first incidence ever of such a reversal. After the Second World War, the so-called dependency ratio was extraordinarily high in all Western industrialised nations. This coefficient describes the ratio of economically dependent age groups (people who are not yet or no longer able to work) to the working-age population. World Wars I and II caused a significant decline in births, and of course many people of working age died. The Great Depression that started in 1929 also caused a decline in births on both sides of the Atlantic and had the same demographic consequences: for example, the dependency ratio in the USA rose to 67 in the 1950s. In a purely statistical sense, this means that one person of working age had to support 0.67 people – an interim high-water mark at the time. The offshoot: workers were in an excellent position to negotiate wages, and the real wage increases seen in the 1950s are still the highest in post-war history.

The World Bank forecasts that in the next three decades the dependency ratios for the industrialised nations will approach the levels of the 1950s, with real wages also rising as a result. If at that point companies pass on the higher wage costs to end users of their products, this would constitute the breeding ground for a sustained increase in inflation rates.

USA: Dependency ratio

Digitalisation and inflation

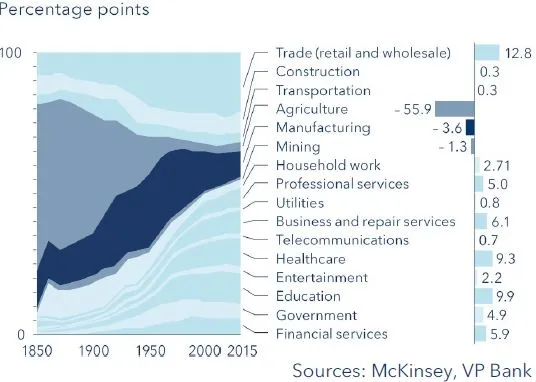

This demographic shift will reduce the supply of labour, but at the same time digitalisation may reduce companies’ demand for labour – fears that are in no way new. Technological change has accompanied mankind throughout the ages. The Industrial Revolution of the late 18th and early 19th century led to an upheaval in the labour market, but no sustained decline in the employment rate. A comprehensive study entitled “Jobs Lost, Jobs Gained: Workforce Transitions In A Time Of Automation” published by the McKinsey World Institute in 2017 sheds light on the historical trends in employment (see chart).

USA: Change of employment by sector, 1850-2015

Whereas in 1850 the agricultural sector employed the majority of Americans, today it plays only a minor role in overall employment. Other sectors have grown in importance, for instance the retail and wholesale trade. These shifts have more than compensated for the loss of jobs in the agricultural space.

The McKinsey World Institute also notes that the personal computer has led to a 15.8 million net increase in jobs in the USA alone (3.5 million jobs were eliminated, but 19.3 million new jobs were created as a result). Already in 1966, a US panel of experts commissioned by the government to study the impact of innovations on the labour market came to the cogent conclusion: technology destroys jobs, but not work.

Digitalisation will also make many jobs redundant, but at the same time new jobs will be created elsewhere, especially in the services sector. In its “Future of Jobs Report 2020”, the World Economic Forum (WEF) projects that some 85 million jobs will be lost worldwide by 2025 due to digitalisation. However, this enormous figure is relativised by the expected creation of 97 million new jobs. What is clear, though, is that the demands placed on the labour force will change. People with only a limited skillset will be faced with unemployment unless they are retrained. But this does not change the overall matrix: going forward there will be a shortage of labour. Hence, wages are unlikely to fall despite the relentless advance of digitalisation; rather, they can be expected to rise, thereby spurring inflation.

How to protect yourself against inflation?

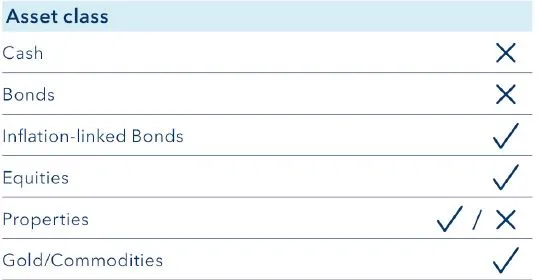

Over the long run, tangible assets such as commodities, precious metals and real estate offer protection against inflation. But shareholdings do, too. In that they represent a fractional financial interest in a company, the investor essentially owns a share of its machinery, administrative buildings and even patents. Therefore, this asset class is also considered to be “tangible”.

But bear in mind: if inflation rises, it cannot be simply assumed (as is so often the case) that tangible assets provide a direct hedge, since their susceptibility to price fluctuation (volatility) initially increases. And there is another important aspect in this regard: if interest rates rise in tandem with inflation, future corporate profits need to be discounted to a greater extent in analysts’ calculations. So it takes more patience for the inflation hedge to kick in. One should also not focus too one-sidedly on real estate. Demographic shifts can lead to an oversupply in the residential real estate segment, an imbalance that would ultimately result in declining house prices. Equally spoken, owning one’s own dwelling can be useful and effective, especially in old age – i.e. after retirement. In the event of a widespread increase in prices, rents will also be affected. If the condominium or house is fully paid off, only the ancillary costs are affected by the inflationary pull.

Bonds, on the other hand, are subject to price losses in response to rising inflation expectations or higher nominal interest rates. Fixed-interest securities therefore offer no protection against inflation. However, the case is different with so-called “inflation-indexed bonds”. Whilst ordinary bonds are issued with a fixed coupon and a pre-defined repayment date, inflation-indexed bonds guarantee a fixed “real” return. For example, if inflation rises, the periodic interest payment due on these securities is reset to reflect that increase. But since inflation expectations are also taken into account in the pricing/coupon of ordinary bonds at the time of issue, inflation-linked bonds only fare better than their “straight” counterparts if the actual rate of inflation turns out be higher than originally expected. It follows that inflation-linked bonds are particularly attractive for those investors who anticipate a surprisingly sharp rise in inflation.

But the general rule still applies: every asset class, including tangible assets, is subject to uncertainty. The future developments expected at the time of purchase can ultimately take a different course. This is precisely why diversification across a broad range of asset classes and taking into account their respective risk/reward characteristics is the best way to protect against inflation.

Investments protected against inflation

Summary

A sustained rise in inflation is not on radar for the time being. However, we do not deny that transitory special effects could temporarily push the upcoming (annualised) inflation figures above the major central banks’ targeted 2% threshold.

But for a longer-lasting rise in inflation to materialise, higher wages are the key factor. Were that to happen, it could set in motion a wage-price spiral that causes inflation rates to trend upwards for years to come. Wage developments as such are largely determined by demographic trends. When the baby boomers start to retire towards the end of this decade, labour will become scarce. In such an environment, the stronger wage-negotiation clout of employees could crystalise in the form of rising inflation, at which point the central banks would have no other choice than to hike interest rates.

Important legal information

This document was produced by VP Bank AG (hereinafter: the Bank) and distributed by the companies of VP Bank Group. This document does not constitute an offer or an invitation to buy or sell financial instruments. The recommendations, assessments and statements it contains represent the personal opinions of the VP Bank AG analyst concerned as at the publication date stated in the document and may be changed at any time without advance notice. This document is based on information derived from sources that are believed to be reliable. Although the utmost care has been taken in producing this document and the assessments it contains, no warranty or guarantee can be given that its contents are entirely accurate and complete. In particular, the information in this document may not include all relevant information regarding the financial instruments referred to herein or their issuers.

Additional important information on the risks associated with the financial instruments described in this document, on the characteristics of VP Bank Group, on the treatment of conflicts of interest in connection with these financial instruments and on the distribution of this document can be found at https://www.vpbank.com/legal_notes_en.pdf

Add the first comment