Under the spell of the corona virus

The initial reaction on financial markets to the new coronavirus was one of shock. The spread of the virus continues to dominate headlines globally. Many experts have offered their assessments and countless studies have been published. However, the fact remains: nobody knows exactly how the course of this virus will develop, nor when its spread might start to slacken. What we do know is that the coronavirus has now claimed more lives today than the SARS pandemic. With regard to financial markets, the watchword of the hour is caution. The situation is still open, which means the risk persists that uncertainty about the virus will revive and put financial markets under renewed pressure.

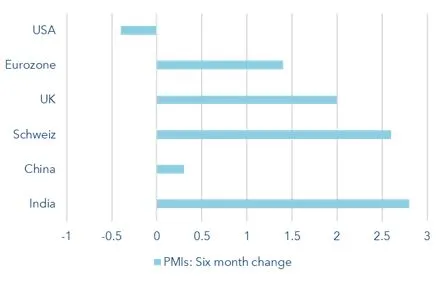

Nonetheless, leaving the coronavirus aside for a moment, we also note some positive economic developments lately. For one, the signals coming from the US-China trade dispute are increasingly pointing toward de-escalation. In addition, the picture painted by some economic indicators has noticeably brightened in recent months. This can be seen in the graphic below. In the past six months, the business climate for manufacturing has improved in most regions, albeit with the US a prominent exception. However, the overall US economy remains robust.

All in all, we consider a broadly diversified portfolio advisable in the current environment. The equity component is oriented toward the strategic quota. That said, we prefer European stocks over their American counterparts. We are also investing in specific selected investment themes.

Economic indicators recover

Shares tactically neutral

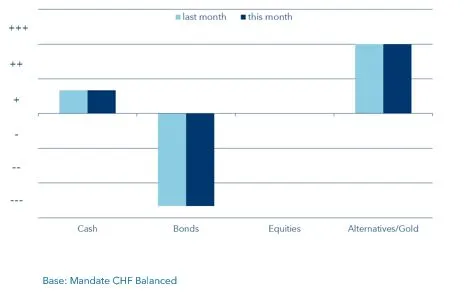

We maintain an overall neutral equity position. Regionally, we prefer European stocks to US stocks. We are also investing in the themes "China Consumer Basket" and "Digital Security".

Government bonds relatively unattractive

We affirm both our underweight in government bonds and our preference for shorter durations compared to the benchmark in order to reduce the risk from interest rate changes in the portfolio.

Gold as a proven stabilizer in the portfolio

Gold has once again proven to be a good hedge in recent weeks. We continue to view gold as an important addition to the portfolio in the current environment.

Tactical deviations

Important legal advice

This documentation was produced by VP Bank AG (hereinafter the bank) and distributed by the companies of the VP Bank Group. This documentation does not constitute an offer or an invitation to purchase or sell financial instruments. The recommendations, estimates and statements contained therein reflect the personal views of the relevant analyst of VP Bank AG at the time of the date stated on the documentation and can be changed at any time without prior notice. The documentation is based on information that is considered reliable. This documentation and the assessments or assessments made therein are prepared with the utmost care, but their accuracy, completeness and accuracy cannot be guaranteed or guaranteed. In particular, the information contained in this documentation may not include all relevant information on the financial instruments covered or their issuers.

For more important information on the risks associated with the financial instruments in this documentation, the proprietary business of the VP Bank Group or the management of conflicts of interest in relation to these financial instruments, and for the distribution of this documentation, see http://www.vpbank.com/legal_notice