A long way back

The past few weeks have been full of superlatives for the financial market. We have seen the fastest slide in stock markets in decades and a wave of enormous consecutive daily movements of a magnitude last witnessed during the Great Depression. We also witnessed one of the strongest countermove in history as the US stock market gained almost 20 percent in just three days. This shows how violently the corona crisis has jolted the world. There are hardly any historical parallels that offer observers much support or orientation.

That said, scenarios can be useful to try to structure the spectrum of possible developments and their effects. In our baseline scenario, we assume that the corona crisis will leave very deep ruts in the economic landscape in the second quarter. The return to social and economic normality will be slow and gradual, but, we believe, it will still take place in 2020.

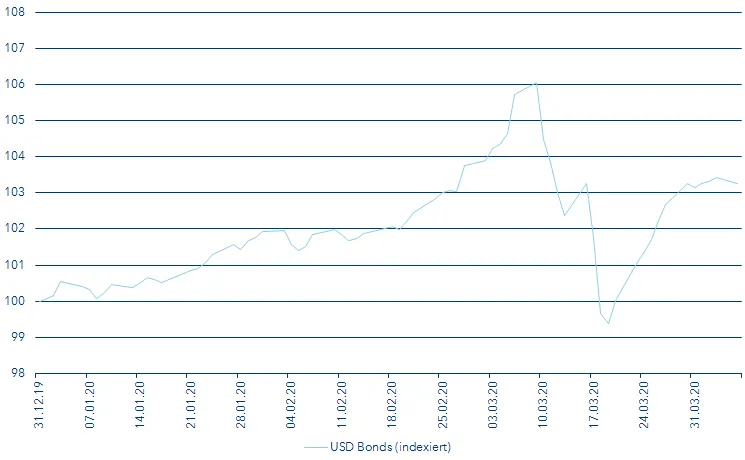

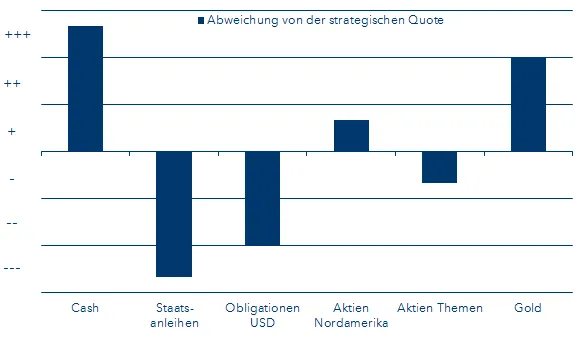

In this scenario, according to our estimates, companies will earn around a third less profit this year than in 2019. Equity markets have in the meantime priced in a decline of this magnitude. Past market corrections, however, have typically unfolded in several waves. Thus far, we have only experienced the first wave. That is why we consider it sensible now to balance the risks in the portfolio. In this environment, this includes not only equity risks but also interest rate, credit and liquidity risks. While we have already taken equities back to neutral after the first strong countermovement, we are now reducing the broad index of USD bonds.