The Fed is leaving no stone unturned

The US Federal Reserve did not wait until the regular meeting in the middle of this week, but already acted on Sunday. The key interest rate will be cut by 100 basis points down to practically zero. Bond purchases will be scaled up again substantially and a whole series of short-term measures are being taken to improve liquidity in the banking system. The message could not have been clearer: The Fed is throwing everything into the balance.

However, this extraordinary move has not helped to calm financial markets. Quite the contrary has been the case. The Asian stock markets have closed in the red and the European stock markets have opened in deep red. The developments surrounding the coronavirus are obviously too dramatic for the Fed measures alone to calm the situation.

It is to be feared that the uncertainty in society and thus also in the financial markets will continue in the coming days. The experts' simulations all indicate that the number of cases of people infected with the coronavirus in Europe and the United States will continue to rise before the isolation measures take effect.

It therefore remains probable that, as in the past few days, glimmers of hope on the financial markets will suddenly be replaced by disillusionment and vice versa. Larger price swings will therefore proba-bly remain the order of the day for the time being. In view of this, our recommendations still apply:

- Avoid situations in which you have to sell. Liquidity is limited in many asset classes during such stress phases and the price markdowns can therefore be enormous.

- Maintain a broad diversification in the portfolio and, if possible, even broaden it. Regional aspects must also be taken into account.

- Consistently hedge currency risks.

- Not to enter any new credit risks.

- Opportunistically take advantage of buying opportunities, while always closely monitoring your own risk budget. We have put together a selective selection of high-quality securities for this purpose.

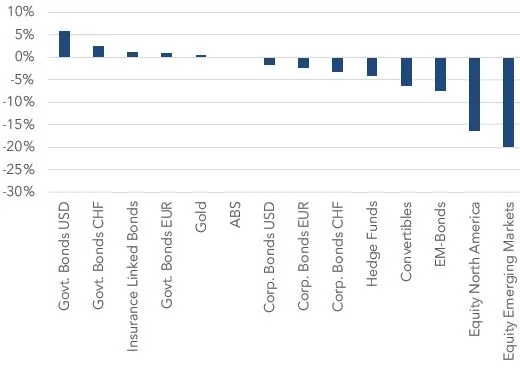

At this point we would like to emphasize the diversification aspect. Many investment classes have cor-rected significantly in recent weeks. First and foremost, the stock markets, some of which have already lost more than 30% since mid-February. But not all asset classes have corrected to the same extent. Some, such as government bonds or gold, have even been able to post gains since the beginning of the year. So, if the portfolio is broadened, the impact of individual investments in the portfolio can be cushioned to a certain extent. Since the beginning of the year, the following chart shows the perfor-mance of the asset classes we include in our mixed mandates. By the end of last week, the VP Bank Strategy Fund CHF Balanced, which contains 40 % equities in its strategic investment allocation, rec-orded a decline of 10.8 % since the beginning of the year.

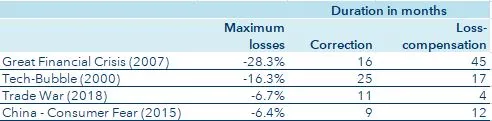

Die Korrektur an den Aktienmärkten macht sich hier natürlich negativ bemerkbar. Immerhin hat die Diversifikation durch die Berücksichtigung der anderen Anlageklassen den Rückgang abfedern können. Nun stellt sich die Frage, ob damit das Schlimmste bereits ausgestanden ist. Dazu haben wir uns die grössten Korrekturen der letzten 20 Jahre angeschaut. Nachfolgende Abbildung zeigt die grössten zwischenzeitlichen Wertverluste für die dem Strategiefonds CHF Balanced zugrundeliegende strategische Anlageallokation. Der grösste Rückgang wurde dabei wenig überraschend im Zuge der Finanzkrise mit rund 28 % verzeichnet. Die Vergangenheit hat aber auch gezeigt, dass es wichtig ist, mit fortschreitender Dauer einer Korrektur nicht auszusteigen, sondern investiert zu bleiben. Dadurch kann man von der darauffolgenden Erholung profitieren und die erlittenen Wertverluste schnellst-möglich wieder wettmachen.

Disclaimer

This document was produced by VP Bank AG (hereinafter: the Bank) and distributed by the companies of VP Bank Group. This document does not constitute an offer or an invitation to buy or sell financial instruments. The recommendations, assessments and statements it contains represent the personal opinions of the VP Bank AG analyst concerned as at the publication date stated in the document and may be changed at any time without advance notice. This document is based on information derived from sources that are believed to be reliable. Although the utmost care has been taken in producing this document and the assessments it contains, no warranty or guarantee can be given that its contents are entirely accurate and complete. In particular, the information in this document may not include all relevant information regarding the financial instruments referred to herein or their issuers.

Additional important information on the risks associated with the financial instruments described in this document, on the characteristics of VP Bank Group, on the treatment of conflicts of interest in connection with these financial instruments and on the distribution of this document can be found at

https://www.vpbank.com/legal notice