Winter is coming

Everyone’s afraid of the R-word but there’s no escaping the many indications that a recession is imminent. The monthly survey of companies’ purchasing managers points in this direction. In the US, the ISM Purchasing Managers Index, a reliable economic indicator, has fallen to 49.1 for the manufacturing sector. This value indicates a decline in economic activity. In Europe, the data also tends to show a contraction. Given the weak numbers coming out of its manufacturing sector, Germany may well already be in recession. Even if friendlier noises are coming from the disputants lately, the global manufacturing sector is feeling the chill from the trade dispute between the US and China.

Weak Purchasing Manager Indizes (PMI)

The world’s central banks have already reacted to these developments, or will do so shortly. The US Federal Reserve as well as the People’s Bank of China have both recently tilted their stances towards stimulus. In China, the reserve rate for banks is as low as it was back in 2007 – which means loans can once again flow quite freely. We expect the European Central Bank also to follow with new stimulative measures.

While interest-bearing securities reflect scepticism about the course of the economy, little fear can be detected in riskier asset markets, especially equities, when looking at the index levels. Buyers argue that low interest rates support equities. However, redistributions are taking place. In August the amount of money flowing out of equity funds reached a level that has only been recorded twice in the past ten years.

Figuratively speaking, when temperatures drop this autumn, it’s probably a good idea for investors to bundle up—because winter is coming.

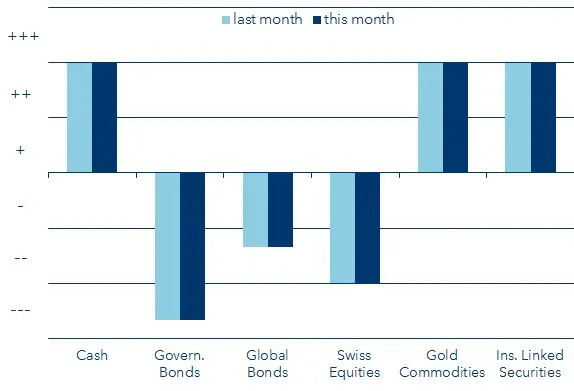

Tactical Allocation - September 2019

Bond durations lowered

In all reference currencies, we lower bond durations, the sensitivity of prices to changes in interest rates, after the recent extreme movements..

Hedged currencies

We are sticking to currency hedging; however, the USD is not fully hedged in EUR and in CHF.

Underweight equities

We continue to underweight the equity allocation in the respective reference currency.

Gold stabilising

Although gold recently gave back some of its gains, in the portfolio context, the yellow metal remains an overweight and an anchor of stability.

Important legal notice

This document has been produced by VP Bank Ltd (hereinafter referred to as the “Bank”) and distributed by the companies of VP Bank Group. This document does not constitute an offer or invitation to buy or sell financial instruments. The recommendations, estimates and statements contained herein reflect the personal opinion of the relevant analysts of VP Bank Ltd on the date stated in the document and can be changed at any time without prior notification. The document is based on information which is believed to be reliable. This document and the estimates and assessments provided herein are prepared with the greatest care, but their correctness, completeness and accuracy cannot be assured or guaranteed. In particular, the information in this document may not include all relevant information regarding the financial instruments addressed herein or their issuers.

Further information on the risks associated with the financial instruments covered in this document, the proprietary trading of VP Bank Group, the handling of conflicts of interest in relation to these financial instruments and the distribution of this document can be found at www.vpbank.com/legal_notice.