What does 2020 hold for investors?

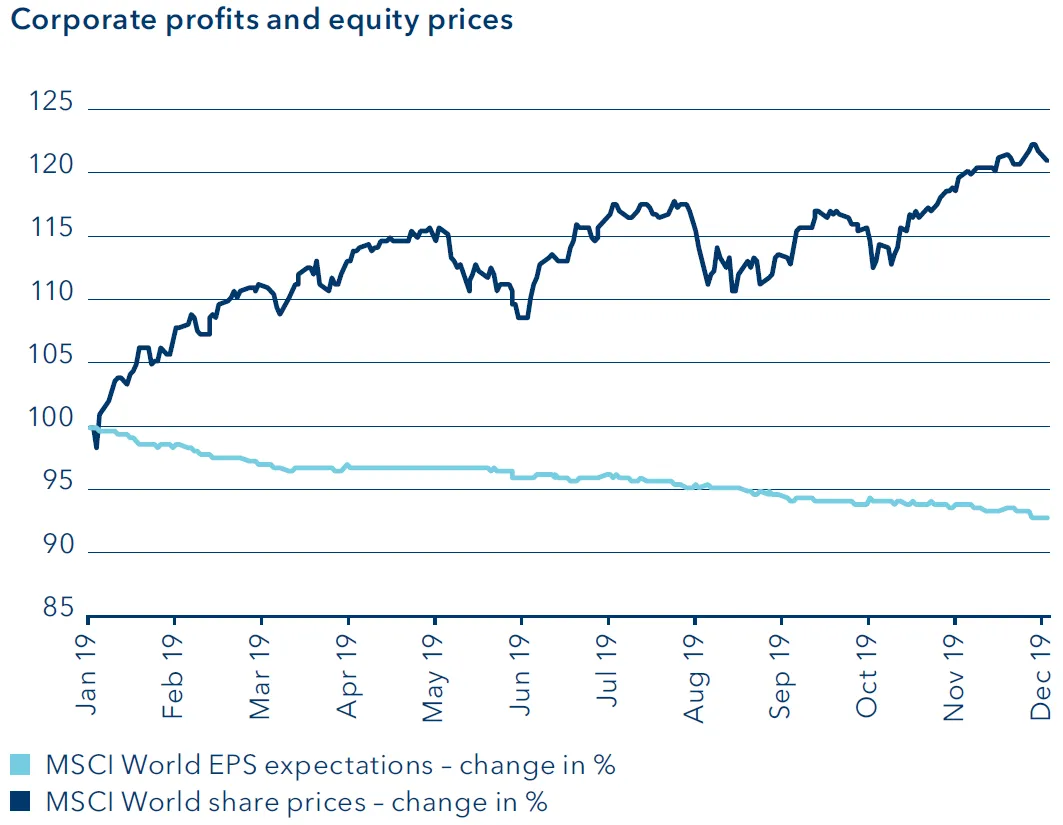

Rarely has the gulf between financial market performance and the real economy been as wide as in 2019. This makes any assessment of the outlook for the coming year all the more difficult. Manufacturing weakness was a major downside factor in the global economy over the past year. Starting in China and Europe, the downturn in industrial activity eventually spread to the US, undermining economic momentum worldwide. But the financial markets, having suffered a sharp correction in late 2018, proved extremely resilient throughout 2019. All asset classes except money market investments were able to chalk up advances. Economic worries led to capital gains on bond investments, while many equity markets climbed to new all-time highs despite flagging corporate earnings. Jitters were few and far between. The prevailing mood was very relaxed in the face of continuing bad news and uncertainty on the political and economic fronts.

Making sense of the contradictions

Despite handsome advances, the markets cannot be accused of undue exuberance. In the light of present conditions, the mood appears optimistic but not euphoric. Even so, how are we to explain this protracted period of decoupling between the real economy and the financial markets?

In 2018 the central banks were earnestly discussing an imminent exit from their ultra-expansionary monetary policies. Several of them started to gradually dismantle their unconventional measures. The European Central Bank terminated its asset purchase programme, while some authorities, notably the Fed, even started to hike their key interest rates. But stock market losses in the fourth quarter of 2018, combined with an increasingly ominous economic environment, led to an abrupt policy about-turn at the start of 2019. A change of tone in the central banks’ forward guidance was followed by interest rate cuts. Here again America led the way. Other central banks were obliged to follow suit, resulting in a renewed global loosening of monetary policy. Investors interpreted these early and energetic actions as evidence of a clear commitment by the central banks to supporting the financial markets. The danger of recession was ignored, and financial asset prices climbed.

Gratifying though this was for investors, the result has been a significant rise in valuation ratios. The markets therefore now have farther to fall if the risks materialise. On the other hand, these higher valuations could turn out to be justified if the overall situation improves. The solidity of the markets’ gains will depend on what happens in the months ahead. We have identified the key factors that will shape the coming year and have put together three scenarios: a baseline scenario "more of the same", a negative scenario "If something goes wrong" and third scenario "fairer and greener" (see below).

So one thing is clear: 2020 will be dominated by a wide array of powerful themes. Each of the trends could rapidly evolve in a positive or negative direction. We would advise, however, not to fixate on just one scenario. An investment portfolio’s basic orientation should be in line with our baseline scenario. Equities and high quality bonds therefore remain core portfolio components. Additional allocations in non-cyclical investments like gold or insurance-linked securities are also important for achieving an appropriate positioning in the present environment.

See below VP Bank Chief Investment Officer Dr Felix Brill answering four questions on the outlook.

Baseline scenario

- Economic reality will influence policy makers' decisions

- Difficult growth environment with a chance for brighter perspectives as the year goes on

- Central banks will stick with loose monetary policy

- Moderatly higher yields and spreads

- Equity markets picking up on positive news

Negative scenario

- An unsolved situation in the trade war and possibly further developments in other key areas will have negative economic consequences

- Weakness in manufacturing sector spreads to other sectors, a recession follows

- Central Bank stimulus is not having the desired effects anymore

- Markets loose their hope

Scenario fairer and greener

- Inequality concerns rise

- People take to the street to protest against social inequality, climate change and negative consequences of central bank policies, managers start to re-think their stakeholder priorities

- Weak growth triggers a re-think in politics

- Fiscal stimulus with a social and green deal