Ready for the new year

It’s well known that memory often skips over unpleasantness, especially if the end result is a positive one. That selective recollection may well happen when looking back at the investment year 2019. Certainly, many asset classes delivered good performance, above all, of course, the stock markets. The Swiss Market Index SMI is 23% up, and in the US the S&P 500 index is up 25% for the year. Moreover, fixed-income and some alternative investments – gold for example – have also done well. This helped our blended investment strategies.

Equities enjoyed a good run

But when looking back at the 2019’s solid returns we should remember that it was anything but a care-free year for investors. In particular, the unmistakable cooling off of leading economic indicators repeatedly sent ripples of recession fears through the markets. In addition, the Sino-American trade conflict and the unending Brexit saga repeatedly stirred up anxieties.

Both the US Federal Reserve and the European Central Bank reacted to flagging economic sentiment with interest rate cuts and new asset purchases. These efforts managed to calm many financial market participants and provided important stimulus to the economy. In addition, the Chinese authorities also opened the credit tap. This makes us confident that economic momentum is stabilising. However, as many nagging uncertainties still persist, we remain committed to our broadly diversified and risk-aware investment policy, making only minor technical adjustments.

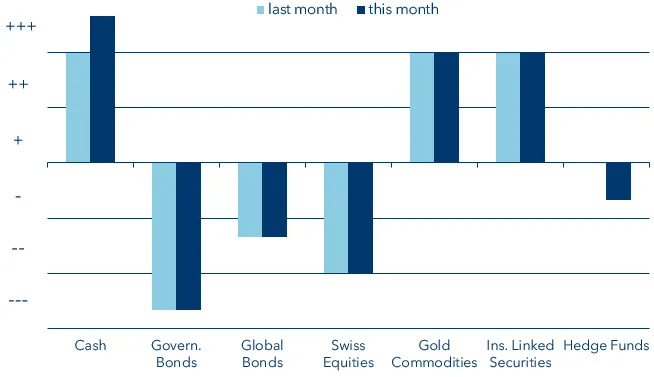

Tactical Allocation

Low duration in bonds

In all reference currencies, the selected duration – the interest rate risk – is below the corresponding index benchmark. We remain underweight in government bonds and global bonds.

Gold is a core component

We see Gold as an important stabiliser in the current environment and give the precious metal the corresponding space in the portfolio.

Currencies mostly hedged

Developed market currencies are strategically hedged, but the USD is only partially hedged in EUR and in CHF.

Caution in equities for now

We confirm the underweight in equities in the respective home market of the reference portfolios.

Important legal notice

This document has been produced by VP Bank Ltd (hereinafter referred to as the “Bank”) and distributed by the companies of VP Bank Group. This document does not constitute an offer or invitation to buy or sell financial instruments. The recommendations, estimates and statements contained herein reflect the personal opinion of the relevant analysts of VP Bank Ltd on the date stated in the document and can be changed at any time without prior notification. The document is based on information which is believed to be reliable. This document and the estimates and assessments provided herein are prepared with the greatest care, but their correctness, completeness and accuracy cannot be assured or guaranteed. In particular, the information in this document may not include all relevant information regarding the financial instruments addressed herein or their issuers.

Further information on the risks associated with the financial instruments covered in this document, the proprietary trading of VP Bank Group, the handling of conflicts of interest in relation to these financial instruments and the distribution of this document can be found at www.vpbank.com/legal_notice.