A Question of Perspective

Now it has caught up with the world’s biggest economy. According to the US companies surveyed by the Institute for Supply Management (ISM), activity in both the manufacturing and the services sectors deteriorated significantly in September.

In particular, this leading indicator’s recent decline in the manufacturing sector has alarmed financial markets just in time for the start of the fourth quarter. The reading was as bad as was last seen in June 2009, when it soon recovered as the US economy climbed out of the deep recession after the 2008 financial crisis. However, given the recent ISM-datapoints, it is not surprising that equity analysts have revised their profit expectations downwards yet again for companies in most regions and sectors. This obviously has a dampening effect on the potential for share price increases.

Weak leading indicators

Weak economic data does not necessarily translate into losses on the stock markets.

The most recent example of this may be the publication of the ISM services survey in early October. Despite an unexpected slump, the US stock market saw a significant upturn. One possible explanation: if the economic data is weak enough, new monetary or fiscal stimulus measures become more likely. Thus, bad data can suddenly become good news. This pattern is as well-known as it is unstable over time.

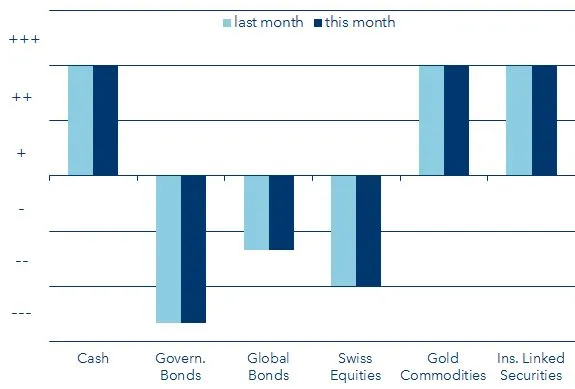

Tactical Allocation October 2019

Low duration in bonds

In all reference currencies, the selected duration – the interest rate risk – is below the corresponding index benchmark. We remain underweight in government bonds and global bonds.

Gold is a core component

We do not hold gold for performance, but rather as a stabilizing element in the portfolio. We therefore confirm our overweight.

Currencies mostly hedged

Developed market currencies are strategically hedged, but the USD is only partially hedged in EUR and in CHF.

Caution in equities

We confirm the underweight in equities in the respective home market of the reference portfolios.

Important legal notice

This document has been produced by VP Bank Ltd (hereinafter referred to as the “Bank”) and distributed by the companies of VP Bank Group. This document does not constitute an offer or invitation to buy or sell financial instruments. The recommendations, estimates and statements contained herein reflect the personal opinion of the relevant analysts of VP Bank Ltd on the date stated in the document and can be changed at any time without prior notification. The document is based on information which is believed to be reliable. This document and the estimates and assessments provided herein are prepared with the greatest care, but their correctness, completeness and accuracy cannot be assured or guaranteed. In particular, the information in this document may not include all relevant information regarding the financial instruments addressed herein or their issuers.

Further information on the risks associated with the financial instruments covered in this document, the proprietary trading of VP Bank Group, the handling of conflicts of interest in relation to these financial instruments and the distribution of this document can be found at www.vpbank.com/legal_notice.