Less sulphur, higher costs: green marine diesel oil burdens the economy

The sulphur emissions from shipping are literally breath-taking. Every year, a mere 15 vessels of the largest category emit as much sulphur dioxide (SO2) as all the cars in the world combined. Thus it was only a matter of time before the International Maritime Organisation of the United Nations (IMO) decided to set stricter standards.

Overview of IMO 2020

Under IMO 2020, the maximum sulphur content of all fuels used on the high seas worldwide is to be cut from 3.5% to 0.5%. That may sound like a drop in a bucket, but the International Energy Agency considers this to be a unique and radical change in maritime fuel guidelines – notwithstanding that a limit of 0.1% already applies along the coasts of North America and northwest Europe. The new emissions directive is only an intermediate step. Looking ahead to the period between 2030 and 2050 there are already detailed plans to protect not only air purity (reduction of CO2 pollution by 50%), but also water quality. These regulations will make shipping goods more expensive in the long run.

That the sulphur content is only now being reduced is a moot issue. Suffice to say that alarmingly high SO2 levels are being recorded in ports and along coastlines. In high concentrations, SO2 can be harmful to humans, animals and plants. But aside from the positive effects the new standard will have on nature and the environment, the changeover will result in direct consequences for shipping/cruise lines, the crude oil market, the global economy and companies’ transport costs.

1. Consequences for shipping companies

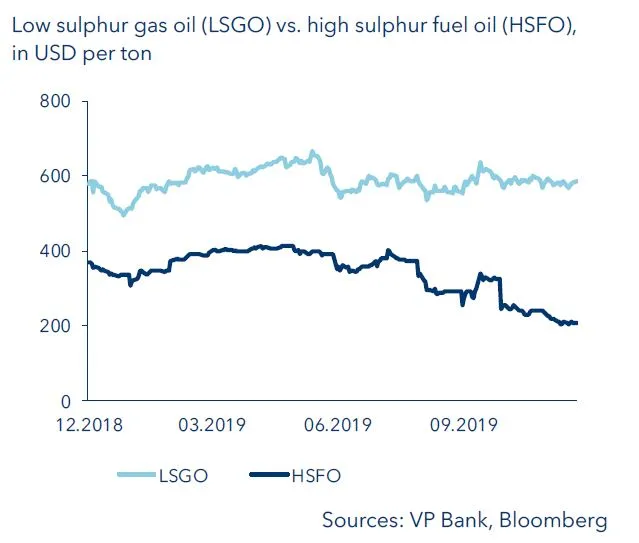

Maritime shipping companies are faced with a daunting challenge. They have three options for meeting the new requirements. The easiest and most obvious way would be to switch to more expensive low sulphur gasoil (LSGO). However, there is a danger that, at least in the early stages of the changeover, demand for these fuels will exceed supply, and the price of environmentally friendly fuels will rise. Thus, the actual added costs to shipping companies are uncertain at this point. At least there are exceptions in place: If IMO-compliant fuels are not available in ports due to supply bottlenecks, ships can request a special exemption in order to avoid delays.

As an alternative, installing an exhaust gas cleaning system (a so-called “scrubber”) can be considered. This will allow operators to continue the use of conventional high-sulphur fuel oil. The downsides are the retrofitting costs of USD 7-10 million per ship (according to logistics firm Hapag-Lloyd) and limited production capacities on the part of manufacturers. And if the IMO were to enforce the fuel regulations even more stringently in future, scrubbers would only serve as an interim solution. Above all, the resulting water pollution (the sulphate by-product of scrubbing is discharged into the sea) is highly controversial. The third and most expensive solution is to convert ships for the use of non-crude-based fuels such as liquefied natural gas (LNG).

Of course some shipping companies may decide not to take any action at all, but they will then face stiff penalties. Compliance with the IMO-2020 directive is monitored by the port authority of the respective country, and the officials can order fines, ship arrest or even imprisonment of the captain in the event of violations.

At present, the assumption is that most shipping companies will switch at least for the short term to low-sulphur fuel and that only a few of them will invest in scrubbers or alternative propulsion systems. According to estimates by the world’s largest crude-carrier company, Euronav, about 3,500 (ca. 6%) of the current 60,000 ships on the world’s oceans will be equipped with scrubbing systems. In the medium to long run, though, the question arises as to which propulsion system will ultimately prevail and, above all, which position the sea route will hold in future goods trade. Whatever the case, IMO 2020 could lead to near-term price distortions in the oil market.

2. Consequences for the crude oil market

The extent of the IMO 2020 impact on the crude oil market is difficult to assess. In terms of low-sulphur fuels, maritime shipping obviously competes with land and air transport. “Heavy” crude has hardly been used elsewhere. This is changing the supply and demand situation. For example, lighter and sweeter types of oil such as the European “Brent” and Brazilian “Ostra” can be expected to trade at premiums over heavier and more sour types such as “Dubai Fathe” or “Urals”. A similar effect can also be observed with US “West Texas Intermediate” versus "Maya" from Mexico and “Western Canadian Select”.

Price distortions also have to be reckoned with in the refined oil products market. “Crack spreads”, which show the price differential between crude oil and its extracted distillates, will widen for lighter products and narrow for heavier products as refineries – at least in the short run – will not be able to compensate for the shift in demand due to a lack of capacity. Hence various X-factors, such as the number of installed scrubbers or the available quantity of low-sulphur fuel for ships, make it difficult to scope out the implications for the oil markets. Investors in any case should expect increased volatility and pronounced price distortions.

3. Consequences for the global economy

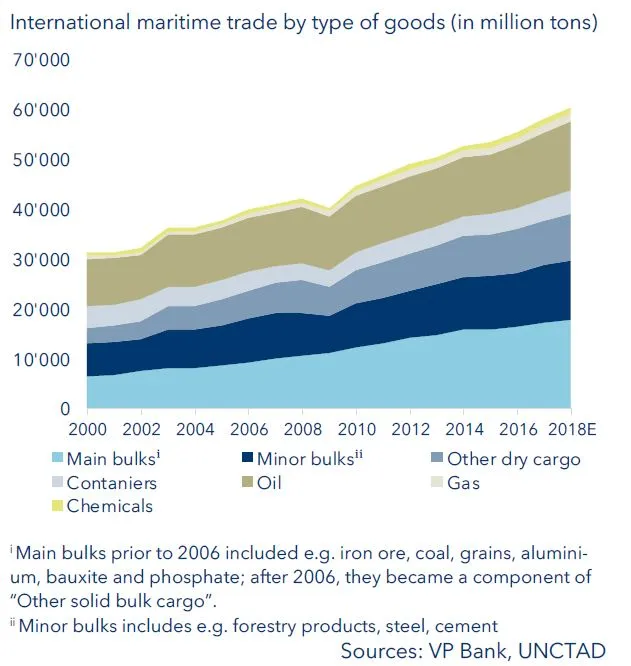

The new IMO 2020 emissions standard is already being identified by some as an unforeseen extreme event – a “black swan" – for the global economy. According to the major shipping companies, freight costs for sea transport could increase by up to 30% in a worst-case scenario. If this in fact materialises, it would place an additional burden on world trade, which is already suffering from tariff conflicts.

Industrial production and private consumption could suffer as a result. In a study by the US-based Payne Institute, renowned energy expert Philip K. Verleger reckons that US gross domestic product could be trimmed by something between 0.6% and 7.1% compared to the status quo without IMO 2020. This wide range shows just how difficult the impact assessment is.

Investigations by price information service SP Global Platts regarding trade in energy, raw materials and agricultural products also make this clear. On the premise of a cost increase in freight rates of more than 15%, the firm assumes that the transport of certain industrial products will no longer be profitable. This includes benzene – one of the most widely traded chemicals in the world. Due to the oversupply in Asia, large quantities of benzene are regularly shipped to North America and Europe. Established flows of goods would be abruptly interrupted with potentially drastic effects on world trade.

Although we are cautious about such estimates due to the myriad determinants that cannot be quantified precisely, this makes clear that the new directive will presumably not leave the world economy unscathed.

4. Consequences for businesses

IMO 2020 is not only a challenge for sea freight carriers; it will also cast doubt on the attractiveness or even usefulness of long transport routes across all industrial sectors. The related costs will play an important role in global price competition – and the initial reflex is always to pass on the higher costs. Hapag Lloyd went so far as to create a new price model because of the impending IMO 2020. Whether shipping companies such as Hapag can raise prices, however, depends on the market.

The amounts involved are not small. British bank HSBC, for example, calculates that the higher fuel prices will place an additional burden of RMB 400 million (around USD 57 million) on Chinese sea freight carrier Cosco Shipping for 2020, equal to some 7.5% of its expected operating profit. This represents a painful hit for an already cost-intensive industry – and a total rethink becomes necessary. Hence it is only logical that three major coalitions (The Alliance, 2M, Ocean Alliance) have now been formed among the shipping companies, similar to the aviation industry. The increasing digitalisation of logistics systems is helping to optimise freight routes and capacity utilisation. Producers and suppliers will respond to rising costs by establishing alternative logistics routes and/or the relocation of production facilities. Recently, the trade conflict between Washington and Beijing has triggered such reactions. IMO 2020 will make things even worse in terms of costs.

However, the first phase of the changeover is somewhat difficult to fathom, with no clear winners and losers foreseeable at this point. For companies that have already positioned themselves in anticipation of the new world order, the coming months could prove to be an opportunity. Refiners OMV and Valero are likely to be among the beneficiaries. Both have adapted their production capacities appropriately at an early stage and stand to profit from shortage-driven prices. Similarly, a regional shift in demand plays into the hands of both companies; for example, OMV can supply benzene via land routes in Europe.

The current increase in demand for fuel cleaning systems (scrubbers) has not sparked any growth fantasies with regard to their producers (including Alfa Laval, Wärtsilä, Yara), inasmuch as this particular trend is only temporary and scrubbers are merely a transitional solution for ship operators.

5. Further industrial consequences

The ramifications of IMO 2020 go even further and can also be expected in smaller markets. The heightened demand for low-sulphur fuels is almost sure to lead to price increases for steel and aluminium and even when it comes to the manufacture of lithium-ion batteries for electric vehicles. The “transmission mechanism” responsible for this infection is called needle coke, which is used in both fields. Low-sulphur crude oil is necessary for its production. So far, this market has been in balance, so the additional demand from the shipping industry could at least in the short-term unbalance demand and supply with consequences for available quantities and prices. However, there are only about ten needle coke producers worldwide, and no new plants are currently planned outside China.

New technologies as well could gain momentum – for instance, 3D printing, which creates a pre-designed component layer by layer with all three-dimensional aspects, directly at the production site and according to the specific use. So, if IMO 2020 results in higher freight costs, 3D printing technology will benefit from the cost advantages. Currently, this technology is being used for bespoke, highly specialised production runs (i.e. in niche markets), but the bridge to mass production has already been built. Here, the greatest gains in productivity can be expected in the supplier segment: instead of shipping a given component several times across the oceans as a raw object, intermediate product and then as a finished good in the global manufacturing process, the supplier can produce it on site at its own plant in a standardised and individualised manner. Not only suppliers, but also producers would benefit. For the sustainability goal of the International Maritime Organisation to be achieved in the long run, it is definitely helpful if logistics as a whole can be streamlined.

Summary

The new IMO 2020 emissions directive can have far-reaching economic consequences for the global shipping fleet. It is astonishing that even freight customers do not have this issue on their radar at all, or if so only vaguely. The intensity, but also the permanence, of the related price changes will, however, come as a shock for those unaware companies that ship bulk goods and are exposed to heightened price competition. Increased freight costs could result in the realignment of entire supply chains and thus to adjustments within the global manufacturing industry. For businesses, this will initially pose an operational burden. IMO 2020 promises to create a headwind for profit growth in the next two years.

In view of the X-factors involved, it is difficult to quantify the economic impact of this development. On the back of today’s trade conflicts and deglobalisation tendencies, though, the new emissions directive represents an added millstone.

Content responsibility

Bernd Hartmann, Head CIO Office

Jérôme Mäser, Junior Equity Analyst

Dr Thomas Gitzel, Chief Economist

Harald Brandl, Senior Equity Strategist

Dominik Pross, Junior Investment Strategist

Important legal information

This document was produced by VP Bank AG (hereinafter: the Bank) and distributed by the companies of VP Bank Group. This document does not constitute an offer or an invitation to buy or sell financial instruments. The recommendations, assessments and statements it contains represent the personal opinions of the VP Bank AG analyst concerned as at the publication date stated in the document and may be changed at any time without advance notice. This document is based on information derived from sources that are believed to be reliable. Although the utmost care has been taken in producing this document and the assessments it contains, no warranty or guarantee can be given that its contents are entirely accurate and complete. In particular, the information in this document may not include all relevant information regarding the financial instruments referred to herein or their issuers.

Additional important information on the risks associated with the financial instruments described in this document, on the characteristics of VP Bank Group, on the treatment of conflicts of interest in connection with these financial instruments and on the distribution of this document can be found at https://www.vpbank.com/legal_notes_en.pdf