Are US tariffs about to hit European car exports?

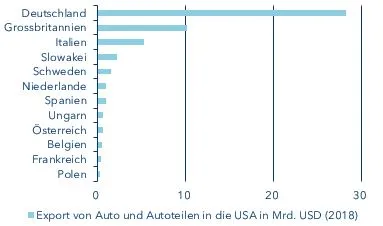

To date, the trade dispute has centred on the trade between the USA and China. Now, the focus is set to shift to Europe. US President Donald Trump has until 13 November at the latest to decide whether he wants to impose a 25% punitive tariff on EU car imports. The reason: a report presented by the US Department of Commerce last February claiming that car imports from the EU pose a potential threat to national security. As is the case in the dispute with China, the aim, however, is to reduce America’s trade deficit. The negative balance of trade in goods with the EU amounted to USD 168 bn in 2018, of which Germany, Ireland, Italy and France accounted for roughly 95%. In particular, imported cars and automotive parts have long been a thorn in Trump’s side. For years, the presence of German automobiles on American roads has irked him. Already back in 1999, the erstwhile real estate entrepreneur said in an interview that special taxes should be levied on these vehicles. Around a quarter of America’s trade deficit with the EU is attributable to automobiles and car parts (see chart).

A hefty chunk

Tariffs imposed on their exported cars would cause harm to European automakers. Cars and automotive parts are the EU’s second most important external trade goods after machinery. In 2018 their volume amounted to EUR 205 bn, which corresponds to about 11% of all eurozone exports. According to United Nations trade statistics, EUR 54 bn thereof went to the USA.

Import tariffs after subsidies for Airbus

The USA introduced punitive tariffs on certain European goods in October. In contrast to the US president’s previous rationale for imposing stiff tariffs as a way of dealing with trade disputes, his latest decision is based on an arbitration ruling by the World Trade Organization (WTO). It allows the US to levy punitive customs duties annually on USD 7.5 billion worth of imported EU goods. The WTO decree is in connection with a proceeding that started 15 years ago, in which the EU and the USA accuse each other of having granted illegal subsidies to their respective aircraft manufacturers Airbus and Boeing. Since 18 October, Airbus planes have been subject to a 10 percent duty, while all other imported goods on the list (including Italian Parmesan cheese, Spanish olive oil and British wool sweaters) are subject to a 25% impost. However, the WTO has already determined that the USA illegally subsidised Boeing as well. In all likelihood, the WTO will issue a ruling on this matter in the coming year, at which point the EU will impose punitive tariffs of its own. The latter will hit Boeing harder than Airbus, given that the European market is more important to the US aircraft manufacturer than the US market is to Airbus.

It is unlikely that the shipment of cars across the Atlantic would come to a complete halt in the event of punitive tariffs. Yet, a study conducted in early 2019 by the German Ifo Institute arrived at a disturbing conclusion: a 25% tariff would halve US consumer demand for European cars over the long run and thereby strike a blow to an important segment of the European economy. The imposts would affect the individual countries within the European Union to different degrees depending on their reliance on the automotive industry (see chart below). Germany would by far suffer the most, in that the USA is its second most important market for car sales.

According to the Institute’s calculations, Germany, the largest economy in the EU, would lose EUR 5 bn in gross domestic product (GDP). Relative to the GDP, this would trim the total by roughly 0.2% – a relatively small amount at first glance, but the long-term negative fallout (e.g. in the form of production relocations) is not taken into account here. In other words, it can be presumed that the automakers would shift even more manufacturing capacity to the United States. The EU has already announced that it will react with countermeasures on US imports if Trump does in fact impose the punitive tariffs. Consequently, there is the very real threat of an escalation spiral similar to what we have seen in the US/China trade dispute.

The EU has an ace up its sleeve

Nonetheless, the EU holds a joker in its negotiations with the USA – because the European and especially the German carmakers not only export vehicles to the USA, they have also built up considerable production capacities in the States, which makes Daimler, BMW and the like important employers there. According to estimates by the European Automobile Manufacturers Association, they directly or indirectly employ 420 000 workers. In 2018, they built more than 3 million cars, equal 27% of America’s total automobile output. Even if the Italo-American carmaker Fiat Chrysler is excluded from the calculation, the number still accounts for 15% or 1.7 million units of US domestic automobile production. Moreover, EU car manufacturers based in the US export a significant portion of their output, thereby making a significant contribution to improving the US trade balance: more than half (54%) of those cars are exported to third countries, including the EU.

And there is yet another aspect that the Europeans will stress in the negotiations: since car parts will also be subject to higher duties, the punitive measures will fly in the face of US automobile manufacturers. Parts account for around 18% of European car-related exports, and in 2018 their value amounted to some USD 10 bn. Germany’s Bosch and Continental are the two largest automotive parts suppliers in the world. ZF Friedrichshafen (Germany), Michelin and Valeo (France) are also amongst the top 10 parts suppliers. US consumers will therefore pay the piper themselves when they buy practically any American-made vehicle. It is precisely these key factors that have until now prevented the trade dispute from escalating to an even greater extent.

Summary

US President Trump could soon be targeting Europe if talks on a transatlantic industrial customs agreement do not make headway. It is therefore entirely possible that punitive tariffs will be imposed on European cars and automotive parts. Equally spoken, it cannot be ruled out that the White House fails to come to a final decision by mid-November. Signals are already being sent out that the US could first negotiate with the EU before taking any action. The realisation that German car manufacturers are important employers in the US could ultimately put the US in a more amicable mood. But the current discourse makes it clear: the “trade war” topic will be a constant companion of financial market participants for quite some time to come.

Content responsibility

Bernd Hartmann: Head CIO Office

Author: Dr Thomas Gitzel, Chief Economist

Important legal information

This document was produced by VP Bank Ltd (hereinafter: the Bank) and distributed by the companies of VP Bank Group. This document does not constitute an offer or an invitation to buy or sell financial instruments. The recommendations, assessments and statements it contains represent the personal opinions of the VP Bank Ltd analyst concerned as at the publication date stated in the document and may be changed at any time without advance notice. This document is based on information derived from sources that are believed to be reliable. Although the utmost care has been taken in producing this document and the assessments it contains, no warranty or guarantee can be given that its contents are entirely accurate and complete. In particular, the information in this document may not include all relevant information regarding the financial instruments referred to herein or their issuers.

Additional important information on the risks associated with the financial instruments described in this document, on the characteristics of VP Bank Group, on the treatment of conflicts of interest in connection with these financial instruments and on the distribution of this document can be found at https://www.vpbank.com/legal_notes_en.pdf