The VP Bank Supply Chain Index - How things stand in terms of global trade

Hardly an industry has not been affected by the current shortage of materials, and no sign of any sustained improvement has been seen in recent months: once one product became available again, another was lacking. For example, the supply of construction lumber has improved, but now it is difficult to obtain insulation material for use at building sites.

It remains to be seen how the situation will evolve in the weeks and months ahead but, due to the seemingly unstoppable spread of Omicron, a rapid deterioration cannot be ruled out. And to make things worse, the zero-Covid strategy pursued by the Chinese government is leading to the renewed closure of manufacturing plants and ports.

Light on the horizon

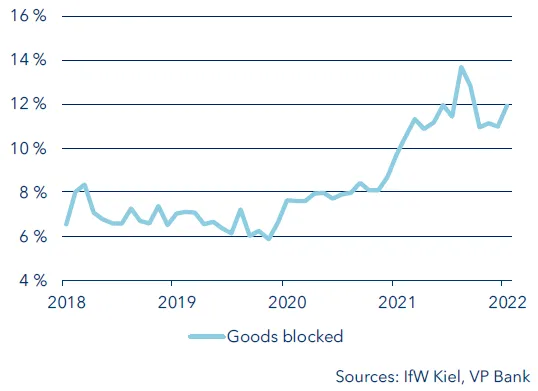

Data compiled by the Kiel Institute for the World Economy (IfW) reveal that the shipping congestion at ports in the US and China has eased somewhat since autumn. However, the quantity of goods yet to be offloaded from container ships across the globe is back on the rise (see chart). Analyses by Swiss logistics firm Kühne + Nagel that monitors waiting times at ports, come to the same conclusion: the situation at US ports has recently deteriorated, presumably due to the highly contagious Omicron variant. Increased infection rates are likely to delay freight handling at many major commercial gateways.

Freight waiting to be offloaded as % of shipped goods

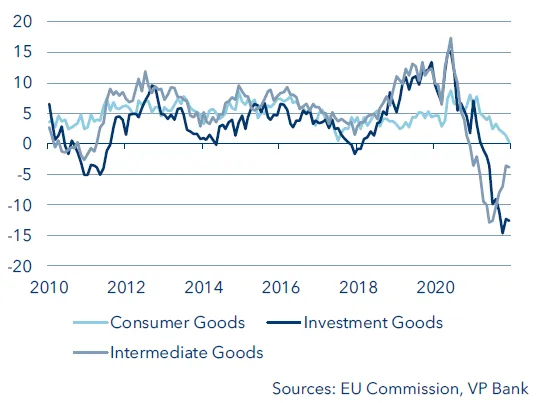

On a brighter note, there has been an increase in European goods inventories of late. The EU Commission’s monthly business surveys show that the situation has improved noticeably in recent weeks.

Business inventories in the EU

Encouraging signs can also be seen in the US. The monthly Institute for Supply Management (ISM) purchasing managers survey indicates that delivery times within the manufacturing sector have shortened in the past several weeks.

Bottlenecks still exist in many areas

As pleasing as these individual improvements are, many sticking points remain. For instance, the ISM data shows that the gap between new orders and inventories still hovers at record high levels. In the longer run, this is good news for the economy; after all, inventories need to be replenished and orders filled. However, it is also a reflection of the considerable short-term supply chain tensions. The persistently high per-container freight costs also provide evidence that maritime trade is not yet running smoothly. The Container Price Index measures the weekly price movements: despite a minor downtick last summer, it has continued to march higher and currently stands just shy of its peak recorded last summer.

Container Price Index

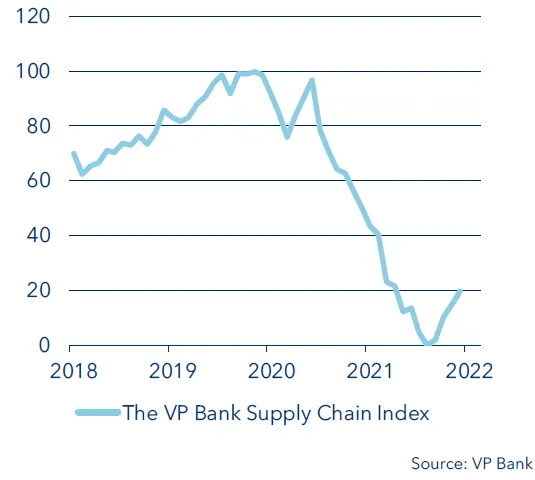

The VP Bank Supply Chain Index

So, in a nutshell: the signals are contradictory. Look in one place and improvements can be seen. Look elsewhere and the situation remains tense. When assessing the economic trend, it is important to keep an eye on the status of supply chain disruptions. Today, scarce goods are driving up intermediate and end prices, with the result being that central banks now have little other choice than to change course by raising their benchmark rates, this in effort to counteract at least the second-round effects. But once the materials shortages become less severe, the overall situation will ease and producer prices could even start to retreat.

In order to systematically map the developments in global trade, we have developed the VP Bank Supply Chain Index. The eleven parameters used in its calculation include the indicators previously discussed and are in particular:

- Container Price Index

- Goods blocked (IfW Kiel)

- Eurozone inventory status based on the EU Commission’s monthly survey (six different product categories)

- ISM Manufacturing Index (sub-aggregates: 1. difference between order backlogs and inventories; 2. Delivery times)

These time series are then condensed by means of a statistical method known as principal component analysis to generate a single indicator. The resulting values are plotted on a scale from 0 to 100, with 100 corresponding to the smoothest material flow to date within the given timeline. Values of zero, or close to zero, indicate a tense supply chain situation. In other words, a high reading means smooth sailing; a low reading, rough seas.

VP Bank Supply Chain Index

This propriety index reflects the supply chain status over the past four years. Clearly visible is the successive deterioration that followed the onset of the first coronavirus wave in March 2020. Although the situation has improved somewhat since the fall of 2021, the conditions are still nowhere near what they were prior to the outbreak of the pandemic.

Summary

The Omicron variant will continue to be a burden on global supply chains in the weeks ahead. The Chinese government’s zero-Covid strategy is adding to the problem by causing plant and port closures. From now on we shall be keeping a close eye on whether or not the recent easing of supply chain bottlenecks has legs. The VP Bank Supply Chain Index will be updated monthly and used to systematically monitor developments in global trade by taking into account freight prices, inventories, cargo ship congestion and delivery times in the USA and Europe.

Important legal information

This document was produced by VP Bank AG (hereinafter: the Bank) and distributed by the companies of VP Bank Group. This document does not constitute an offer or an invitation to buy or sell financial instruments. The recommendations, assessments and statements it contains represent the personal opinions of the VP Bank AG analyst concerned as at the publication date stated in the document and may be changed at any time without advance notice. This document is based on information derived from sources that are believed to be reliable. Although the utmost care has been taken in producing this document and the assessments it contains, no warranty or guarantee can be given that its contents are entirely accurate and complete. In particular, the information in this document may not include all relevant information regarding the financial instruments referred to herein or their issuers.

Additional important information on the risks associated with the financial instruments described in this document, on the characteristics of VP Bank Group, on the treatment of conflicts of interest in connection with these financial instruments and on the distribution of this document can be found at https://www.vpbank.com/legal_notes_en.pdf