The franc flexes its muscles

The Swiss franc broke out of its 1.08 to 1.10 trading range in mid-January, a band that had remained intact since August, and is now in the process of flexing its muscles against the euro. This burst of strength was triggered by the heightened tensions between the US and Iran. The rising geopolitical risks have, as usual, driven safety-conscious investors into the franc.

Meanwhile, however, people are rubbing their eyes in astonishment: the punches and counterpunches in Iran have lost their explosive power. At the same time, the trade dispute between the US and China have eased noticeably and concerns about Brexit have been put on the back burner. Yet despite these signs of détente, the franc has continued its advance. Could the reason not to be the strength of the franc but rather the weakness of the euro? No. The European common currency shows neither particular strength nor particular weakness in trade-weighted terms.

The bar for forex market intervention is higher

So, in an attempt to explain the recent price action in the franc, it is perhaps best to take a different route and gain a broader perspective. By doing so, it becomes clear that the Swiss franc has also quietly appreciated against the dollar. So maybe the reason for strength of the franc is more on the dollar side? Indeed. In mid-January, the US put Switzerland back on the watchlist for countries suspected of being potential currency manipulators. The Swiss Confederation was already on that list from October 2016 to October 2018. Hence there is a real risk that US-president Donald Trump, after having recently signed a partial trade agreement with China, will in future devote more of his attention to America’s European trading partners. Switzerland is also coming under pressure because of its high bilateral trade balance surplus with the USA and the foreign exchange market interventions, even if the SNB denies being on the defensive. In the worst case, Switzerland faces sanctions.

This development is of course an open invitation for certain currency market players to explore the limits of the Swiss National Bank. Speculators are likely to bet that the SNB will be more tolerant of further gains in the franc. Thus, a recalibration of the currency’s downside risks is taking place, something that could even enhance the franc’s reputation as a "safe haven". For the last year, the SNB’s weekly figures on sight deposits suggest that it intervened in the region of EUR/CHF 1.08. Now, it would appear that the intervention threshold has gradually shifted downwards. Of late, no open market operations on the part of the SNB have been observed, i.e. the sight deposit readings have remained largely constant. This of course does not mean that the monetary watchdogs in Bern are no longer willing to intervene. Rather, the threshold is likely to have been merely notched-down to something just shy of CHF 1.07. And despite Washington’s suspicion of currency manipulation, the SNB will not simply stand back and watch the franc appreciate unabatedly. The US tolerates currency purchases of up to 2% of gross domestic product (GDP). In 2019, the foreign reserve assets grew by CHF 28 bn equalling about 4% of GDP which puts the SNB at odds with the US rules (see boxed text above). Thus, selective interventions by the SNB are entirely possible without immediately provoking further ire in Washington. An abrupt end to the franc’s current strength is therefore not to be reckoned with. And to a certain extent, the currency markets have already got wind of this burning fuse.

Developments in the euro still count

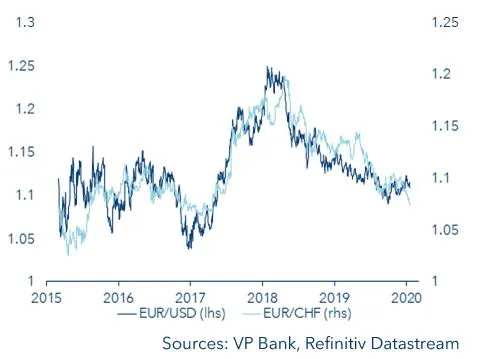

Peering beyond the horizon, though, we are still convinced that the euro will play a decisive role. If the European common currency were to develop broader strength versus the other major currencies as the year progresses, this would inevitably be reflected in its relationship with the Swiss franc. The two currency pairs – EUR/USD and EUR/CHF – have essentially moved in lockstep ever since the SNB abandoned its exchange rate floor of CHF 1.20 in January 2015.

So, the overriding question is whether the euro is predestined to be strong or weak. Indeed, the common currency seemingly has the potential for broad-based appreciation against both the US dollar and the Swiss franc since it is clearly undervalued in terms of purchasing power parity. However, the weak eurozone economy is at the moment acting like a handbrake. Although the arrows of many leading economic indicators point in the direction of recovery, there is still scepticism in the foreign exchange markets as to whether the trend will last. The common currency area is in the midst of a structural transition due to its heavy reliance on the automotive industry, especially in Germany – and the changeover to e-mobility is taking its toll on growth potential. Moreover, the Brexit issue is far from being finally resolved. Negotiating a free trade agreement between the EU and the UK will be difficult, and the tone of voice on both sides of the English Channel sounds is harsh, to say the least. Furthermore, Italy's government is weakened and some fear elections to happen sooner rather than later. In view of these negative factors, the traffic lights for the euro have not yet turned green. However, if the recovery tendencies in the eurozone gather some steam and more conciliatory inclinations between Brussels and London become apparent, the euro could finally start to gain some ground.

Summary

The weakness in the EUR/CHF currency pair is most likely short-term in nature. The forex markets at present are putting the SNB’s intervention policy to the test. In our view, however, the way the euro develops going forward will be the more decisive factor. If the common currency can show at least a modest strength in the course of the year, this will naturally become noticeable also in terms of the Swiss franc. In our view, CHF will then have a chance to ease back to levels slightly above CHF 1.10 versus the euro.

|

Who is a currency manipulator in the eyes of the US?

The US Treasury Department analyses the monetary and foreign trade policies of each of the major trading partners. The accusation of currency manipulation can be lodged against any country that has a significant trade balance surplus with the USA, achieves a substantial current account surplus, and constantly intervenes unilaterally in the foreign exchange markets. This is not just a qualitative assertion; individual criteria are also quantified in order to underscore the contention. Just one criterion is enough to be included in the list.

Trade balance surplus: The threshold for the bilateral trade criterion amounts to USD 20 billion or 0.1% of US gross domestic product (GDP).

Current account surplus: Here, the threshold lies at 3% of the given country’s GDP.

Foreign exchange market interventions: Any country that exceeds a volume of 2% of its GDP in the form of foreign exchange market intervention is in violation of this criterion. Currently, the Treasury Department considers nine countries to be currency manipulators, namely Japan, South Korea, Germany, Italy, Ireland, Singapore, Malaysia, Vietnam and Switzerland. China is still on the list but is no longer accused of actual currency manipulation. |

Content responsibility

Bernd Hartmann, Head CIO Office

Autor: Dr Thomas Gitzel, Chief Economist

Important legal information

This document was produced by VP Bank AG (hereinafter: the Bank) and distributed by the companies of VP Bank Group. This document does not constitute an offer or an invitation to buy or sell financial instruments. The recommendations, assessments and statements it contains represent the personal opinions of the VP Bank AG analyst concerned as at the publication date stated in the document and may be changed at any time without advance notice. This document is based on information derived from sources that are believed to be reliable. Although the utmost care has been taken in producing this document and the assessments it contains, no warranty or guarantee can be given that its contents are entirely accurate and complete. In particular, the information in this document may not include all relevant information regarding the financial instruments referred to herein or their issuers.

Additional important information on the risks associated with the financial instruments described in this document, on the characteristics of VP Bank Group, on the treatment of conflicts of interest in connection with these financial instruments and on the distribution of this document can be found at https://www.vpbank.com/legal_notes_en.pdf

Add the first comment