Rising Anxiety

Scanning the economic headlines lately, one can be forgiven for thinking that hardly anything has really changed in the past few weeks. The ongoing US-China trade dispute still simmers, Brexit, in whatever form, is still unrealised, and in Italy there are discussions about new elections. However, if one reads the stories below the seemingly unchanging headlines, it quickly becomes apparent that theses vexing economic and political problems have indeed intensified.

Despite temporary glimmers of hope, the trade conflict has not been resolved and even worse, it now threatens to turn into a full-blown currency war. Lately, a dollar costs more than 7 renminbi, a threshold that in recent years had staunchly been defended by the Chinese central bank. The reaction in stock markets were correspondingly severe. For example, the US S&P 500 stock index lost 3% on a single trading day. Meanwhile, the British pound has retreated further since Boris Johnson took over as prime minister. Obviously, investors believe that an orderly Brexit has now become even more difficult to achieve.

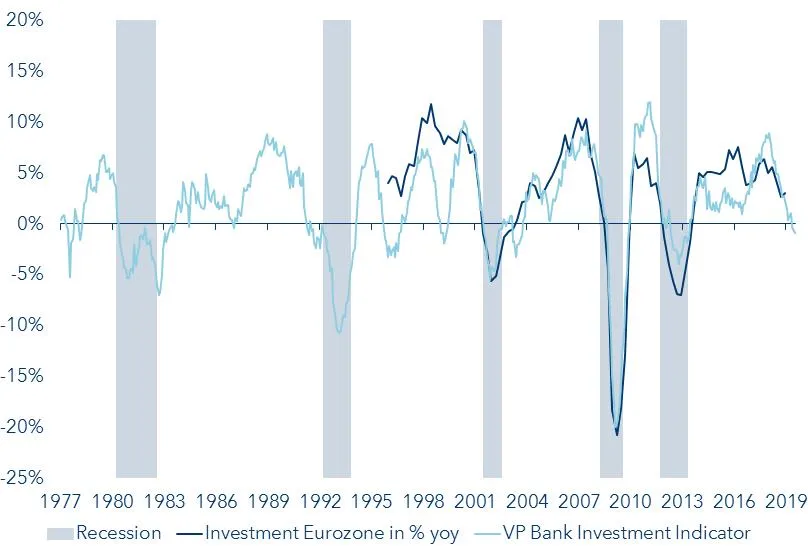

On top of this, words such as “disappointing”, “weaker” or “declining” accumulate in economic news stories. This troubling deterioration is plainly reflected in the VP Bank Investment Indicator for the Eurozone, which has fallen into negative territory for the first time since 2011, at the onset of the euro crisis (see graph below). Against this backdrop, we fear that the financial market environment will continue to be characterized by nervousness in the coming weeks. Therefore, we stick to our defensive portfolio stance.

VP Bank Investment Indicator

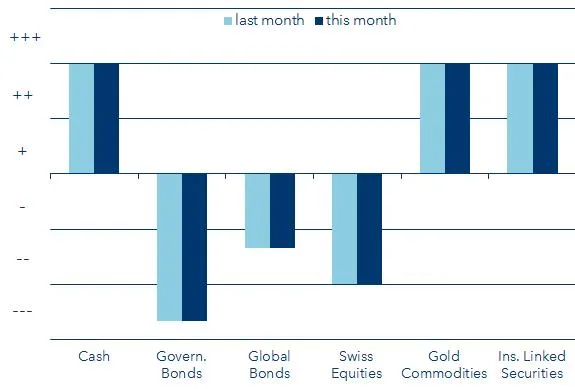

Bonds underweight

Interest rates have fallen further and the volume of government bonds yielding negative has risen. This leads us to reaffirm our underweight in government bonds as well as our preference for shorter durations.

Equities underweight

We think the equities environment will remain challenging until the end of the year. We confirm the underweight in the respective reference currencies.

Gold confirmed

The portfolio’s gold position has proven itself as a hedge. The per-ounce price of gold has reached a level never seen since the beginning of 2013.

Currencies hedged

Developed-country currencies are strategically hedged, while in EUR and CHF mandates the USD remains partially unhedged.

Tactical Allocation

Important legal notice

This document has been produced by VP Bank Ltd (hereinafter referred to as the “Bank”) and distributed by the companies of VP Bank Group. This document does not constitute an offer or invitation to buy or sell financial instruments. The recommendations, estimates and statements contained herein reflect the personal opinion of the relevant analysts of VP Bank Ltd on the date stated in the document and can be changed at any time without prior notification. The document is based on information which is believed to be reliable. This document and the estimates and assessments provided herein are prepared with the greatest care, but their correctness, completeness and accuracy cannot be assured or guaranteed. In particular, the information in this document may not include all relevant information regarding the financial instruments addressed herein or their issuers.

Further information on the risks associated with the financial instruments covered in this document, the proprietary trading of VP Bank Group, the handling of conflicts of interest in relation to these financial instruments and the distribution of this document can be found at www.vpbank.com/legal_notice.

Add the first comment