No spring before Christmas

The supermarket shelves are already filled with Christmas treats, and the first pre-Christmas parties are already planned. As they do every year, the financial markets are looking forward to a sweet year-end rally. The hopes this year are fuelled by signs of a relaxation in tensions coming from Washington and Beijing, and from London and Brussels too.

In the Sino-American trade conflict, there have been some promising noises lately, and the Brexit saga has shown increased chances of reaching an orderly separation of the UK from the EU with the election of a new British Parliament. Stock markets have welcomed these signals and share prices have risen significantly in recent weeks. Several indices, including those in the US and Switzerland, reached record highs. So it seems, everything is in place for a year-end year rally, no?

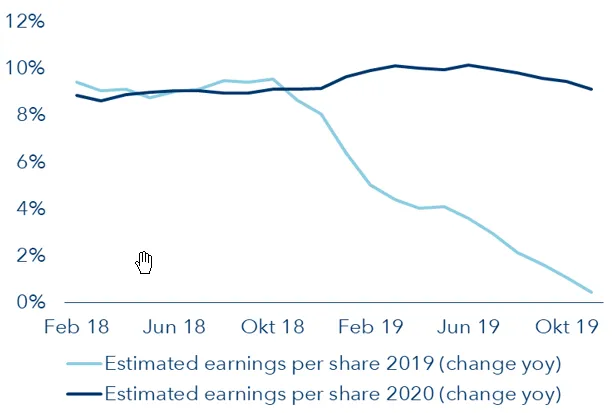

Earnings Estimates MSCI World

We do have our doubts. As positive as the political signals may be, they constitute only a few pieces in the puzzle. To get a more comprehensive picture, it’s necessary to zoom out a bit. The economic indicators are still offering little relief, in our view. Although leading indicators such as the business climate did not deteriorate further recently, they are still not sending a clear signal of a stabilising or even a reviving economy. Accordingly, in our view, the economic risks remain high. Against this backdrop, analysts’ expectations that corporate earnings in the larger economies will rise by around 10 % next year strike us as rather bold (see chart).

In this environment, we consider it advisable to diversify the portfolio and make it as robust as possible. Equities certainly have their place, but their share should be below the long-term target allocation right now.

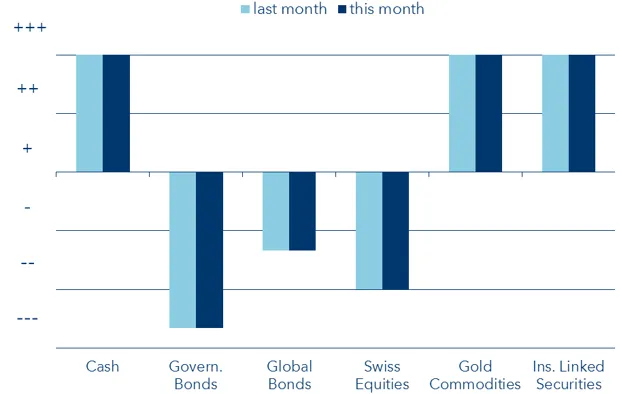

Tactical allocation

Low duration in bonds

In all reference currencies, the selected duration – the interest rate risk – is below the corresponding index benchmark. We remain underweight in government bonds and global bonds.

Gold is a core component

We see Gold as an important stabiliser in the current environment and give the precious metal the corresponding space in the portfolio.

Currencies mostly hedged

Developed market currencies are strategically hedged, but the USD is only partially hedged in EUR and in CHF.

Caution in equities

We confirm the underweight in equities in the respective home market of the reference portfolios.

Important legal notice

This document has been produced by VP Bank Ltd (hereinafter referred to as the “Bank”) and distributed by the companies of VP Bank Group. This document does not constitute an offer or invitation to buy or sell financial instruments. The recommendations, estimates and statements contained herein reflect the personal opinion of the relevant analysts of VP Bank Ltd on the date stated in the document and can be changed at any time without prior notification. The document is based on information which is believed to be reliable. This document and the estimates and assessments provided herein are prepared with the greatest care, but their correctness, completeness and accuracy cannot be assured or guaranteed. In particular, the information in this document may not include all relevant information regarding the financial instruments addressed herein or their issuers.

Further information on the risks associated with the financial instruments covered in this document, the proprietary trading of VP Bank Group, the handling of conflicts of interest in relation to these financial instruments and the distribution of this document can be found at www.vpbank.com/legal_notice.