Digital Transformation Online Commerce - «Alexa: What shall I buy?»

E-Commerce is a divisive topic. For consumers, a new, more enjoyable and personalised shopping experience has opened up. Alas, as part of the deal, those buyers must reveal personal data which the online merchants meticulously compile and evaluate. Despite this trade-off, digital purchases are growing rapidly and will continue to do so - a trend that should also be taken into account in investment portfolios.

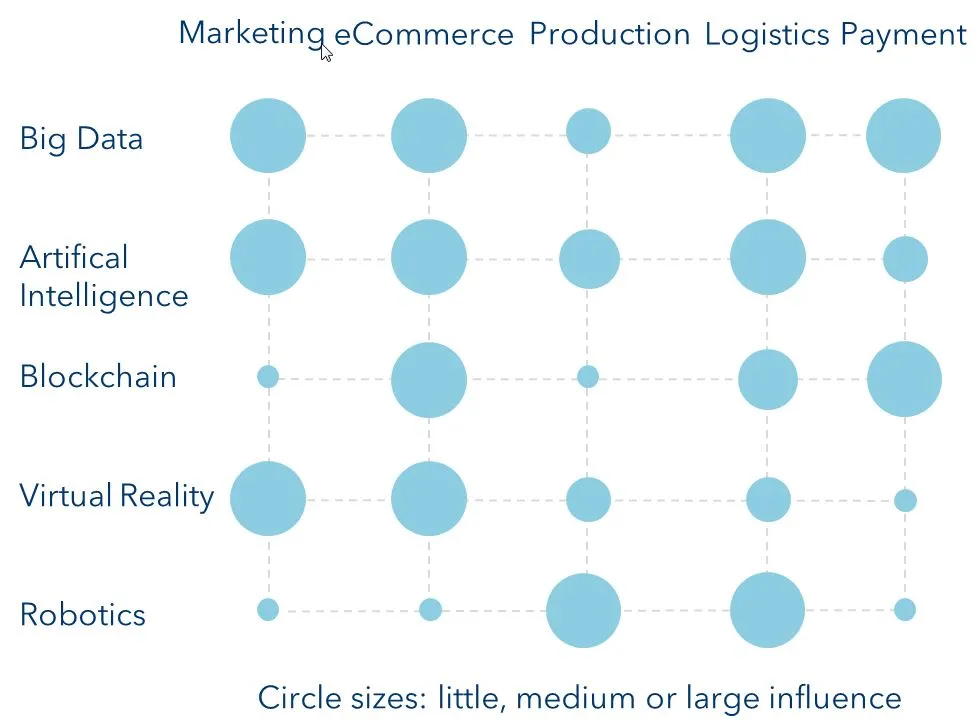

Digital transformation already started to reshape the retail trade years ago, initially by shifting the mail-order business to the internet. Meanwhile, the momentum has accelerated dramatically as the related value chain expands at lightning speed. Each second, billions of megabytes of “Big Data” are collected in connection with internet usage and evaluated by means of artificial intelligence. The seamless networking of production, warehousing, logistics and payment systems facilitates not only trend-driven sales initiatives, but also the leveraging of region-specific and customer-targeting possibilities derived from purchasing power segmentation.

This is the second episode of our series «Digital transformation - The path to the future». The series draws on five drivers to explain how digitalisation is changing business models and how investors can benefit from this evolution. Find the introduction and the overview to the series here.

All of this together stimulates sales and profitability. The outlook speaks for itself: an annual growth rate of 4.5% is forecast for the global retail sector through 2023, whereas projections by Statista suggest that orders via the Internet will increase by more than 16%.

Some companies have woken up to that fact. American sporting goods manufacturer Nike confirmed that in its latest quarterly report: in the first quarter of Nike’s 2020 fiscal year, sales for the company’s shoes in the USA grew by 4%; this in contrast to the 30% revenue increase recorded by its online division “Nike Digital”, with China alone registering a 70% increase. A large proportion of these orders were placed via mobile phones. The result: a significant increase in profit margins.

Influence of the five key technologies

The individualisation of the masses

E-commerce has drastically changed consumers’ purchasing behaviour. Although the majority of them still enjoy window-shopping, it is definitely “out” to rummage through the mountains of wares in large, stuffy department stores only to then stumble home carrying heavy shopping bags without getting run over in city traffic. Shopping today needs to be fast, convenient, intuitive and inspiring. Nike’s success shows how at least certain modern retailers have learned to address customers directly and individually. More than 90% of the companies that advertise on the internet also do so on Facebook. According to a survey conducted in the US, 26% of Facebook users who click on a banner ad end up making a purchase.

If a retailer wants to be successful on the internet, the place to seek advice is Facebook or Google, because they are the wizards who collect, evaluate and market click data. But new marketing players are also getting into the act. Whereas in past decades door-to-door salesmen were the pitchpersons for the mail-order business, today it is the so-called “influencers” who use digital media to market products to specific target groups.

Taken together, these persuasive elements are aimed at stimulating the digital trade. The latest study by German Internet portal “Idealo” confirms this trend: 52% of the buyers surveyed stated either that they had no intention of making their most recent internet purchase or that they had been “seduced” into doing so. But in fact the customers themselves are the ones who provide the expertise for this success, because every time they surf on the internet and above all participate in social media they allow conclusions to be drawn about their person. According to studies conducted by the universities of Cambridge and Stanford, user data is more effective than recommendations from friends and family. Creepy? Yes, but the harsh reality.

Customers consider price transparency, a wide selection, and fast delivery to be crucial in their decision to buy online and remain loyal to the vendor. In China, online entertainment and food retailer Meituan-Dianping has leveraged this approach to strengthen its market position and is now growing rapidly. Initially, the company focused on the distribution of local consumer goods and then expanded its services into the food, restaurant, hotel and entertainment sectors. It not only delivers the goods, but also offers cars and bicycles to get to the restaurants. Founded in 2010, the start-up company went public in 2018 and this year recorded its first profit. With 420 million customers in over 2,800 cities, Meituan-Dianping has established itself as a serious competitor in China.

In the USA, the hypermarket chain Walmart and internet retailer Amazon are in fierce competition with each other and have started to offer delivery within six hours at initial locations. The decisive factor here is food, which accounts for more than 40% of the retail trade. The importance of food products for the future of digital retailing is demonstrated by Amazon’s takeover of Whole Foods Market in June 2017. The acquisition of an offline food retailer by an internet company is ground-breaking.

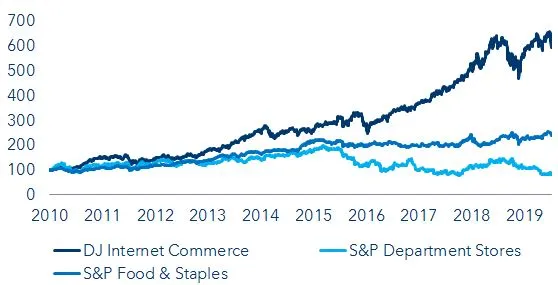

The shopping experience is becoming more and more embedded in the daily lives of customers. Long-standing department stores are falling by the wayside. Over the past ten years, investors have not made any money with shares of the traditional US department stores, whilst internet commerce has increased almost sevenfold in the same time frame. The bottom line: either adapt like Walmart or go broke.

Online beats Offline in the US (indexed performance)

Click & pay

Digital retailing is also changing the way people pay. Today the credit card is only one of many means of payment and many digital companies like PayPal and even Facebook are forging ahead in this area. There are different ways of getting there: PayPal is a classic online financial service provider whilst Facebook wants to create its own cryptocurrency, “Libra”. Here, Facebook is less interested in making money than in the data associated with transactions. However, the sole deciding factor for the acceptance of legal tender of any kind is the trust people place in it, and the majority of them are very sceptical when it comes to crypto currencies.

The last important pillar in online retailing is transportation. Established transport companies have adapted their abilities to the high-speed transactions resulting from e-commerce, but now have mainly assumed the role of carriers. Be that as it may, online logistics already starts with the production of the goods. Given a solid understanding of digital ordering processes, the nature of the specific products, as well as regional and crossborder regulations (including customs and import regulations), intelligent and rapid transport can be organised. In recent years, Canada’s Descartes Systems for example has developed into an internationally recognised specialist in this field. With realtime monitoring, it helps companies to keep an eye on the goods in transport, even as it optimises the capacity utilisation and networking of the delivery companies worldwide.

What needs to be kept in mind?

Those who wish to invest in the theme of e-commerce should have an eye out for the entire value chain and replicate it as best as possible in their portfolio. The technological dimension includes social-media-driven online marketing expertise as well as complex payment and logistics systems. And with online retailers, investors have the opportunity to participate not only in international consumer spending growth, but also in supra-regional product trends. From this perspective, e-commerce offers an unusually attractive and promising investment spectrum.

Please get in touch with your personal contact at VP Bank for Investment Ideas.

Verantwortlich für den Inhalt

Bernd Hartmann, Leiter Group Investment Research

Harald Brandl, Senior Equity Strategist

Important legal information

This document was produced by VP Bank AG (hereinafter: the Bank) and distributed by the companies of VP Bank Group. This document does not constitute an offer or an invitation to buy or sell financial instruments. The recommendations, assessments and statements it contains represent the personal opinions of the VP Bank AG analyst concerned as at the publication date stated in the document and may be changed at any time without advance notice. This document is based on information derived from sources that are believed to be reliable. Although the utmost care has been taken in producing this document and the assessments it contains, no warranty or guarantee can be given that its contents are entirely accurate and complete. In particular, the information in this document may not include all relevant information regarding the financial instruments referred to herein or their issuers.

Additional important information on the risks associated with the financial instruments described in this document, on the characteristics of VP Bank Group, on the treatment of conflicts of interest in connection with these financial instruments and on the distribution of this document can be found at https://www.vpbank.com/Disclaimer_en.pdf

Add the first comment