Online banking transactions made easy with the launch of the new VP Bank e-banking

In August 2017 VP Bank upgraded its website and established the basis for its future client portal with advanced portal technology. By integrating its e-banking into this client portal in May 2018, VP Bank has achieved a further important milestone in the VP Bank Group’s digitisation strategy.

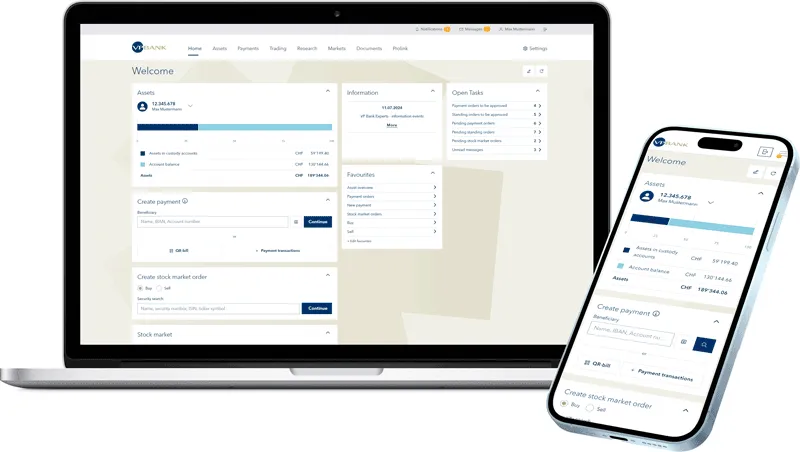

In addition to ensuring the highest possible security for clients, requirements for the new VP Bank e-banking system also included intuitive user guidance as well as an appealing and refreshing design. “The new VP Bank e-banking is clearly laid out in a simple structure," explains Christoph Mauchle, Head of Client Business at VP Bank Group. “Our clients will now be able to carry out their banking transactions easily online – the new system perfectly complements the personal care and guidance given by our client advisors.”

The most important features of the new service can be seen at a glance on the home page of the VP Bank e-banking system. Thanks to the clearly structured menu, each user can quickly find their way around the upgraded site. Chart-based summaries of their current assets help them review their personal financial situation at a glance. Payments and stock exchange orders can be captured quickly without any problems, and a large amount of current stock market data from different markets is clearly represented in the form of graphics and charts. This enables trading-oriented clients to have a gateway to global stock market trading.

Modern interfaces for corporate clients and intermediaries

The new VP Bank e-banking also offers a professional solution for establishing a direct link to corporate client software. In the future, corporate clients can carry out their global payment transactions conveniently, easily, and complying with the most rigid security standards by means of a so-called EBICS (electronic banking Internet communication standard). What’s more, third-party asset managers can now submit stock exchange orders straight to VP Bank via an automatic interface.

ProLink, the information platform for intermediaries, is directly integrated into the portal, so that clients can access all relevant information with the same login details.

Staged rollout

The VP Bank e-banking has been rolled out in a staged delivery across different client segments since March 2018. As of May, all clients of VP Bank Group will benefit from complete access to the new VP Bank e-banking, which clients can access on our website at www.vpbank.com. Since we want to make the switch-over to the new e-banking as simple as possible, the old VP Bank e-banking shall continue to operate as a parallel resource and remain available to users in a transition period lasting a few more months.

In addition to the desktop version, VP Bank offers a mobile option which enables users, for example, to easily scan payment slips in a matter of seconds. The app can be downloaded for Apple devices in the App Store or for Android devices in the Google Play Store by entering the search term “VP Bank”.

Further details of the VP Bank e-banking are available at www.vpbank.com/e-banking.