VP Bank goes for agile client consultancy

In investment consultancy, bank clients want the greatest possible flexibility and their individual requirements to be met. VP Bank believes in providing personal and comprehensive advice, backed up by investment-consultancy software running in the background. Together with the client, the client advisor defines the investment objectives and the individual investment strategy. Combined with the investment consultancy packages launched in the spring, clients have a choice: They can delegate investment decisions and portfolio-monitoring to the bank, or receive all the relevant market and product information, so that they can make their own investment decisions.

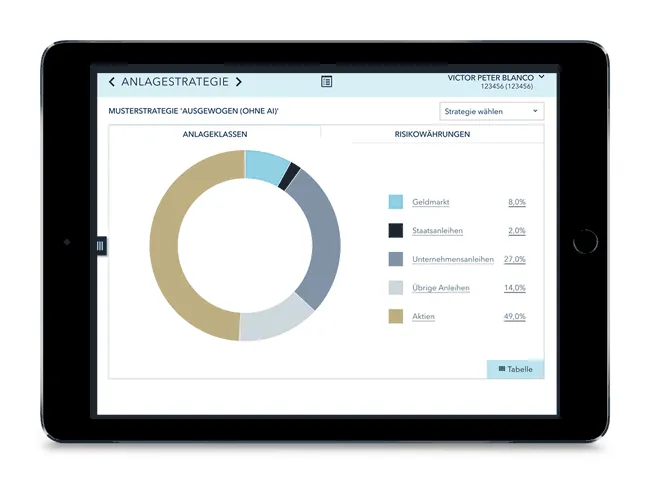

Investment consultancy software is used to draw up tailor-made investment proposals, which are based on current bank recommendations and which take account of the regulatory requirements of the respective client domicile. The software combines the expert knowledge of client advisors, research and investment specialists. Thanks to this digital investment advice, the portfolio is also continuously monitored, and in the event of deviations, the client advisor can immediately highlight the possible actions.

Tablets for personal advice

As part of the expansion of its services, VP Bank is making investment advice even more agile and tangible to customers. Starting at the beginning of October, client advisors will be gradually equipped with tablets, which will be used to simulate various investment proposals, including any adjustments suggested by the client during the consultation. As a result, the consultation can not only take place anywhere, the client also immediately sees, thanks to user-friendly visualization, how their portfolio could change and develop following minor adjustments. In this way, they can carefully evaluate the different investment options during the consultation, with the advisor at their side providing support and advice.

The implementation of digital investment advice combined with tablets represents another milestone in the bank's digitalization strategy. "We believe the future model will be a combination of digital solutions and personal advice. Our customers benefit from first-class innovative tools, and they always have their usual contact at their side," says Christoph Mauchle, a member of the Group Executive Management of the VP Bank Group.