Theme-based investing: Sustainable infrastructure

Note: This is the fifth and final study in our five-part series “Investing in the green and social transition” (link).

Global population growth, and the demand-driven economic growth that goes along with it, will result in ever-greater environmental challenges as well as a shortage of crucial resources. In the quest to mitigate those negative consequences, the modernisation of existing infrastructure and the construction of new basic facilities will play a pivotal role.

China has demonstrated just how extreme these developments can be: the US Geological Survey reports that between 2011 and 2013 alone, China produced and used 6.6 billion tonnes of concrete – more than the US ever did during the entire 20th century (4.5 billion tonnes by 2000). The environment has also felt the impact. The production of one single cubic metre of reinforced concrete results in an average CO2 emission of 320 to 340 kilograms – an amount equivalent to what it takes 4000 trees to absorb in a day.

China may be a special case in this regard, but the rest of the world as well cannot escape the fact that demographic developments and long-term global economic growth will engender a dire need for additional, modern infrastructure. According to various estimates, half of the infrastructure necessary to cope with the 2 billion increase in the world’s population by 2050 is not yet in place, and most certainly not in emerging countries where the exodus from rural regions into cities is magnifying the urban sprawl.

The Organisation for Economic Cooperation and Development (OECD) expects global demand for raw materials to double to 167 gigatons per year by 2060. The construction industry, with its reliance on basic resources like sand, gravel and limestone, will account for a good half of this. Nature will no longer be able to bear the resulting environmental burden. Alas, a continuation of industrialisation with today’s methods is no longer viable. Fully aware of the urgency, the World Climate Summit in Glasgow (COP26) last year reaffirmed the goals of the 2015 Paris Climate Agreement.

Green investment thrust

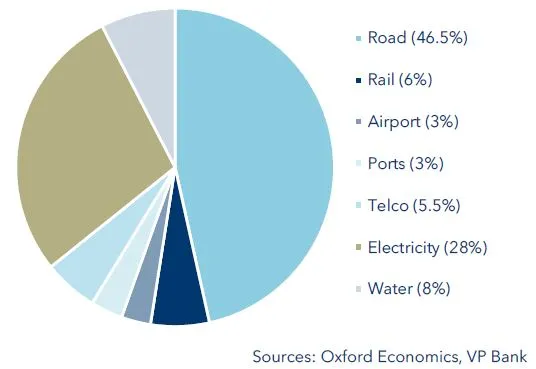

Based on the estimated needs of more than 50 nations, Oxford Economics, an analytics firm commissioned by the World Bank, has calculated that annual investments of around USD 4 trillion will be necessary through 2040 just to realise the agreed emissions goals of the green transition. This, when compared to the present funding plans, will result in an annual financing gap of some USD 800 billion over the next 19 years; in other words, a total shortfall of around USD 15 trillion.

Moreover, if the environmental and social sustainability targets are to be met, an additional USD 7 trillion will be needed to finance the expansion/rejuvenation of the global road network. And in terms of the power grid, the gap versus current plans will amount to roughly USD 4.4 trillion (see below: Smart Transportation and Smart Grids).

Proportionate distribution of financing gaps for global infrastructure through 2040

The Oxford study also reveals that the need for additional funding in the industrialised nations is relatively small. Here, the reallocation of existing government outlays is the keyword. For example, a sizeable amount can be freed up from the reduction of fossil fuel subsidies. The modernisation of outdated infrastructures will be accorded a high priority in the next ten years – especially in the US. Of all the industrialised nations, it is the one that for many years now has shown the least concern about maintaining its domestic infrastructure. The total investment needs for America alone amount to USD 3.8 trillion, equal to almost one-quarter of the total worldwide investment gap.

In terms of the emerging nations, their geographical location and topographical characteristics are the main determining factors for how much needs to be invested in which sector. The transport sector will be the key target for spending, but large infrastructure shortcomings also exist in the telecommunication and power generation sectors. Companies that help to shape this change will enjoy above-average growth for years to come.

Creating infrastructure

The entire matter of “sustainable” infrastructure is viewed from three angles: ecological, social and systemic. The ecological perspective seeks to minimise the impact human beings have on the climate and the environment. The social aspect addresses not only demographic developments and the need for security, but also accessibility; in other words, as many people as possible should be able to use or benefit from the infrastructure.

As to the systemic dimension, the question regarding which infrastructures are of more relevance to a specific region depends on the given geographical/topographical circumstances, population density and available resources. Across the globe, the transformation of infrastructures involves a huge amount of construction activity, which in turn poses a dilemma due to the excessive demand for raw materials and energy. Ultimately, the environment will have to cope with above-average CO2 emissions until climate-neutral modernisation is achieved. Industrial transformation, burgeoning metropolises and economic growth spawn increasing demand for basic resources and necessary construction materials such as steel, aluminium, copper and petrochemical products.

Thus paradoxically, this activity also triggers added demand for fossil fuels, as almost all construction machinery is powered by conventional diesel engines, and a climate-friendly means of fabricating industrial metals still lies far in the future.

Industries most responsible for CO2 emissions

Cement and steel production alone account for 8% of the world’s total CO2 emissions. Companies are being called upon to change their current manufacturing and processing methods. Innovations such as synthetic additives and alternatives to steel have the potential to significantly reduce CO2 output. By replacing steel with carbon fibre reinforced with synthetic binders, structures can be erected with the same or even better statics than before, but with up to 40% less concrete. The addition of lime to cement and concrete leads to greater load-bearing capacity and thus allows for less bulky constructions. The use of 3D planning technologies such as Autodesk is already quite advanced, and these tools are now finding further application by means of their direct linkage with three-dimensional manufacturing processes. Especially in construction, sustainability is an extremely complex issue. Bringing architects and engineers together so they can exchange their expertise and experiences is crucial to gaining new insights into the structural design and statics of buildings. Going forward, the creation of modern infrastructures will require integrated planning. This also applies to spatial design. Authorities need to rethink previous concepts and planning approaches. A good example of this is the decentralised structure of Germany’s education system, with its three domains: federal, state and local. They all perform roughly similar tasks but do not plan infrastructure together, as can be seen in the physical separation of the various education levels. This stands in the way of ecological and social sustainability.

When it comes to transportation infrastructure such as airports and railway stations, the focus is frequently centred merely on the task at hand. Sustainable and socially inclusive approaches to the direct inclusion of public utilities, retail commerce, housing and culture are not taken into consideration. Here again, technical innovations and integrated project planning are key to the design of modern and environmentally friendly infrastructures.

Smart Transportation

Transportation infrastructure is of central importance. The International Energy Agency (IEA) foresees an enormous leap in global transportation by 2050, with personal mobility increasing by some 70% and freight transport by even more. Projections show a 130% rise in tonne-kilometres for lorries, even as the capacity utilisation of aircraft and ships is expected to almost double. This scenario is substantiated by an anticipated 25% increase in the global population, as well as gradual yet continuous economic growth and the resulting greater prosperity in emerging nations. The strategic change of course necessary for global freight transport alone relegates the discussion surrounding electrically powered vehicles to mere background noise.

Trends in global transport through 2050 (indexed)

While expenditures for the modernisation and expansion of the transportation and mobility infrastructure will be highest for America and the emerging nations, the focus in Europe and China is more likely to be placed on digital connectivity and the preparatory measures necessary to facilitate autonomous driving. Already today, smart traffic control systems span entire metropolitan regions and help to regulate peak roadway loads. In initial field trials, like the pilot project being conducted in Wiesbaden Germany, traffic lights function intelligently. The city, which is regularly plagued by traffic jams, hopes that this will not only save time for drivers, but also significantly reduce air and noise pollution. All 227 traffic lights have been retrofitted, and 400 thermal imaging cameras monitor traffic at 60 intersections. Notable successes have already been achieved in the initial phase. Bus travel times have fallen by 30%, the number of bicyclers has doubled, and CO2 pollution is significantly lower.

In the next ten years, a significant change is expected within the transportation sector as the first applications of autonomous driving go live. Especially for the future of cities with millions of inhabitants, this will represent a landmark development for modern and efficient urban planning. Whilst electric power merely makes vehicles more climate-friendly, autonomous driving completely changes the long-standing usage profile of those vehicles. In other words, instead of cars being left for more than 90% of their potential operating time simply parked along the street or in prime-location multistorey garages, autonomous vehicles can be on the move virtually around the clock. New mobility concepts can be devised and the freed-up spaces repurposed for more beneficial use by the general public.

Smart Grids

If one considers the many initiatives aimed at achieving the agreed sustainability goals, it becomes clear that electricity is the linchpin of almost all the related measures. Needless to say, clean electric power can reduce the consumption of fossil fuels; but modern control mechanisms also help to enhance energy efficiency in manufacturing as well as in residential and commercial buildings. All of this hinges on the ability to store electricity. And, not to forget: digitalisation in also indispensable for the smart grid.

In this regard, the ability to ensure a flexible, efficient flow of electricity between power generation facilities, storage units and consumers is key. One can talk all day about smart solutions and digital applications, but they would be inconceivable without a smart power supply. Going forward, there will still be large power plants contributing electricity to the grid, since alternative means are unable to produce constantly the same amount of energy as coal or nuclear power plants. Ever-increasing demand will result in the flow of electricity being subject to greater fluctuations.

However, production is being decentralised. In future, a variety of smaller sources of power generation units will contribute to the grid. Even today, consumers can use electricity even as they produce it. This also means that the flow will no longer be in just one direction. To achieve a robust and constant supply of electricity, information technologies and artificial intelligence will be used to recognise, analyse and steer the power consumption of homes and communities. In this regard, research firm Maximize projects that investments will grow at an annual rate of roughly 19% through 2027 and the total market volume will reach USD 123 billion.

Summary

The global transformation of infrastructure is crucial to the achievement of the Paris Agreement goals. It will trigger above-average investments in view of the emission targets set for the 2030 to 2060 time frame. The lion’s share of that money will be spent on the necessary adaptations in the energy and transportation sectors as well as the modernisation of the global power grid. Companies that help shape this change through their solutions and services will enjoy above-average growth for many years and already today present an interesting opportunity for long-term investors. We recommend the following fund solution as a means for participating in the theme of sustainable infrastructure.

For our product recommendation, please contact your client advisor.

Important legal information

This document was produced by VP Bank AG (hereinafter: the Bank) and distributed by the companies of VP Bank Group. This document does not constitute an offer or an invitation to buy or sell financial instruments. The recommendations, assessments and statements it contains represent the personal opinions of the VP Bank AG analyst concerned as at the publication date stated in the document and may be changed at any time without advance notice. This document is based on information derived from sources that are believed to be reliable. Although the utmost care has been taken in producing this document and the assessments it contains, no warranty or guarantee can be given that its contents are entirely accurate and complete. In particular, the information in this document may not include all relevant information regarding the financial instruments referred to herein or their issuers.

Additional important information on the risks associated with the financial instruments described in this document, on the characteristics of VP Bank Group, on the treatment of conflicts of interest in connection with these financial instruments and on the distribution of this document can be found at https://www.vpbank.com/legal_notice_en

Add the first comment