Will Covid-19 overtrump Trump?

The outbreak of the coronavirus pandemic, coupled with the related collapse of the US economy and recent protests following the death of Georg Floyd at the hands of rogue police officers, have all caused the November election cards to be reshuffled. In our February “News from the financial markets”, we expressed our firm belief that Donald Trump would be re-elected. Our analysis of past elections showed that, when the US economy is running smoothly, the “incumbent bonus” is an especially important influencing factor in the outcome. In other words, a renewed four-year stay in the White House is a pretty safe bet under normal circumstances.

Recessions are good for the challenger

Only four months have passed since then and the situation today is anything other than normal. Recessions and the accompanying high levels of unemployment give rise to dissatisfaction amongst the populace – and it is already clear that, in economic terms, the Covid-19 crisis is practically beyond compare. The US unemployment rate climbed to 14.7 % and is still above 13%, the highest readings since WW2. Although the recovery of the economy should result in the (re-)creation of jobs in the weeks ahead, the core unemployment rate will remain high for the time being. A study by the University of Chicago posits that 42% of the jobs that have been cut as a result of the coronavirus crisis will not be re-filled on a permanent basis. Add to that the fact that large cross-sections of the US population view the crisis management in response to the death of African-American Georg Floyd by white police officers as being totally insufficient.

But the influence the state of the economy alone has when it comes to the re-election chances of a sitting US president becomes patently clear from a glance at the history books. Only ten US presidents have ever been voted out of office after their first term – four of them due to the difficult economic circumstances at the time. To wit:

Herbert Hoover: the Great Depression

Herbert Clark Hoover (Republican) was the 31st president of the United States from 1929 to 1933. His term of office fell in the middle of the global economic crisis. In the November 1932 presidential elections, Hoover came away the clear loser to Franklin D. Roosevelt. He took leave of the Oval Office as one of the most unpopular presidents in American history.

Gerald Ford: first oil-price shock

Gerald Ford (Republican) was the 38th US president from 1974 to 1977. Ford’s term in office was marred right from the start by the 1973 oil crisis, and consequently the US economy was in recession through the spring of 1975. Moreover, the aftermath of both the Watergate affair (which forced his predecessor Richard Nixon to resign) and the Vietnam War, plus a series of congressional investigations into illegal activities by US intelligence agencies, all led to a public crisis of confidence in the powers-that-be in Washington.

Jimmy Carter: second oil-price shock / stagflation

James Earl “Jimmy” Carter, Jr. (Democrat) held office as the 39th US president between 1977 and 1981. He was unable to remedy the stagflation that predominated the 70s due to yet another oil-price shock and, worse yet, the US economy slid into a full-blown recession in 1980. This difficult economic situation, combined with faulty crisis management following the Three Mile Island nuclear power plant disaster in Pennsylvania and the failed Iran hostage rescue mission, certainly did him no good in his re-election ambitions.

George H. W. Bush: recession, labour market woes

George Herbert Walker Bush (Republican) was the 41st president of the United States from 1989 to 1993. At the outset of his stay in the Oval Office, Bush’s approval ratings were quite high but then started to decline steadily as the recession in the wake of the war to liberate Kuwait from Iraqi occupation started to take hold. Although this economic slowdown officially ended in March 1991, business conditions remained difficult. The US unemployment rate rose to almost 8%, hence the 1992 race to the White House hinged largely on the public’s sense of who could handle the economy best. Ultimately, Bill Clinton came away the winner.

So it goes to show: The person who wants to remain seated behind the “Resolute Desk” in the Oval Office needs the backing of a strong US economy. The current situation is eerily comparable to the Jimmy Carter era, when not only the economic weakness of 1977-81 had to be overcome, but also the crisis management skills of the US president were in demand. Donald Trump is up against the same wall, and his popularity is on the decline.

Latest approval ratings are heading south

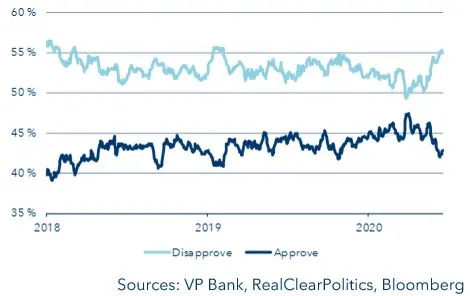

The outbreak of the coronavirus pandemic and the mass protests that have followed the death of George Floyd pose a major challenge for Trump. The White House’s responses to these unfortunate circumstances are now perceived by many registered voters as totally inadequate, a fact that is also reflected in the approval ratings. According to an analysis by research institute RealClearPolitics, only 42% of Americans are still satisfied with the president’s accomplishments; 55% are somewhat to utterly dissatisfied.

Approval ratings are sinking

However, this mood barometer is only an initial indication of what lies in store for November. The president is not elected directly (i.e. via the majority of the popular vote), but instead by “electors” who themselves have been directly appointed by the people. In almost all states, the electors are bound to represent the majority vote of their constituency. In other words, the party that achieves a simple majority wins all the electoral votes of that state. The so-called “Electoral College” then collectively casts what ultimately becomes the deciding vote – which is not by necessity in favour of the presidential candidate who won the most votes of the people. The only thing that counts is how many votes the candidate receives from the Electoral College.

So here we come to the so-called “swing states”. They are the ones that traditionally have no predominating preference for either political party, but which nonetheless send a large number of delegates to the Electoral College. For example, national polls in 2016 showed that Hillary Clinton had a double-digit lead over Donald Trump in some places just prior to the 2016 presidential election. Today we know what the outcome was.

Currently the presumptive Democratic candidate, Joe Biden, is the frontrunner in most of the swing states. However, the race remains tight and there are still four months or so before the election in November. Thus these demographic pulsometers need to be viewed with a cautious eye – precisely due to the Electoral College dimension.

Ultimately, the further course of COVID-19 and all of its economic repercussions will be decisive in the re-election (or not) of Donald Trump. Although presently the number of new infections at the US-national level is on the decline, the exact opposite trend can be observed in certain states – amongst them, swingers like Arizona, Florida and North Carolina. In traditionally Republican Texas, the new-infection rate is also increasing substantially. If as a result the economy in these states starts to take a significant turn for the worse, the mood could shift resolutely in favour of Biden. In Texas, Trump already has no clear lead over his Democratic challenger.

The bets are on Biden

This mood shift is also being reflected in the betting odds. While at the beginning of 2020, the money was clearly wagered on Donald Trump’s re-election, his chances of winning have waned of late. The probability of a Trump victory as derived from various betting venues is now only 44%, with challenger Biden now in the lead at 54%. As recently as February, that reading stood at 58% in favour of Trump. The odds may change significantly in the coming months, but even then it is clear that the sitting president’s inept handling of the coronavirus pandemic is not good for his image.

Summary

The sharp slump in the US economy following the outbreak of the COVID-19 pandemic, along with the mass protests in response to the death of George Floyd have spawned a noticeable change in political sentiment. A re-election victory by Donald Trump seemed almost certain at the beginning of the year; now his chair in the Oval Office has started to wobble. If the presidential election were to be held today instead on the first Tuesday of November, the moving crates would probably be already stacked at the White House.

Since any rapid introduction of a vaccine against the coronavirus is more wishful thinking than reality, “social distancing” will remain the order of the day until further notice. But as long as today’s restrictions on interpersonal proximity are maintained, the economy can be expected to stay in state of partial paralysis. This certainly raises the bar when it comes to Donald Trump’s re-election chances.

At any rate, the current occupant of the Oval Office cannot be written off entirely. In the all-important swing states, the opinions are not yet hewn in stone.

Important legal information

This document was produced by VP Bank AG (hereinafter: the Bank) and distributed by the companies of VP Bank Group. This document does not constitute an offer or an invitation to buy or sell financial instruments. The recommendations, assessments and statements it contains represent the personal opinions of the VP Bank AG analyst concerned as at the publication date stated in the document and may be changed at any time without advance notice. This document is based on information derived from sources that are believed to be reliable. Although the utmost care has been taken in producing this document and the assessments it contains, no warranty or guarantee can be given that its contents are entirely accurate and complete. In particular, the information in this document may not include all relevant information regarding the financial instruments referred to herein or their issuers.

Additional important information on the risks associated with the financial instruments described in this document, on the characteristics of VP Bank Group, on the treatment of conflicts of interest in connection with these financial instruments and on the distribution of this document can be found at https://www.vpbank.com/legal_notice_en

Add the first comment