Financing

—

Mortgage loans & real estate financing

With our comprehensive range of real estate financing products, you can easily make your dream of owning your own home come true. We are one of the leading lenders in Liechtenstein and the region of Eastern Switzerland, and our experienced specialists will actively support you in determining the best financing option for your new construction, alteration of a property or real estate acquisition. Our assistance also includes optimally matching the terms and interest charges to your asset situation.

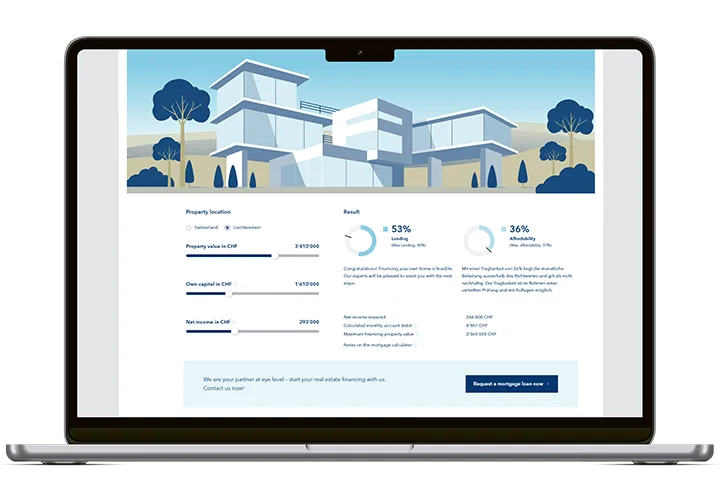

Mortgage calculator

Do you dream of owning your own home, and would like to know whether your financial means are sufficient? With our mortgage calculator, you can determine the affordability of your future real estate and the monthly charges in just a few steps. It’s quick, easy and uncomplicated.

VP Bank – your reliable financing partner in Liechtenstein

- Personalised support: Our mortgage specialists in Liechtenstein provide you with personalised support and develop a financing solution that is tailored precisely to your needs.

- EEA access: Thanks to our site in Liechtenstein and our international network, we can implement structured financing solutions for clients with cross-border assets.

- Stability and independence since 1956: As an independent bank headquartered in Liechtenstein with a strong capital base, VP Bank offers legal certainty and reliable long-term terms and conditions.

- Support right up to the handover of keys: Dedicated contact persons coordinate all stages of the financing process – from the initial consultation to the disbursement of the mortgage loan – so that you can concentrate on your new home.

Arrange an appointment now

Silvan Stettler

Head of Client Advisory Corporate Clients & Loans

Frequently asked questions

At least 20% of the mortgage lending value must come from your own funds, of which at least 10% must not consist of pension funds.

Your annual housing costs, imputed interest (4.5%), amortisation and ancillary costs may not exceed one third of your gross income. Only if this limit is adhered to is the financing considered affordable.

With a fixed-rate mortgage, the interest rate remains unchanged for the selected term (e.g. 5 or 10 years), which offers complete planning security. The SARON mortgage follows the daily fluctuating SARON reference interest rate plus our margin. This allows you to benefit from lower interest rates, but also carries the risk of rising rates.

A SARON mortgage (money market mortgage) is attractive if you expect interest rates to remain stable or fall, can cope financially with short-term interest rate fluctuations and would like to switch to a fixed-rate mortgage if necessary.

Early termination in the form of cancellation or partial repayment is not possible.