Alternative investments in focus: Risks and opportunities following the interest rate turnaround

However, the risk of a global recession is still present, as growth rates in both Europe and the USA remain low and China is struggling with political and economic problems. In the following, we therefore take a look at the various alternative investment classes to analyse whether they have managed to grow in 2023 in what is an extremely difficult market environment for them and thus deliver on their promise of being adaptable and resilient.

Investor opinions

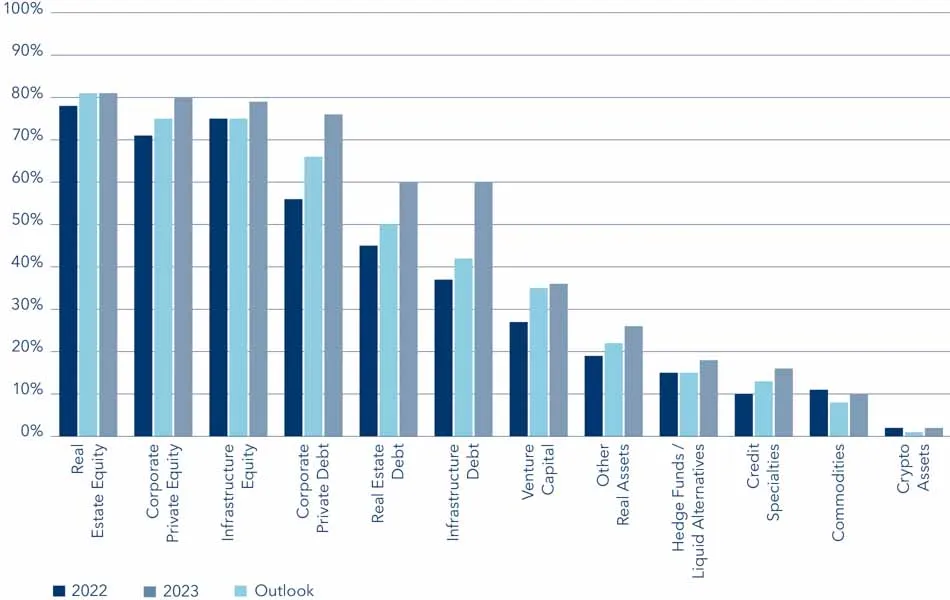

Based on the BAI Investor Survey 2023, in which 109 institutional investors from all over Germany took part, representing around 2/3 of the balance sheet assets of institutional investors in Germany, the following picture emerges.

For the first time in many years, liquidity is an issue for investors as fixed income investments can no longer be sold at short notice to fund investments in the private markets, leading to a potential risk of an investment freeze in the private markets. Investors must now also carry out scenario analyses to ensure that they are prepared for all possible eventualities. Otherwise, they could be forced to sell. Nevertheless, these challenges are mostly individual to each investor. Nevertheless, the issue of inflation protection is not yet perceived as a challenge by many investors.

Nevertheless, considerable market entries are forecast for most alternative asset classes. It should be noted that private equity (PE) and infrastructure equity have almost caught up with the real estate (RE) sector as the traditionally most popular asset class in Germany. Private debt (PD) is experiencing the greatest expected growth due to new investors for infrastructure loans. Private corporate and property loans are also likely to attract new investors. In the more liquid segment, hedge funds (HF) and liquid alternative investments, the outlook remains uncertain. It is therefore questionable whether first-time investors will be able to compensate for the redemptions of existing investors.

Share of investors in the individual investment categories

A tough test for private equity (PE)

Private equity is one of the asset classes most affected by the changing economic and geopolitical situation. The slowdown in transaction activity can be partly attributed to the more difficult financing conditions that are affecting takeover activity. The sharp rise in interest rates since mid-2022 has made banks more hesitant to lend in the face of increased uncertainty. According to data from the investment data provider Preqin, a total of 5,438 transactions with a total value of USD 618 billion were concluded in the first nine months of 2023. This corresponds to 60.3% of the total transaction volume in 2022 and only 48.5% of the value of transactions carried out. As key interest rates are expected to have peaked, this is expected to bring some certainty back into lending, which in turn could support the flow of transactions.

Declining deal flow in a difficult market

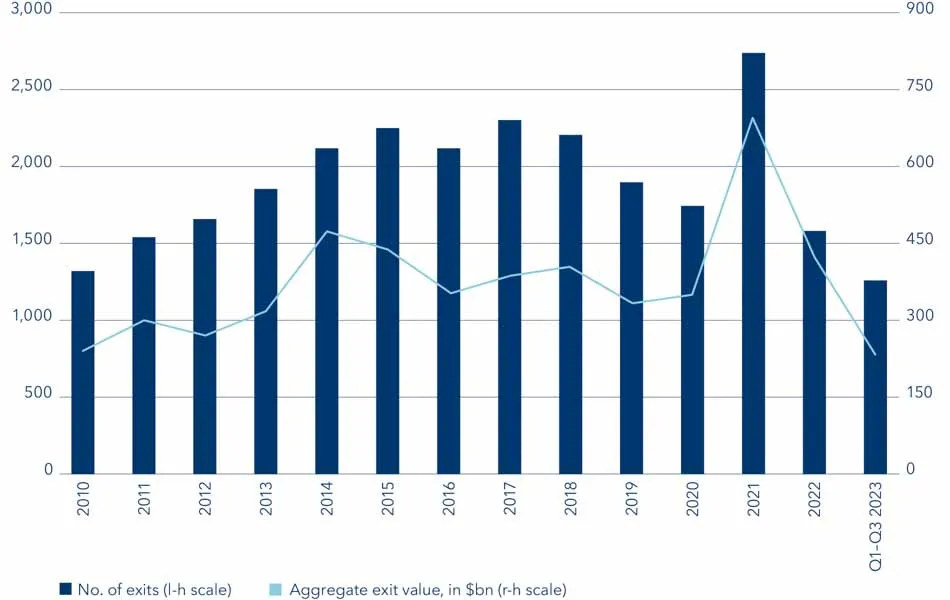

The current exit environment represents the key challenge for generating returns over the next 12 months. Based on data from Preqin, 1,255 exits with a total value of USD 232.4 billion were completed in the first nine months of 2023. This represents 80% of the total number of transactions in 2022, but only 55% of the value of these transactions. Despite a recovery in equity valuations over the course of the year, IPOs continued to perform poorly due to weaker equity market conditions, but there is hope for more activity in 2024.

Private equity exits have slowed down in view of the weak IPO market

Improvement in sentiment regarding investor performance expectations for venture capital (VC) investments

Fundraising was difficult for VC managers in 2023, as investors were very cautious at times. As a result, competition for investors' capital has increased.

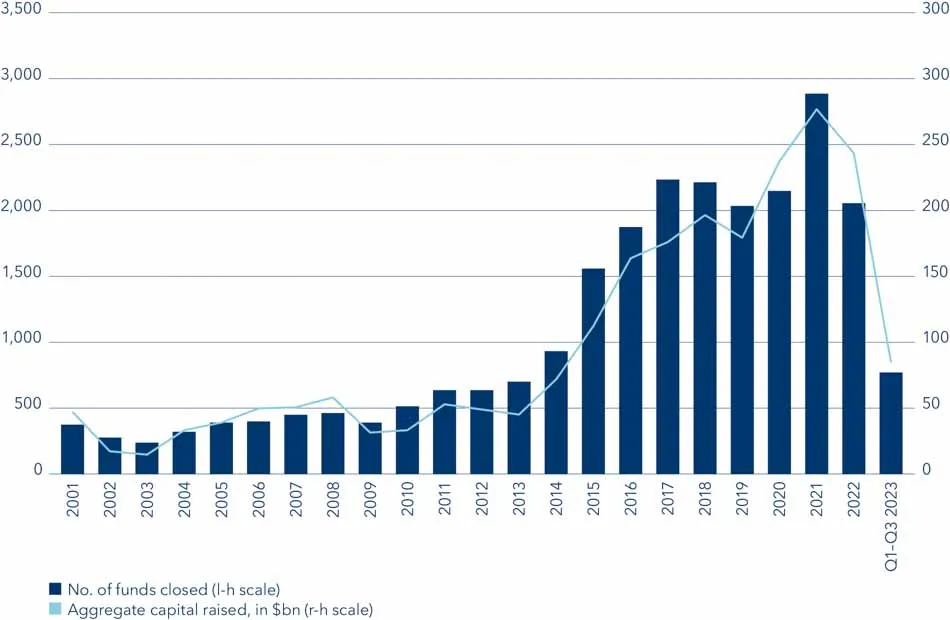

Lower fundraising after a 10-year rise

In view of the weak fundraising, house banks will be cautious in their investments. The pessimistic outlook for fundraising means that only limited capital is available for investment in start-up founders, which could lead to a higher number of insolvencies in the current year 2024.

Investors see the exit environment, asset valuations and interest rates as the biggest challenges going forward. However, data from Preqin shows that investors' views on performance over the next 12 months have improved. As valuations have fallen over the past two years, prices are now more reasonable than in the recent past. The 2023 and 2024 vintages could therefore perform better than the previous two years.

Continuous inflows in private debt (PD)

The total capital raised by private debt funds worldwide is likely to have reached or even exceeded the fundraising figures for 2022 as a whole.

Given inflationary pressures and rapidly rising interest rates, investors have been attracted to the floating rate nature of private debt. As a result, private debt fundraising has outperformed most other private capital strategies in 2023.

Investor demand continues unabated. In line with the relative strength of private debt fundraising, the number of private debt funds in the market has also increased by 19% since 2022 to 1,080 (as of October 2023), according to Preqin.

Rising AuM for hedge funds (HFs) despite net outflows

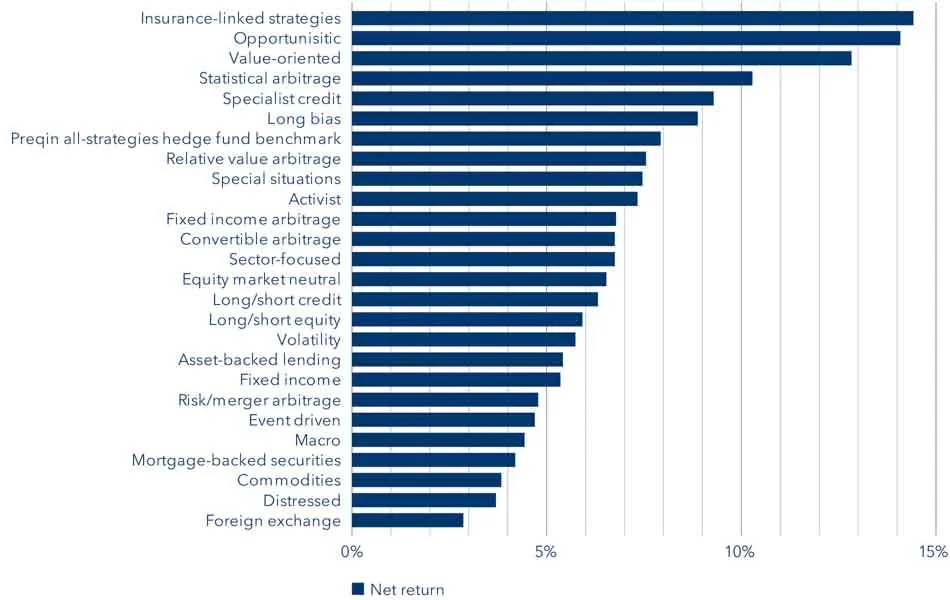

At a time when both equities and bonds have yet to fully recover, hedge fund strategies such as relative value, macro and niche strategies have proven suitable for avoiding market volatility and preserving investors' capital.

At a time when investors are looking for hedge fund strategies to diversify systematic risks, strategies on cryptocurrencies and funds trading insurance-linked securities (ILS) are becoming increasingly popular due to their low correlation to established markets and strong returns. ILS, for example, performed the best of all hedge fund sub-strategies with an annualised return of 14.4% in 2023.

Although they currently account for only around 2% of hedge funds' total assets under management (AuM), demand for niche strategies is high as investors continue to diversify away from the risks of traditional financial assets.

Hedge fund assets under management have continued to grow. However, this growth has been driven primarily by asset returns rather than investor cash flow. The long-term trend of cash outflows in this asset class therefore remains intact.

Annualised performance 2023 of HFs by sub-strategy

Real Estate (RE) is under pressure

With the rise in interest rates, the "denominator effect" on asset valuations is intensifying, leading to a decline in the value and volume of property transactions. Fundraising is also declining. In addition, the market sees rising interest rates as a major problem for realising returns over the next twelve months.

Investors' strategy preferences have also shifted. The proportion of investors interested in core or core-plus strategies continued to decline last year, while opportunistic strategies and distressed strategies are still seen as the most promising. This indicates that, in the current market environment, direct property investments are more likely to seek capital growth than income returns.

Possible trend reversal for infrastructure investments

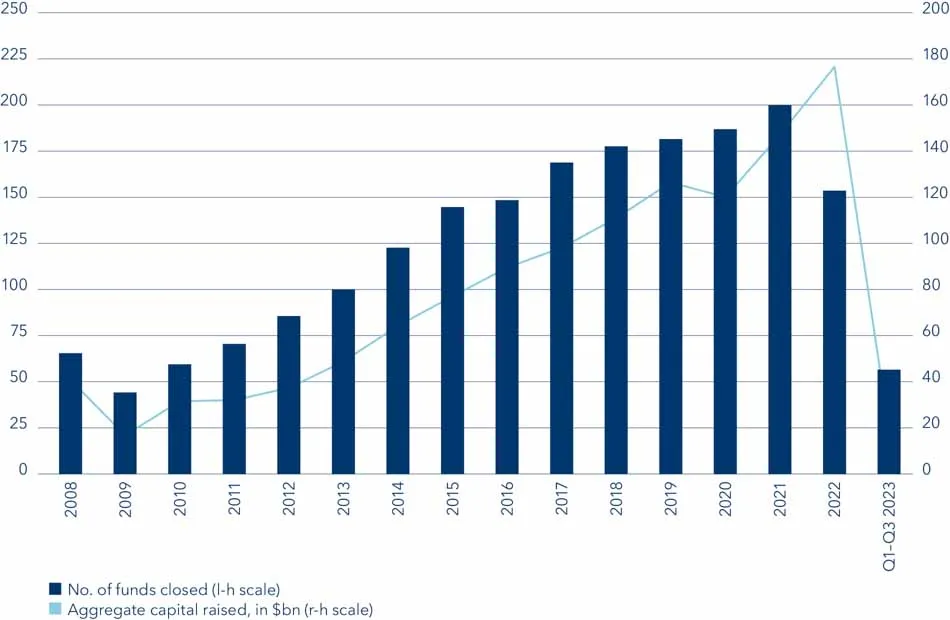

After a record year in 2022, fundraising has fallen sharply in 2023 as high interest rates and supply chain-induced inflation created barriers to conducting primary transactions.

While the better-than-expected performance, reflected in unrealised values, provides some comfort to long-term investors, there is growing concern about performance gaps compared to public benchmarks.

Lower fundraising will impact the flow of new capital competing for assets, contributing to a less competitive transaction market. Less competition for new business could help managers realise better value, but will put further pressure on the performance of managers looking to sell assets. Nevertheless, tailwinds from the energy transition should continue to support the long-term growth of unlisted infrastructure funds.

Private infrastructure funds closed and capital raised

Outlook

The current interest rate level is having an impact on investors' strategic asset allocation (SAA) and has changed the relative attractiveness and weighting of asset classes compared to the years of zero interest rate policy. In the area of alternative asset classes, the effects vary depending on the interest rate sensitivity of the respective alternative asset class. Nevertheless, there are still corresponding opportunities in all alternative asset classes. Even in the current environment with downside risks, but the ever-present possibility of dynamic market recoveries, alternative investments are seen as a good opportunity for diversification compared to long-only strategies.