Opportunities in Swiss Small & Mid Caps

Companies with a market capitalization of approximately CHF 300 million to CHF 10 billion are classified as "Small & Mid Caps." This segment is highly diversified in Switzerland and represented by a number of successful companies, including Lindt & Sprüngli, Schindler, Straumann, and Galderma.

Some of these companies have achieved remarkable international success in recent years and have since risen to become blue chips. Kühne + Nagel, Sonova, Logitech, Partners Group, and Sika are among the most recent additions to the Swiss Market Index (SMI).

Against the backdrop of current global market developments, we view Swiss equities—particularly Small & Mid Caps—as especially attractive for several reasons:

- High Innovation Power: These companies achieve market leadership in niche markets through continuous innovative solutions.

- Differentiated Positioning: This leads to above-average growth profiles.

- Highly Skilled Workforce: Thanks to excellent universities and training centers, these companies have access to outstandingly qualified professionals.

- Competent Management Teams: Demonstrated success and outstanding corporate leadership distinguish their management.

- Solid Balance Sheets: Stable finances and easy access to capital strengthen these companies.

- High Flexibility and Efficiency: This is crucial for facing challenges such as strong currencies and high labor costs.

- Stable Political Environment: Low taxes and a well-functioning legal system promote entrepreneurial activity.

Why are Small & Mid Caps a Preferred Investment Option Compared to Large Caps?

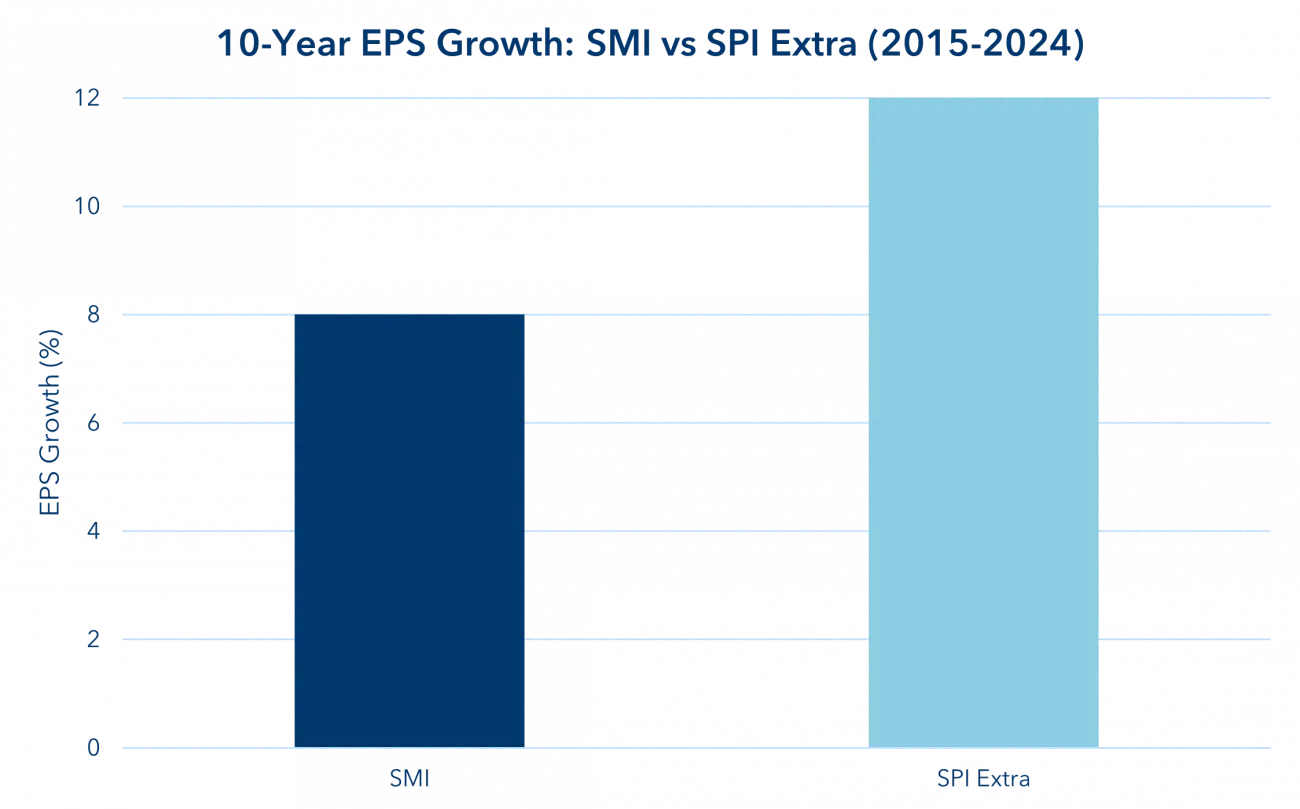

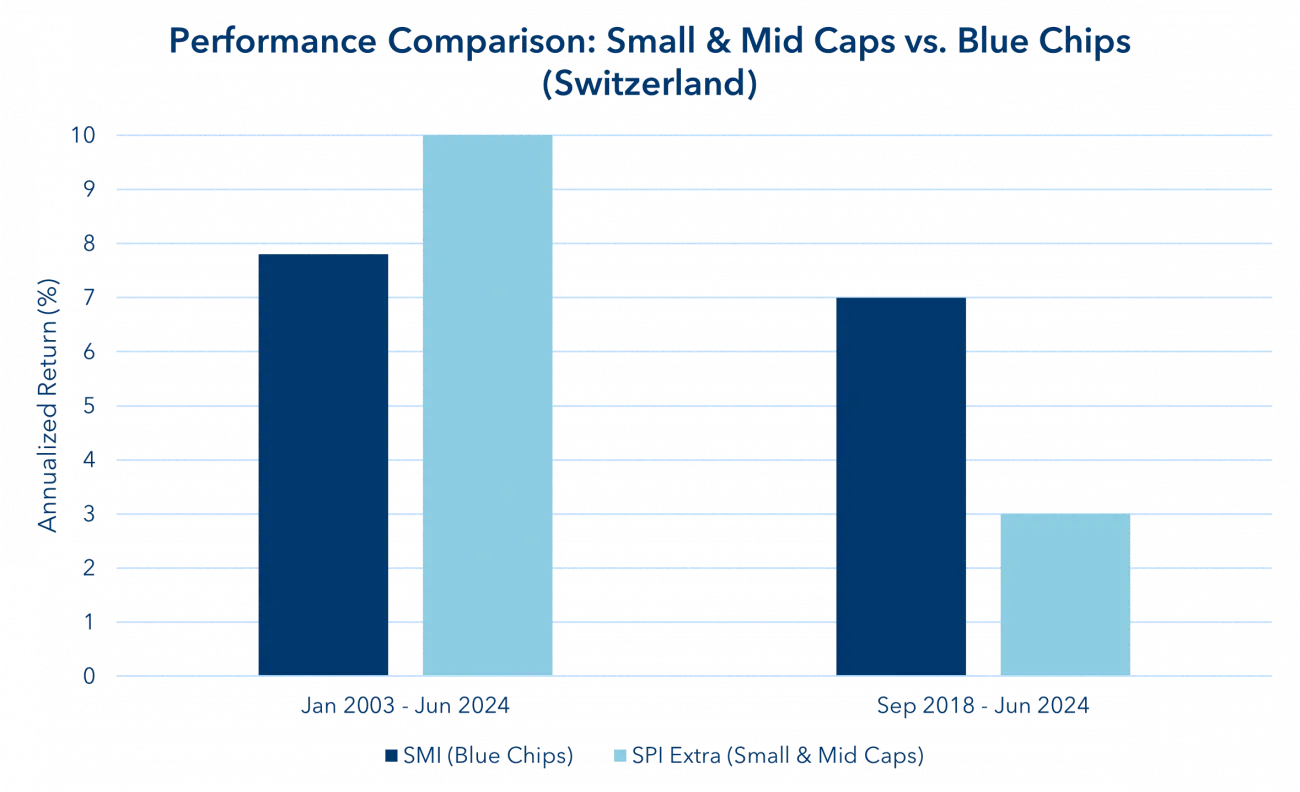

Long-term analyses, for example over the period from 2003 to 2024, show that Small & Mid Caps (SPI Extra) have outperformed the overall market (SPI) with an annualized return of 10%, while the SPI achieved just 7.7%. This above-average performance is due to the historical earnings growth of smaller companies, as illustrated in the following chart.

Despite this outstanding long-term performance, investors tend to underweight Swiss Small and Mid-Cap stocks in their portfolios—in our view, unjustifiably, especially when considering the positive diversification effect.

The SMI Index is composed of about 80% of the three largest sectors: healthcare, consumer staples, and finance, which means the significant industrial sector is largely overlooked. In contrast, the SPI Extra has a significantly lower share of the three largest sectors (industry, finance, and healthcare) at about 67%.

In the past two years, especially since 2022, Small & Mid Caps have suffered under the pressure of rising interest rates, geopolitical challenges, and uncertain economic conditions. The strong Swiss franc as well as weak economic growth in Germany, particularly in the automotive and construction industries, led to several profit warnings in the fourth quarter of 2024. This negative development has, however, led to lower expectations, which now creates an opportunity.

Currently, Swiss Small & Mid Caps are valued more attractively than large caps, particularly in terms of their long-term growth potential. We expect that with a return to lower inflation and correspondingly falling interest rates, this segment will soon outperform large-cap stocks again, both in Switzerland and globally. Key reasons for this outlook are:

- Market prices currently reflect many negative developments, which could create a favorable base effect.

- A strong correlation between falling interest rates and rising prices for Small & Mid Caps.

- The lower cost base will significantly boost profitability during an economic upturn.

- This asset class is currently trading at historically low valuations, similar to the situation during the 2008 financial crisis.

Your Partner for Swiss Small & Mid Caps

3V Asset Management is an independent fund manager with a clear focus on Swiss Small & Mid Caps. Our investment approach can be summarized as follows: we are long-term, fundamental investors who invest in high-quality companies with sustainable business models. We are convinced that being co-owners of companies with sustainable competitive advantages in structurally attractive markets is one of the most profitable investment strategies. We value working with competent and integrity-driven management teams that act like entrepreneurs, and we place importance on building stable relationships.

As committed owners, we pay attention to modern corporate governance standards and exercise our shareholder rights accordingly. We firmly believe that a strong focus on the local Swiss niche and consistent action are crucial for creating value for our clients. Therefore, we pursue a concentrated strategy with around 30 carefully selected stocks. By investing in qualitative structural winners, we aim to capitalize on the short-term mindset of many market participants regarding long-term growth potential.