Dividend Stocks ahead of the Next Boom: The Return of a Forgotten Giant

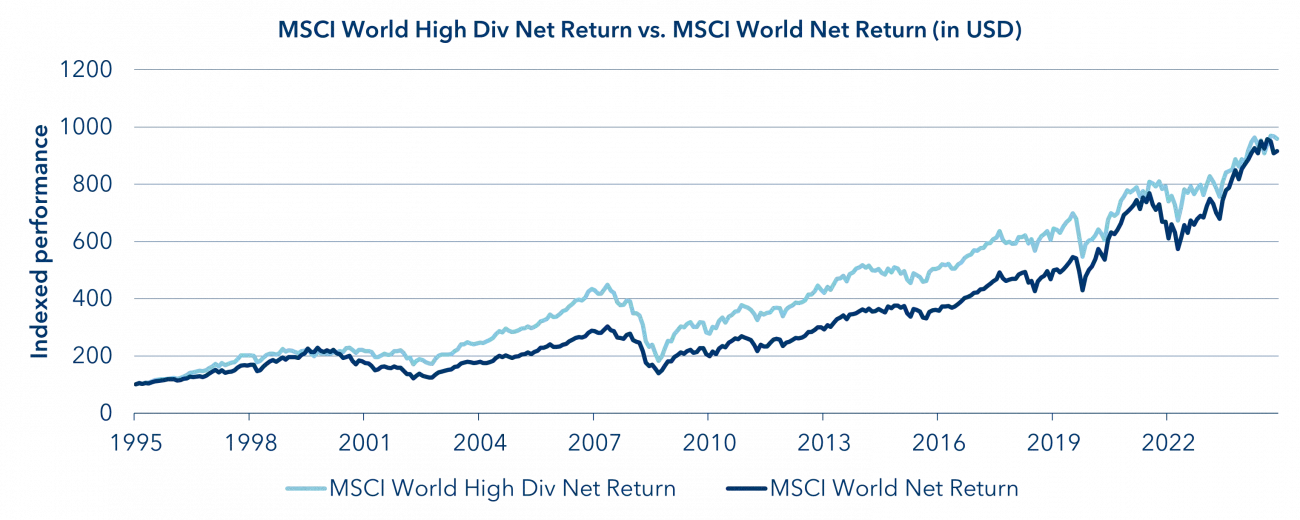

Between 2011 and today, high-dividend stocks have experienced a record underperformance relative to the global market. From December 31, 2011, to April 30, 2025, the broad-based MSCI World Net Return Index soared by an impressive +294%, while the MSCI World High Dividend Yield Net Return Index gained only +174% in the same period. This lag stands in stark contrast to long-term trends: Over the past three decades (1995–2025), stocks with above-average dividend yields – despite recent periods of weakness – have delivered excess returns compared to the overall market.

From Valuation Premium to Bargain

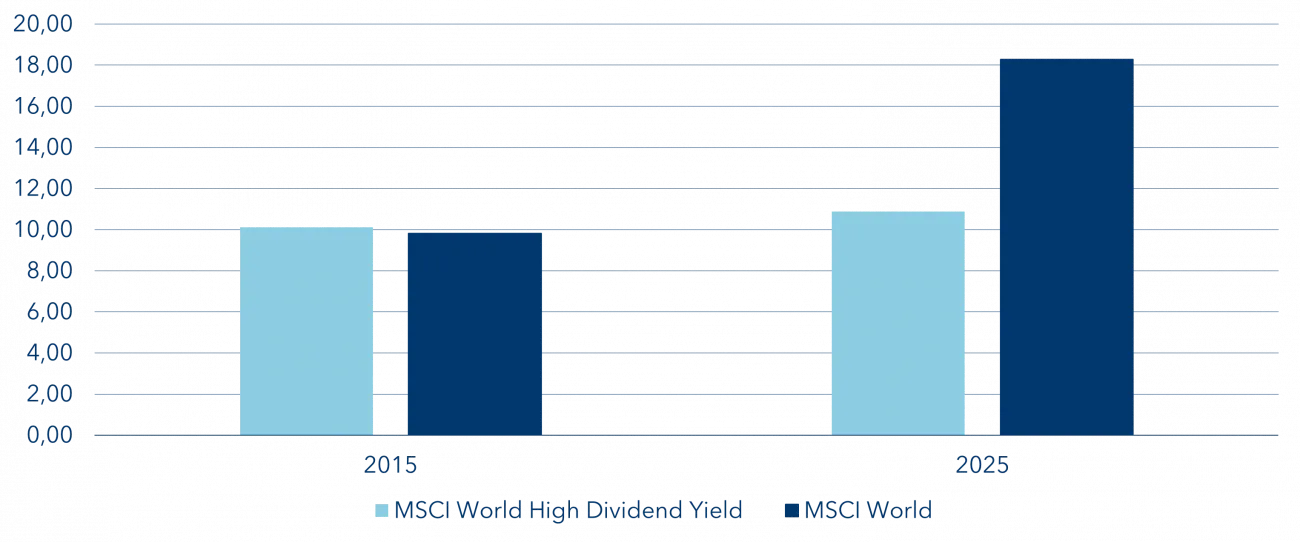

While high-dividend companies were still trading at a valuation premium in 2015, this picture has fundamentally changed since then. Today, stocks with attractive and sustainable dividend policies are trading at a significant discount to the overall market – even though many of these companies boast above-average quality. This is reflected in solid balance sheets and highly resilient earnings, which are largely independent of global economic cycles.

Currently investors can find shares with above-average earnings streams at historically low entry prices – a market environment that clearly favors a contrarian, anti-cyclical investment approach.

Valuation premium of dividend stocks turned into a discount

Stability in Turbulent Times

An often underestimated advantage of dividend stocks lies in their defensive characteristics. Studies show that stocks with stable dividend payouts are subject to lower price volatility. During periods of heightened market turbulence, they typically decline less and thus serve as a stabilizing factor in an equity portfolio.

These risk-mitigating qualities became particularly evident during the most recent market downturn in spring 2025: Between February 20 and April 8, the MSCI World Net Return Index lost -16.2%, while the MSCI World High Dividend Yield Index fell by only -9.0% over the same period.

The resilience of dividend stocks not only preserves investors’ nerves but also addresses the psychological asymmetry between loss aversion and the joy of gains. After all, investors feel losses much more intensely than comparable gains – a factor that becomes especially important during more turbulent market phases.

Conclusion: Dividend-Rich Value Stocks Offer Attractive Entry Opportunities

The current market environment presents dividend hunters with a rare opportunity: historically low valuations meet above-average stability and long-term return potential. While many investors continue to focus on the tech cycle, there are growing signs of a possible comeback for high-dividend companies. The excess return of the MSCI World High Dividend Yield Net Return Index of +6.5% from December 31, 2024, to April 30, 2025, may well be just the beginning of a more sustained outperformance.