The renaissance of the Multi-Asset strategy (guest article)

On the equity side the market is now highly concentrated. Large-cap companies, also known as mega-caps, set the direction for the benchmark index due to their high share, even though the majority of mid-cap and smaller companies do not move at all or even fall. One could also speak of a "The Winner Takes It All" investment environment, in which the big players are getting bigger and bigger, sometimes at a breathtaking pace.

Active strategies aiming to generate risk-adjusted returns by actively managing asset allocations to avoid temporary losses generally struggle in such an environment. Multi-asset strategies have faced particularly strong headwinds in the last two years. The historically unique cycle of interest rate hikes has led to sharp price losses on the bonds side and a dynamic sector rotation in equities. As a result, multi-asset strategies were confronted with strong redemptions due to their relatively weak performance. But as the saying goes: "The reported dead live longer."

In our view, the current capital market environment could lead to a renaissance of multi-asset strategies. Actively managed multi-asset strategies are the supreme discipline in asset management. In general, individual investment approaches can differ greatly from each other and pursue different goals. For this purpose, the portfolio management has a wide range of instruments at its disposal. From stocks and bonds to precious metals, derivatives and cash. In addition, the allocation can be adjusted according to the capital market environment. A large playing field that offers the opportunity to participate in an entire stock market cycle.

Weatherproof multi-asset strategy for every capital market phase

We stand for an actively managed multi-asset approach, which we adapt to the respective market environment, regardless of a benchmark index. We do not focus statically on a particular investment style or a capital market theme. Rather, the focus is on a broad diversification of different asset classes and instruments. With this investment strategy, we are pursuing two overarching goals that we believe are indispensable for wealth accumulation and preservation: on the one hand, our multi-asset strategy participates in the performance of the capital markets in prosperous market phases, and on the other hand, it prevents or at least dampens sharp slumps in market corrections.

Achieving these goals requires a broad toolbox. In our investment approach, we prefer to allocate the asset classes equities, bonds and gold. Historically, equities make a significant contribution to performance. The share of equities varies between 60 and 80%. We actively manage the gold allocation between 5 and 10%. However, due to the sharp rise in yields, bonds also have a place in our opportunity-oriented multi-asset strategy. Bonds allocation can range from 10 to 35%.

Another component is liquidity (cash position). Liquidity is an interest-bearing option that allows us to buy more and cheapen positions during weak market periods. In addition, we use exchange-traded derivatives to reduce temporary losses. Our strategy has particularly demonstrated its strength in the last two years, which were characterised by increased volatility.

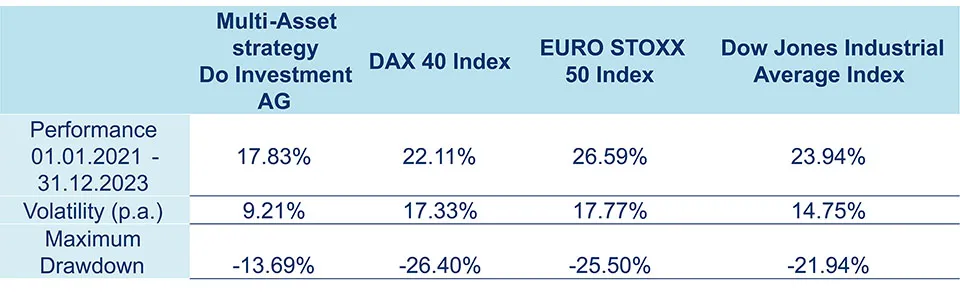

Performance and Risk Ratios – Period: 01/01/2021 to 31/12/2023

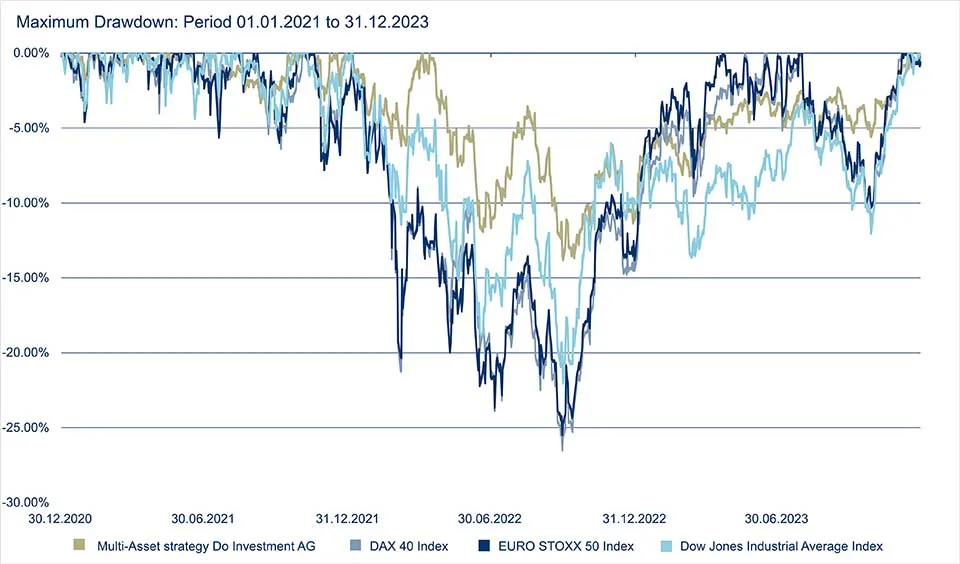

Maximum Drawdown – Period: 01/01/2021 to 31/12/2023

The table and chart represent our exemplary multi-asset strategy compared to major equity indices in the period from 01.01.2021 to 31.12.2023. Although our equity allocation averaged below 70% over this period, our multi-asset approach was able to keep pace with the performance of equity indices. The volatility (p.a.) and the temporary loss, represented by the maximum drawdown, were only about half as strong as for the selected equity indices. In our experience, it is important to avoid large temporary losses, as investors experience losses more intensely than equal-sized gains. We were particularly successful in this during the correction phases in autumn 2022 and 2023.

Hypes come and go – quality remains!

In addition to our dynamic asset allocation, the selection of individual securities is an essential part of our risk management process. On the equity side, we prefer quality. Quality stocks are characterised by solid balance sheets, attractive cash flows, and substantial competitive advantages. These companies are better equipped to withstand economic turbulence and achieve above-average returns in the long term.

As a result, we may miss short-term hypes and trends on the stock market. However, with our multi-asset approach, we pursue a long-term and stable performance. We want to avoid short-term steep increases and subsequent corrections. Investing in fixed-income bonds offers the opportunity to improve the risk profile after the vertical rise in yields. In our multi-asset strategy, fixed income therefore plays a central role in optimising the balance between growth and safety to achieve the long-term goals of our investors.

Gold remains the safe haven in our portfolio structure. Over centuries, the precious metal has established itself as a unique store of value. Its ability to preserve purchasing power over long periods distinguishes it from paper currencies and many other asset classes. For this reason, gold is an important pillar in our multi-asset approach.

Multi-asset offers investors long-term opportunities

The capital market environment has changed over the past two years. The negative interest rate experiment has ended, and positive yields have returned. On the equity side, large-cap companies have a significant share and drive the major indices. Demographics, deglobalisation, decarbonisation and global high indebtedness are cause for concern. Our multi-asset strategy, consisting of dynamic asset-allocation and a clear focus on essential asset classes, offers investors the opportunity to continue to participate in equity-like returns in the future and to be able to sleep peacefully in volatile market phases.

About Do Investment AG

Integrated into a unique network and in close connection with the family office of the Silvius Dornier family, private individuals, medium-sized entrepreneurial families, conservative institutions and foundations are comprehensively supported in all matters of wealth planning and asset management. In addition to the structuring and management of liquid assets in selected tangible asset investments, Do Investment AG's core competencies lie in the agricultural sector. Do Investment AG is authorised by the German Federal Financial Supervisory Authority (BaFin) in accordance with the German Securities Institutions Act (WpIG) and is subject to its supervision.

Company Contact

Do Investment AG

David Wehner

+49 (89) 95 411 93 50

Legal Notice

This information is a marketing communication. As a marketing communication, this information does not satisfy all legal requirements to ensure the impartiality of investment recommendations and investment strategy recommendations and is not subject to any prohibition on trading prior to the publication of investment recommendations and investment strategy recommendations. Furthermore, it has not been prepared in accordance with legislation to promote the independence of financial research and is not subject to any prohibition on trading following the dissemination of financial research.

The information contained in this commentary is intended for journalists and media representatives only and should not be relied upon by private investors or other persons as a basis for financial decisions.

This document, including all data and opinions, does not constitute investment advice, tax or legal advice. Nor does it imply any offer, recommendation or solicitation to make investment decisions of any kind. The information is of a general nature and does not take into account the individual needs of the investor in terms of income, tax situation and risk tolerance.

The statements contained in this information are based either on the Company's own sources or on publicly available third-party sources and reflect the state of information at the time of writing the presentation indicated below. Subsequent changes cannot be taken into account in this document. Information may no longer be accurate due to the passage of time and/or as a result of legal, political, economic or other changes. We assume no obligation to provide notice of such changes and/or to provide updated information. Please note that past performance, simulations or forecasts are not a reliable indicator of future performance and that custody costs may arise that reduce performance.

Keep in mind that investing in securities involves risks as well as opportunities. The future performance of an investment may be subject to taxation, which depends on the personal situation of the investor and may change in the future. Returns on foreign currency investments may rise or fall due to currency fluctuations. In the case of investment funds, you should always make an investment decision on the basis of the sales documents (key investor information document, prospectus, current annual and, if applicable, semi-annual report), which contain detailed information on the opportunities and risks of the respective fund. All of the above-mentioned documents can be requested free of charge from Do Investment AG, Oettingenstraße 35, 80538 Munich, Germany, or from the capital management company.