2024 global public real estate outlook report

Market Recap

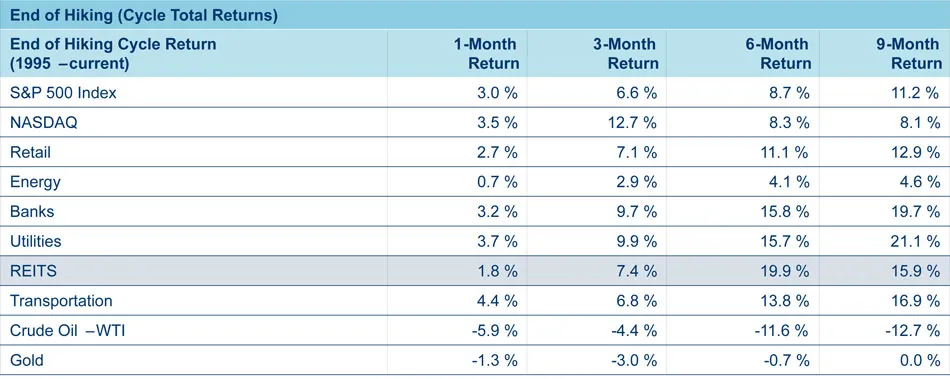

Over the past 2 years, central banks worldwide implemented 520 interest rate hikes to curb inflation and restore it to pre-COVID-19 pandemic levels. Despite the tightening of financial conditions in 2023, inflation exhibited unexpected resiliency, buoyed by a robust labour market, ultimately defying the anticipated recession, predicted by economists and Wall Street strategists for 2023.

2024 global real estate securites forecasts

As we enter 2024, we believe REITs are ready to takeoff after two years of sitting on the runway.

We believe the current economic and capital markets environment is meaningfully more favourable today than it has been in the past two years, especially concerning the outlook for interest rates.

Recent economic signals indicate a slowdown in both inflation and economic growth, boosting the confidence of central bankers. They anticipate that the tightening of financial conditions, combined with the delayed impact of elevated interest rates and the reduction of central bank balance sheets, will likely restrain inflation to levels reminiscent of the pre-pandemic years.

Where does this leave us?

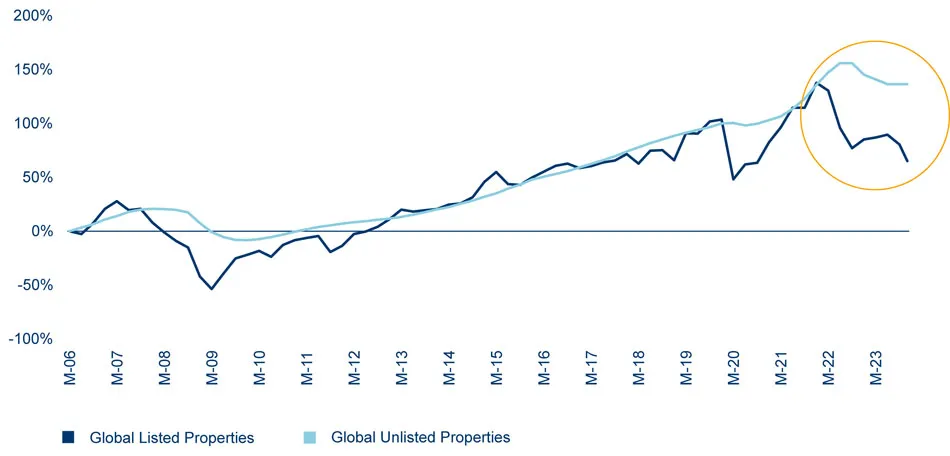

Relative to private real estate

Wie aus Abbildung 2 hervorgeht, beträgt der derzeitige Abschlag zwischen öffentlichen REITs und privaten Marktpreisen -30 %. Wir glauben, dass sich die Lücke zwischen den Bewertungen öffentlicher und privater Immobilien im Jahr 2024 zu schliessen beginnt, wie in den vorherigen Zyklen zu beobachten war. Würden die Bewertungen öffentlicher REITs wieder auf das Niveau des privaten Immobilienmarktes zurückkehren, würde dies ein Aufwärtspotenzial von 43 % bedeuten.

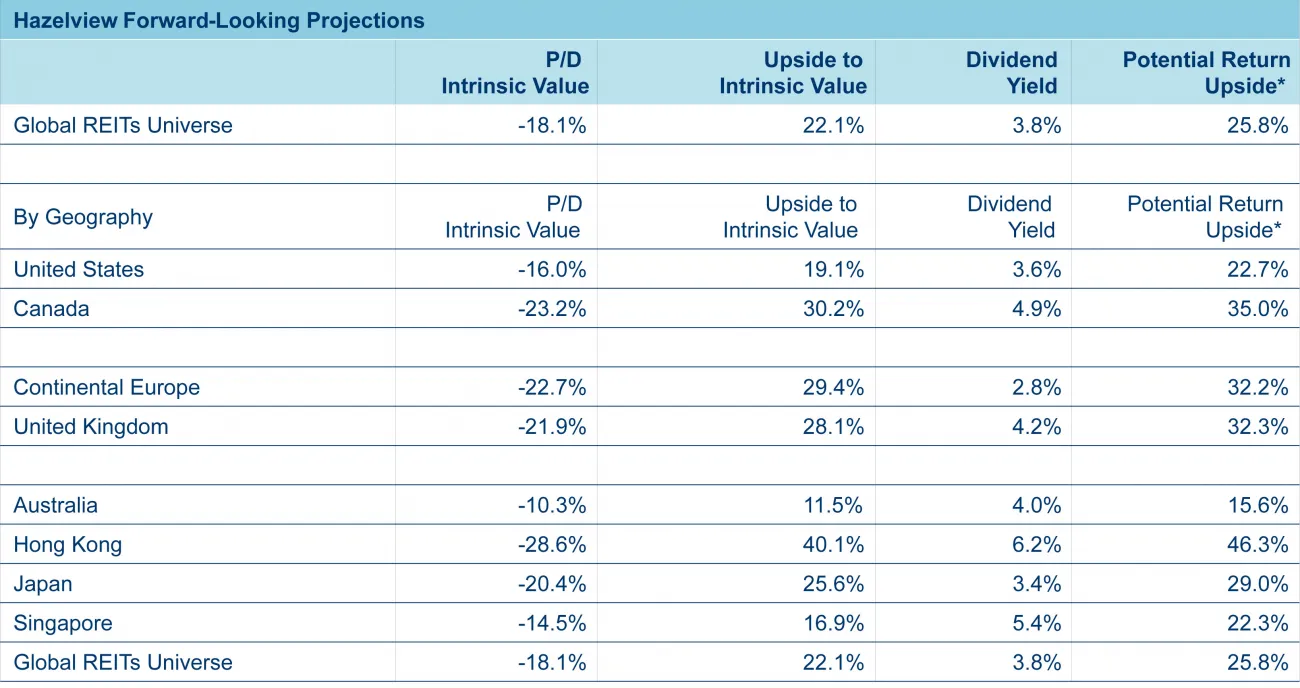

Relative to Hazelview valuations

Our valuation models suggest that REITs are priced at a high-teen discount to intrinsic value (defined as a blend between NAV and Discounted Cash Flow), which implies ~22% upside in price from today.

How does this valuation paradigm change?

Resilient corporate earnings

According to J.P. Morgan, the global economy is forecasted to grow 2.2% in 2024, which is slower than 2022 and 2023 due to the lag affect from 384 basis points of global tightening over the last two years.

Even though economic growth is forecasted to be slower in 2024, we believe REIT earnings will prove resilient supported by annual contractual rent increases, positive releasing spreads upon expiration, and the lease-up of vacant space. According to UBS, global REIT earnings are forecasted to rise by over 10% cumulatively in 2024 and 2025. This growth rate already incorporates higher property taxes, payroll costs and higher interest expenses from raised rates. The ability for REITs to deliver mid-single digit earnings CAGR that is more than twice the rate of real GDP growth is, in our view, both attractive and defensive.

In addition to the positive outlook for earnings, we see stark differences within the REIT Universe. While stock prices have suffered from negative sentiment, operating fundamentals differ significantly from company to company. Historically, we have found that we are able to generate attractive alpha after time periods where strong market reactions are mainly caused by macro factors, as experienced in 2022 and 2023.

Rapid declines in new supply

There are two sides to the fundamental coin: demand, and supply. Currently, demand for residential and commercial real estate space is good across most geographies and property types (with the exception of life sciences), driven by a resilient global economy supported by ongoing job growth.

Not enough attention is being given to how much new supply is forecasted to decline in 2024 and 2025. A consequence of the rise in inflation over the past 18 months has been a significant increase in construction and financing costs over the last 12 months, from interest rates staying higher for longer.

We frequently meet with companies and brokers who point to a supply shortage across numerous property types starting in the second half of 2024 and 2025. In certain markets, we began 2023 with minimal supply. The decrease in construction activity will further highlight the supply-demand imbalance in specific regions and property types.

For example, in the U.S. industrial sector, developers are experiencing tighter financial conditions, including higher recourse requirements and loan rates, making many projects less economically feasible. According to CBRE, industrial construction declined to 59.6 million square feet in Q2 2023, decelerating for three consecutive quarters, and down 50% compared to 2022. During their second-quarter earnings call, Prologis mentioned that new construction starts in Europe have decreased by 50%. We believe a declining supply backdrop in the second half of 2024, combined with a steady demand for space will result in a more sustainable rent-growth environment, as we enter 2025.

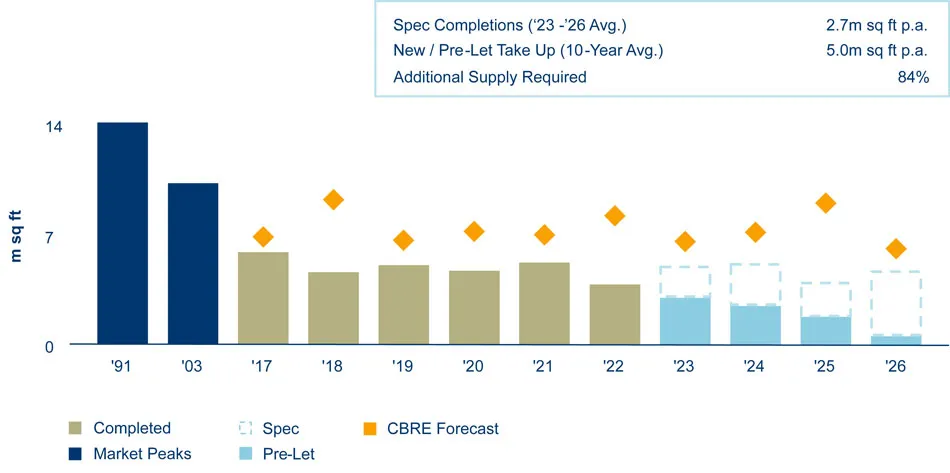

As demonstrated in Figure 4, according to CBRE and Great Portland Estates, supply of new Grade A space in central London between 2023 and 2026 is forecasted to decline to 2.7 million square feet per annum, which is 46% below the amount of annual demand (i.e., 5 million square feet per annum) experienced over the past 10 years.

According to Vonovia, the German multifamily sector anticipates a decrease in new community completions and permits for new projects in 2024 and 2025. This is expected to result in a demand/supply imbalance of 700,000 units by the end of 2025. We believe that this imbalance will contribute to strengthened fundamentals and the potential for higher rents in the coming years. Considering housing supply shortages is a concern in many major economies, we believe municipalities and national governments will rely on private capital to solve those supply shortages.

According to Smith Travel Research, new supply in the U.S. lodging industry in 2024 is forecasted to rise slightly more than 1%, which is nearly 50% below the long-term average of 2%. We see travel demand as stable, especially from group and leisure customers. We believe steady demand combined with significantly less supply in 2024, may lead to an improvement in hotel occupancy rates that are still meaningfully below pre-pandemic levels.

According to Cushman and Wakefield, a global leader in commercial real estate services, in the Canadian senior housing sector, construction starts as a percentage of total inventory is anticipated to decline to 1.5% of existing stock in 2023, the lowest amount in seven years, and down from 2.2% in 2022; 3.4% in 2021; and a peak of 5.6% in 2017. As a result of lower levels of new supply, Cushman and Wakefield is forecasting that national senior housing occupancy rates will continue to rise and match prior peak highs in 2025 and 2026.

To learn more on why we believe REITs are positioned for outperformance in 2024, read the full report here.