Energy transition - investing in a future-oriented asset class (guest article)

Investments in the energy transition have developed into a megatrend with long-term potential. According to Bloomberg New Energy Finance (BNEF), global investment in this sector reached an all-time high of USD 1.1 trillion in 2022. This creates attractive opportunities for investors. At the same time, they are required to adapt their investment strategies in view of the increasing climate challenges in order to assume both economic and ecological responsibility.

The effects of climate change are becoming increasingly apparent, particularly in Central Europe. A study carried out on behalf of the German government predicts that the economic costs caused by climatic changes such as droughts and floods could rise to up to 900 billion euros in Germany alone by 2050. This development highlights not only the environmental but also the economic risks associated with climate change - and reveals the need for investors to invest in forms of investment that generate resilient and sustainable benefits in the long term.

Renewable energies differ fundamentally from other asset classes

Change in awareness among institutional investors

The latest study by US asset manager Nuveen suggests a marked change in awareness among institutional investors worldwide: 59 per cent of the 800 asset managers surveyed signalled a reorientation of their investment strategies towards greater sustainability - with German insurance companies leading the way, 74 per cent of which are planning to shift their portfolios to protect the climate. In addition, a study by Steinbeis University Stuttgart shows that 79 per cent of German savings banks and VR banks (Volksbanken and Raiffeisenbanken), which have not previously invested in renewable energies, are now looking to enter this sector.

The potential for investment in the energy transition is enormous and diverse. The International Renewable Energy Agency (Irena) estimates the global investment requirement at USD 5.7 trillion annually by 2030. According to BNEF, global investment in the energy transition has already increased around fivefold in the past ten years. "Global players" are getting on board in a big way. For example, the Norwegian sovereign wealth fund announced in January 2024 that it would invest 307 million euros in a solar and wind power portfolio in Spain and Portugal. The plants have an installed capacity of 674 megawatts and can supply around 350,000 households with electricity. The German energy supply company RWE has already invested 20 billion euros in the decarbonisation of the energy system since 2021. The Executive Board announced in November that the company intends to invest 55 billion euros worldwide in renewable energies, storage technologies, flexible production and hydrogen projects by 2030, 11 billion euros of which will be invested in Germany alone.

Renewable energies are becoming increasingly attractive

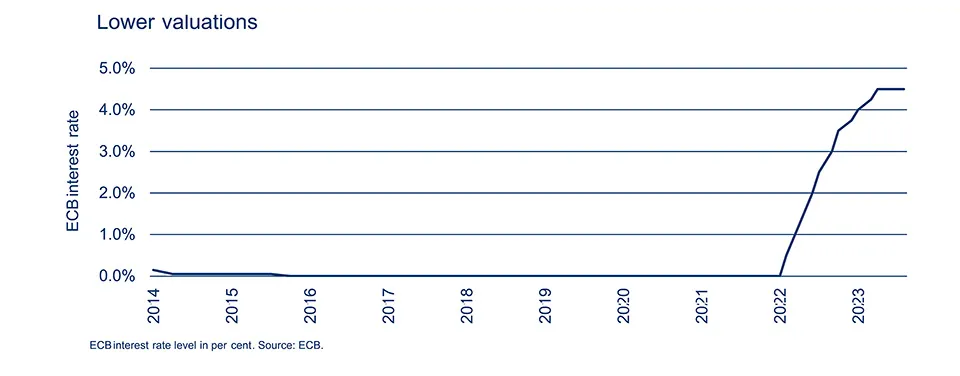

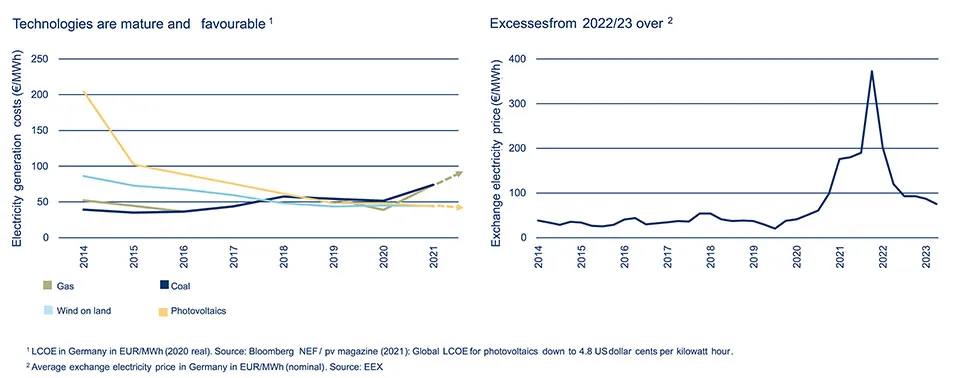

Developments on the financial markets are favouring this trend. The long phase of zero and negative interest rates had increasingly attracted institutional investors to the property market over the past ten years because higher returns were possible there. Since the turnaround in interest rates in 2022, the valuations of many properties have now also come under pressure, with the increasing vacancy rate in commercial and office properties in particular depressing investor sentiment. By contrast, renewable energy plants are in demand like never before. Their yields are proving to be largely stable, independent of the volatility of other markets and significantly higher than the current yield on German government bonds.* As soon as the European Central Bank (ECB) lowers the key interest rate again as inflation eases, investments in the energy transition are likely to become even more sought-after.

* Past performance is not a reliable indicator of future performance.

Promising markets and segments

As energy from wind and sun is now usually cheaper than energy generation from fossil fuels, the expansion of wind energy and photovoltaics will continue to accelerate. The exaggerations on the energy markets as a result of the war in Ukraine are a thing of the past. At the same time, energy storage systems are taking centre stage. Even if experience with this new asset class is still limited, one thing is certain: investments in storage systems are particularly profitable in combination with wind and photovoltaic parks. The ongoing electrification and sector coupling is leading to an expansion of the possible spectrum for infrastructure investors.

With its current sustainable energy concept, for example, BVT aims to achieve a balanced allocation to promising energy sectors. These include wind energy and photovoltaics in particular, supplemented by battery storage and efficiency projects in trade and industry. The focus is on majority holdings in fully developed projects in order to optimise the return on assets during the operating phase as well; "late stage" development projects are also included. Looking at other countries within the EU can also be worthwhile in order to additionally increase the portfolio return. In the EU, slightly higher returns can currently be achieved on some markets than, for example, in Germany- with absolutely acceptable risk profiles. The decisive factor here is to know the local conditions in detail and to have a good local network.

About BVT

BVT has been a pioneer in the energy and infrastructure asset class since the 1980s and has many years of project experience with investments in various areas of the infrastructure sector, in particular renewable energy and electricity grids. Various investments for institutional investors have already been successfully realised. The BVT team covers the entire value chain from acquisition to operation and exit. Thanks to a strong network with contacts to renowned project developers, brokers, investment banks and investors, access to projects in the European market is guaranteed. Sustainable tangible assets thus form a core BVT expertise, which is reflected in a new "Article 9" fund: the BVT Sustainable Energy Fund concept enables investments in renewable and sustainable energy projects that drive forward the energy transition in Europe.

As a bank-independent asset manager, the BVT Group, with headquarters in Munich and Atlanta and offices in Berlin, Cologne and Boston, has been opening up the diverse opportunities of international real asset investments to institutional investors and German private investors for over 45 years. With a total investment volume of 8.8 billion euros and around 80,000 investors since its foundation, BVT is one of the most experienced providers of closed-end investment concepts in Germany.

About the author

Dr Dominik Schall, who holds a doctorate in industrial engineering and is a Certified ESG Analyst, heads the Energy and Infrastructure division at the BVT Group in Munich. A graduate of the Karlsruhe Institute of Technology (KIT), Dr Schall has extensive experience as a project manager in the energy industry and most recently worked as Senior Portfolio Manager Illiquid Assets at MEAG in Munich. In his previous positions, he was successfully involved in the development and acquisition of new projects as well as in the asset management of infrastructure projects in the renewable energy and transport sectors for institutional and private investors.