Cat Bonds: Natural Diversification and High Yields (guest article)

Cat Bonds (short for Catastrophe Bonds) offer a unique diversification opportunity in fixed income, with minimal exposure to credit, equity, interest rate, and currency risks. Their stable returns and low correlation with traditional markets make them an attractive choice for enhancing portfolio diversification.

What are Cat Bonds?

A Cat Bond is a fixed income instrument, similar to any corporate or government bond. The major difference between a Cat Bond and a regular bond is the source of risk. The investor is providing protection against (mostly) natural catastrophes and is receiving a coupon in compensation. Cat Bonds are a type of insurance-linked securities (ILS) that are designed to provide financial protection against natural disasters, such as hurricanes, earthquakes, and other large-scale events. They are sponsored by insurance companies, governments, or other entities, and are structured as debt securities, with the bonds paying periodic interest to the investor until the maturity date, at which point the principal is returned. In the event of a covered catastrophe, the payment of interest and/or the return of principal may be deferred, reduced, or eliminated.

What are the benefits for investors?

Cat Bonds are an innovative form of investment that offers several key benefits:

- Access to insurance risk premium: Cat Bonds provide exposure to the insurance industry and to the risk premium associated with natural disasters. The Cat Bond market is an important part of the reinsurance market, which has a combined capital base of around $600 billion.

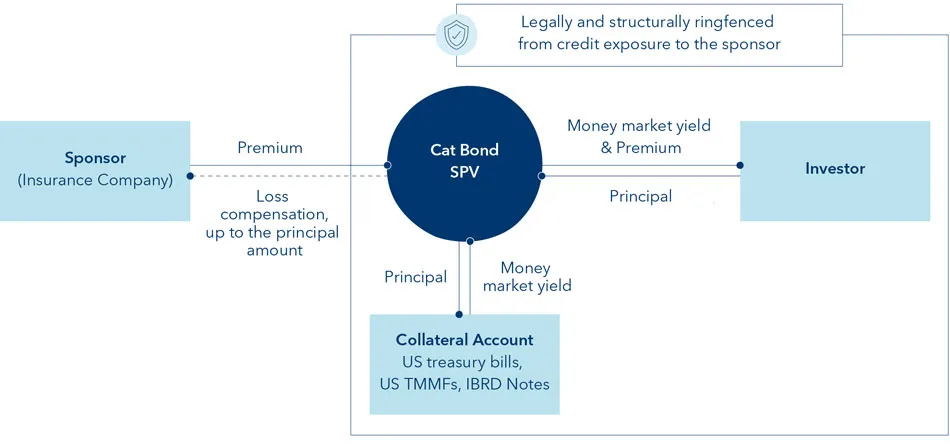

- Low credit risk: Cat Bonds are structured to reduce any credit risk to a minimum with the nominal amount being held in a trust account with T-Bills as collateral.

- Diversifying: Cat Bonds are often considered to have low correlation to other asset classes, making them a suitable option for risk management and diversification purposes.

- Floating rate: Most Cat Bonds are structured as floating rate notes, which almost fully eliminates interest rate risk in those instruments.

These features result in Cat Bonds having almost no exposure to credit, equity, interest rate, and currency risk thus allowing the investor to enjoy a high degree of diversification compared to most other financial instruments.

How are Cat Bonds structured?

One of the unique aspects of Cat Bonds is their structure, which is designed to transfer risk from insurance companies and governments to the capital markets using a special-purpose vehicle (“SPV”). This transfer of risk allows insurance companies and governments to manage their exposure to natural disasters, while also providing investors with a new investment opportunity. As a result, Cat Bonds can play an important role in helping the industry and the wider economy to manage the financial impact of natural disasters. The SPV structure effectively isolates the investor from direct credit exposure to the sponsoring company.

Typical Cat Bond Structure

What is the market size?

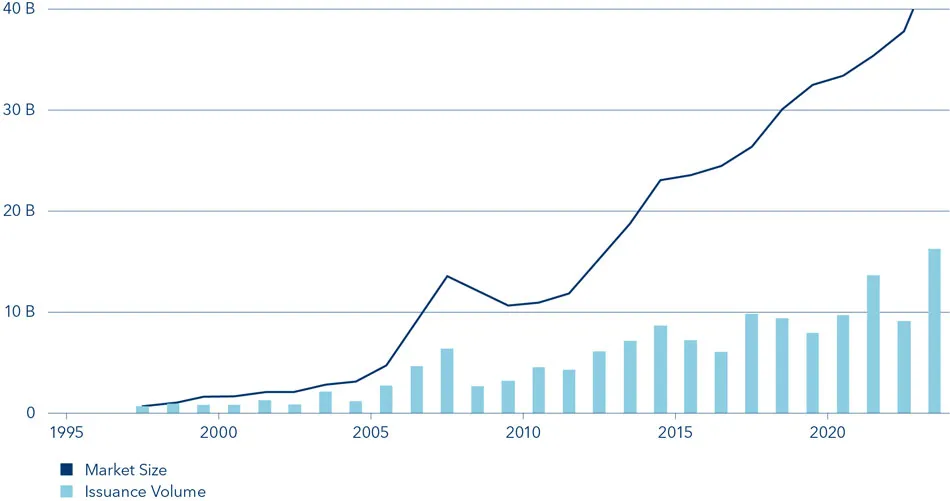

The Cat Bond market has grown significantly over the past few decades, driven by the increasing demand for insurance and risk transfer solutions. According to our database, the total size of the Cat Bond market was approximately $40 billion as of 2023 and is expected to continue growing in the coming years. Despite this growth, the market is still considered to be relatively small compared to other fixed income asset classes, providing investors with the opportunity to access a profitable and fast-growing niche market. The growth of the Cat Bond market can be attributed to several factors, including an increasing awareness of the benefits of Cat Bonds, concerns over increased exposure to natural disasters due to urbanisation and rising global real estate values, and the growing need for insurance and risk transfer solutions through capital limitations in the traditional reinsurance market. Additionally, the growth of the market has been driven by the increasing availability of data and analytics tools, which have made it easier for issuers and investors to evaluate the risks associated with natural disasters.

Market Size & Issuance Volume

How have Cat Bonds performed?

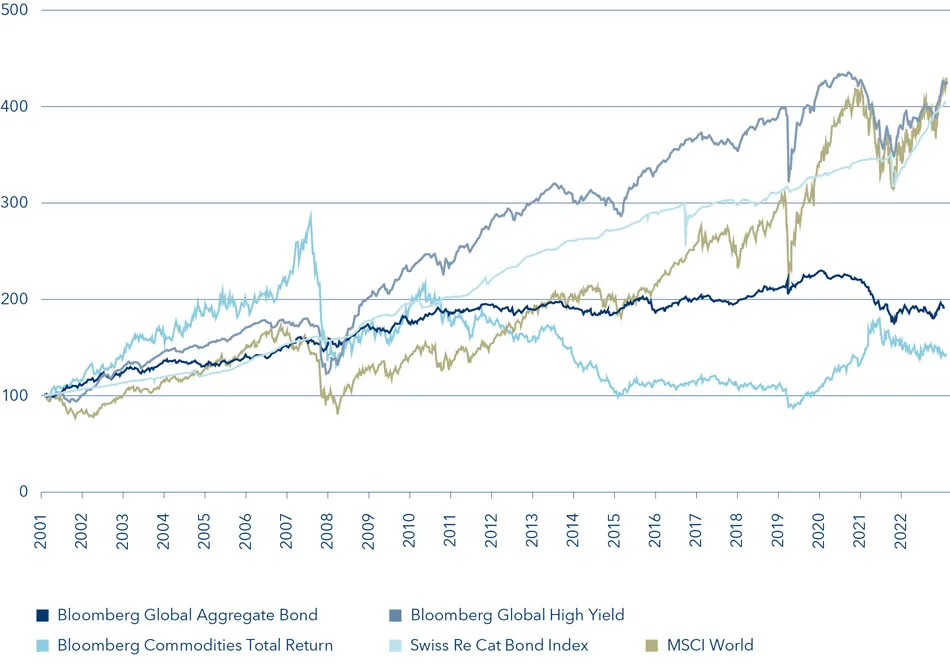

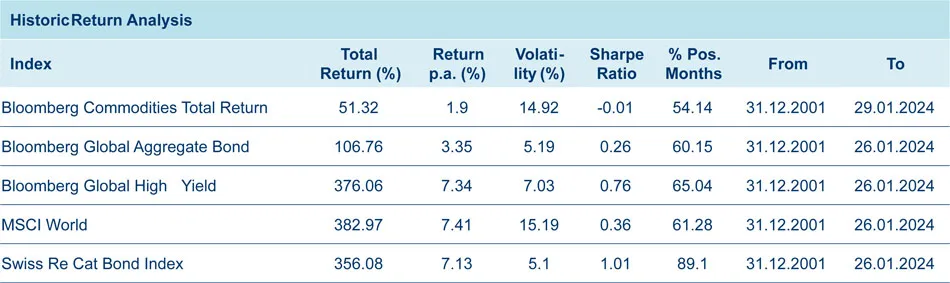

Over the past two decades, Cat Bonds have demonstrated an impressive track record of delivering stable returns and low correlations with traditional financial markets, making them an attractive option for investors seeking portfolio diversification. During periods of heightened market volatility, Cat Bonds have historically performed well, outperforming other fixed-income assets. One reason for the strong performance of Cat Bonds during periods of market volatility is their unique risk profile. Unlike traditional fixed-income securities, Cat Bonds are not exposed to typical credit risks, such as defaults or downgrades. Instead, their performance is tied to the occurrence of natural disasters or catastrophes, which are largely independent of economic cycles or geopolitical events. As a result, Cat Bonds provided an alternative source of risk exposure, which has helped to significantly diversify a portfolio and reduce overall risk since the start of the asset class more than twenty years ago. The strong historic performance does not make Cat Bonds a risk-free asset class, of course. Cat Bonds are typically issued as multi-year contracts, with a set of pre-defined triggers that determine whether investors will receive their principal back or not. These triggers are based on specific loss events, such as hurricanes, earthquakes, or other natural disasters, and are designed to protect the ceding (re)insurance company from losses resulting from catastrophic events. Should a large catastrophe occur, the principal of a Cat Bond is at risk. The fact that Cat Bonds have performed very well in the past two decades, where significant natural catastrophes have taken place (e.g., Hurricane Katrina, the Tohoku earthquake in Japan) shows the resilience of the asset class to generate positive returns even in challenging environments.

Historic Return Comparison of Cat Bonds vs. Equities and Bonds

Are Cat Bonds ESG-friendly instruments?

Cat Bonds are typically perceived as ESG-positive instruments for several reasons:

- Disaster relief: Cat Bonds provide an important source of funding for disaster relief efforts, which can help to mitigate the environmental and social impacts of natural disasters.

- Promotion of transparency: Cat Bonds promote transparency and risk management in the insurance industry by requiring insurers to disclose detailed information about their risks. This information can help investors to make more informed investment decisions, while encouraging insurers to transform their risk management practices to be sustainable and ESG compliant.. The fact that insurance companies are heavily regulated certainly reduces governance risks.

- NGO & non-profit support: Many Cat Bonds are sponsored by NGOs and other non-profit organisations, such as the World Bank, who have discovered that reducing the insurance protection gap in developing countries is a prerequisite to eliminate poverty. This highlights again the positive impact on society and the environment, that adequate insurance capacity can have.

- Impact investing: A specific example of using Cat Bonds as an impact instrument is the Pandemic Emergency Financing Facility (PEF), established by the World Bank which obtained insurance protection through issuing Cat Bonds. These particular Cat Bonds provide financial resources to quickly respond to major outbreaks of infectious diseases. The goal is to prevent the spread of diseases and thus minimise potential impacts on public health and the economy.

Summary

Cat Bonds offer investors a rare and attractive investment opportunity by providing access to alternative risk premiums from the insurance industry and exceptional diversification compared to traditional asset classes. Structured as floating-rate securities, they almost completely eliminate interest rate risks. The use of short-term government bonds as collateral further minimises credit risk, leading to a fundamental decoupling from traditional financial market risks, which contributes to their historically observed low correlation. Additionally, investing in Cat Bonds plays a significant role in disaster relief and risk distribution, making this asset class attractive not only financially but also from an ESG perspective. With a growing market, impressive performance, and continued high yields, Cat Bonds represent an innovative and responsible choice for forward-thinking investors looking to diversify their portfolios while achieving positive social and environmental impacts.