Lombard loan

—

Flexibly make use of opportunities with a lombard loan

Our lombard loan is intended for investors with fluctuating or unforeseen funding requirements and creates financial flexibility while you remain invested. Lendable assets from your portfolio serve as collateral. The lending value must be higher than the desired loan amount.

A lombard loan is ideal if you

- want funds available quickly for private or business purposes

- do not want to sell securities and wish to maintain your investment strategy

- want to avoid potential tax disadvantages associated with a sale

- want to take advantage of market opportunities without making substantial changes to your portfolio

Lombard loan calculator

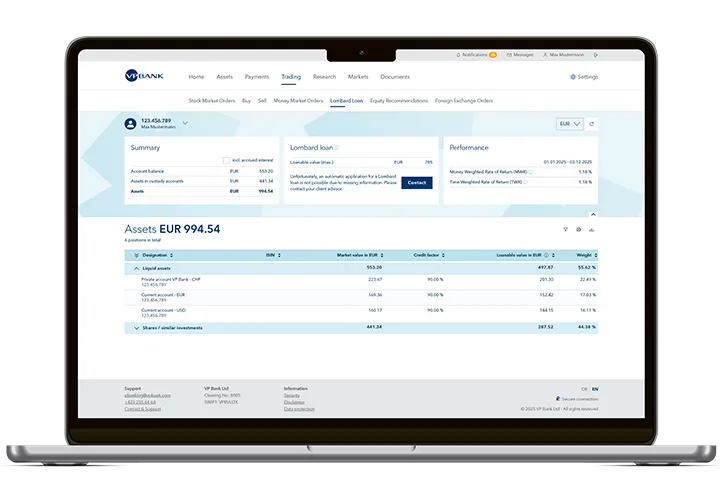

In the VP Bank client portal, you can view the current lending value and your limit utilization transparently at any time and, if necessary, submit further loan requests directly.

Mortgageable assets

- All common securities

- Precious metals

- Time deposits

- Fiduciary deposits

- Account balances

Our products at a glance

Fixed interest loan

A fixed interest loan is suitable for investors who have a clearly defined financing requirement over a fixed period of time. They offer customized financing and additional capital while the securities continue to offer potential for appreciation and returns, but are tied up for the term of the loan.

Characteristics

| Minimum amount | CHF 100,000 |

| Interest rate | Fixed |

| Interest date | Individual, and annual in the case of a term of more than one year |

| Amortisation | Repayment at the end of the fixed term |

| Cancellation | At any time; in the event of cancellation before the fixed interest rate agreement expires, cancellation is only possible against payment of an early redemption penalty |

Overdraft facility

The overdraft facility is suitable for investors who need flexible funds or who expect market rates to fall. It offers individually tailored financing and additional capital while maintaining the securities' potential for appreciation and returns. It should be noted that the interest rate depends on market conditions and is not capped.

Characteristics

| Interest rate | Variable, plus a credit commission |

| Interest date | Quarterly |

| Amortisation | Possible at any time |

| Cancellation | Possible at any time |

Request a lombard loan

Would you like to find out whether a Lombard loan is right for you? Contact us now, we will be happy to advise you.

Frequently asked questions about lombard loans

Once your credit line has been set up, you can use the lombard loan at short notice. How quickly this can be done depends primarily on your portfolio, credit rating, and the desired credit line.

As a rule, selected, easily tradable securities such as many stocks, bonds, and funds are eligible for lending. Whether a security is eligible for lending and at what rate depends on the risk, liquidity, and composition of your portfolio.

You generally only pay interest on the amount you actually use, not on the entire limit.

In many cases, lombard loans are flexible in terms of repayment. Periods for notice of termination and other conditions are set out in the loan agreement.

Lombard loans are available in CHF, EUR, and USD; other currencies may be available depending on the structure of the loan. The currency that is right for you depends on whether you want to avoid currency risks or are willing to take them on.

We need basic information about your financial situation and details of the securities that serve as collateral. If you are not yet a client or if you are a company, identification and company documents may also be required, depending on the case.

The interest rate is usually variable and depends, among other things, on the currency, market situation, loan amount, and your individual circumstances (portfolio/credit rating). You will receive the specific interest rate as part of a personal offer.

Under normal circumstances, there are three steps:

- Check portfolio: Which assets are eligible for a loan and what is the loan value?

- Set limit: You will receive a credit limit and the contractual terms and conditions.

- Use credit: You draw down amounts as needed; the usage and loan value are monitored on an ongoing basis.