Financing

—

Mortgage loans & real estate financing

With our comprehensive range of real estate financing products, you can easily make your dream of owning your own home come true. We are one of the leading lenders in Switzerland, and our experienced specialists will actively support you in determining the best financing option for your new construction, alteration of a property or real estate acquisition. Our assistance also includes optimally matching the terms and interest charges to your asset situation.

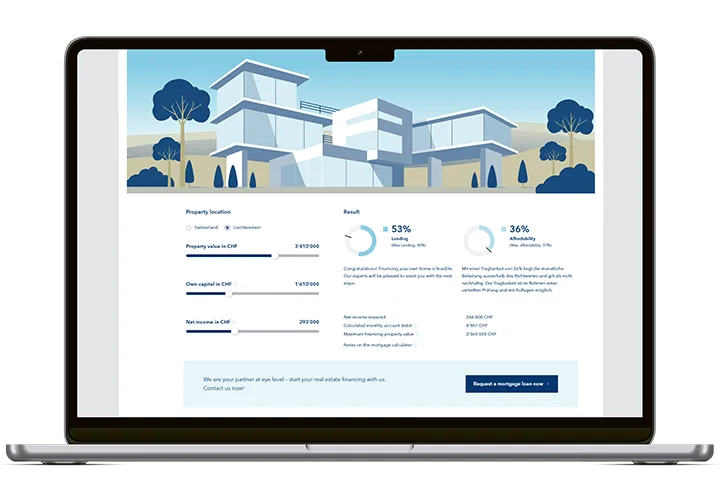

Mortgage calculator

Do you dream of owning your own home, and would like to know whether your financial means are sufficient? With our mortgage calculator, you can determine the affordability of your future real estate and the monthly charges in just a few steps. It’s quick, easy and uncomplicated.

VP Bank – your reliable financing partner in Switzerland

- Swiss expertise and personalised service: our mortgage specialists in Zurich provide you with personalised support and develop a financing solution that is tailored precisely to your needs in the Swiss market.

- Swiss presence & EEA access: with sites in Zurich and our headquarters in Liechtenstein, we offer ideal solutions for cross-border asset structures.

- Stability and independence since 1956: As an independent bank with headquarters in Liechtenstein and a strong capital base, VP Bank offers legal security and reliable long-term conditions.

- Support right up to the handover of keys: Dedicated contact persons coordinate all stages of the financing process – from the initial consultation to the disbursement of the mortgage loan – so that you can concentrate on your new home.

Arrange an appointment now

Our experienced specialists will advise and assist you in finding the best financing option for your property.

Frequently asked questions

At least 20% of the mortgage lending value must come from your own funds, of which at least 10% must not consist of pension funds.

Your annual housing costs, imputed interest (4.5%), amortisation and ancillary costs may not exceed 40% of your gross income. Only if this limit is adhered to is the financing considered affordable.

With a fixed-rate mortgage, the interest rate remains unchanged for the selected term (e.g. 5 or 10 years), which offers complete planning security. The SARON mortgage follows the daily fluctuating SARON reference interest rate plus our margin. This allows you to benefit from lower interest rates, but also carries the risk of rising rates.

A SARON mortgage is attractive if you expect interest rates to remain stable or fall, can cope financially with short-term interest rate fluctuations and would like to switch to a fixed-rate mortgage if necessary.

Early termination in the form of cancellation or partial repayment is not possible.