Investment fund savings plan

—

Build up your assets step by step with the investment fund savings plan

Even small amounts can make a difference. Regular deposits create wealth in the long term – transparently, flexibly and tailored to personal goals.

The savings plan gives structure to saving and provides access to the world of capital markets. Through widely diversified investments, reduced risk and the ability to make adjustments at any time, saving really becomes planning for the future.

The benefits at a glance

Here’s how it works – fund saving in just a few steps

Your personal savings plan is easy to put together – with a combination of thematic funds and strategy funds. Thematic funds allow for targeted focus areas – such as technology, sustainability or health. The strategy funds complement the portfolio with a stable foundation, tailored to the individual risk profile.

This creates an investment fund savings plan that fits your own goals in just a few clicks – understandable, flexible and with a focus on sustainability. In the calculator below, you can select your preferred thematic funds, and the savings plan can be configured specifically for you.

Frequently asked questions about the investment fund savings plan

Traditional savings accounts yield hardly any return – and inflation reduces purchasing power. If you want to achieve goals such as education, home ownership or retirement planning, you need a flexible investment strategy.

An investment fund savings plan combines regular saving with professional investment – individually tailored, widely diversified and transparent.

For children in particular, this is a smart alternative to a savings account, with better return opportunities and a 0% all-in fee if the plan is in the child's name.

Payments can be made flexibly – via standing order or manual transfer to the investment fund savings plan account. It starts from CHF 100 – without a minimum commitment.

The all-in fee is 0.25%. For those up to the age of 18, a rate of 0% applies – ideal for an early start in wealth creation.

Money can be transferred flexibly to the investment fund savings plan account through either a standing order or individual deposits – whenever and as often as you like. Large deposits are not required; investments can be made with as little as CHF 100. The invested money has the potential to achieve more in the long term than in a traditional savings account. Attractive conditions apply in combination with the VP Nova Start and VP Nova Next banking packages – including a transparent all-in fee of 0% or 0.25%.

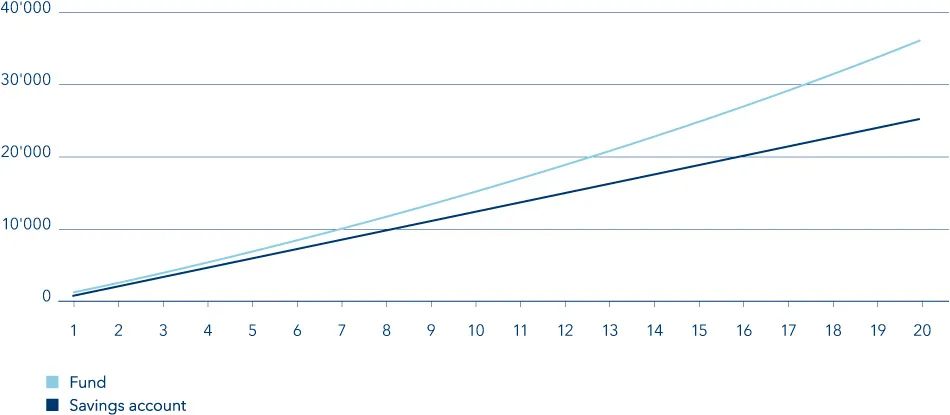

| Amount saved per month | Savings accumulated after 20 years |

|---|---|

| 100 | 24'000 |

| Your asset growth | Your asset growth after 20 years | Your assets after 20 years |

|---|---|---|

| … with a savings account | 1'243 | 25'243 |

| … invested in a fund | 12'503 | 36'503 |

Investment funds pool the capital of many investors and invest it broadly – for example, in equities, bonds or real estate. This way, risks can be reduced and market opportunities can be better utilised. Even small amounts can build wealth in the long term – professionally managed and clearly structured.

A quick explanation of the building blocks of the investment fund savings plan

The fund selection is at the core of every savings plan – and the investment fund savings plan offers two strong building blocks for this purpose: thematic funds and strategy funds. Each has different focus areas, but they can be combined flexibly.

VP Bank thematic funds make it easy to invest in companies that benefit from major future trends – such as in the areas of consumption, industry or infrastructure. There are three funds to choose from: VP Bank Future Citizen, VP Bank Future Industry and VP Bank Future Infrastructure.

Each of these funds consolidates companies from a specific economic sector and is managed professionally – ideal for anyone looking to invest strategically and grow with the transformation in the long term.

The VP Bank strategy funds offer an easy way to invest broadly around the world – in various asset classes such as equities, bonds and other assets. The risk of price fluctuations is reduced thanks to the broad distribution across different markets and regions.

This creates a stable foundation for long-term wealth creation – professionally managed and well balanced.